Thanks for joining me this Friday the 30th May, I’m Grady Wulff, Market Analyst with Bell Direct and this is our weekly market update.

Trump was back in the headlines this week and subsequently markets reacted accordingly … no surprise there. We also had key corporate trading updates move the local benchmark so let’s dive into the week that was.

Trump’s proposed tariffs returned to the spotlight this week, culminating in a major legal setback as a U.S. federal court blocked the so-called ‘Liberation Day’ tariffs. The court ruled that President Trump had overstepped his authority by attempting to impose broad import taxes on countries with trade surpluses against the U.S. The Manhattan-based Court of International Trade ruled that only Congress has the constitutional authority to regulate foreign commerce, a power that cannot be overridden by presidential emergency measures. This decision came in response to a lawsuit filed by the Liberty Justice Centre on behalf of five small U.S. businesses, marking the first major legal challenge to Trump’s tariffs. The businesses, ranging from a wine importer to an educational kit maker, argue the tariffs harm their operations. This case is one of seven legal challenges to Trump’s tariff policies, including suits from 13 states and other small business groups.

While the president can now appeal the ruling, markets rallied both during trade locally and in after-hours trade in the US as a result of the court’s ruling on Thursday.

Earlier in the week, markets rebounded from the late sell-off of the previous trading week after Trump announced and subsequently delayed 50% tariffs on the EU until July.

And in a turbulent week for Trump, his right-hand man, Elon Musk, announced he is stepping away from politics to focus on his businesses, much to investors relief but not great news for Trump. Musk completed his 130-days mandate of service in his special government role and his off-boarding began on Thursday US time. The move saw shares in Tesla rise over 2% in after-hours trade on Wednesday US time.

While turbulence is faced by the Trump administration on where the tariff turmoil goes from here, investors may finally have some stability and certainty on the horizon in the wake of Trump’s tariff chaos collapsing in the courts.

Nvidia’s latest earnings results for Q1 were released this week signalling demand for AI is going from strength to strength with revenue rising 12% to US$44.1bn while net income rose 26% to US$18.78bn. On the China production front, Nvidia said it incurred a US$4.5bn charge in Q1 associated with excess inventory and purchase obligations of the H20 products which are designed primarily for the China market. The stellar results fuelled a rally for locally listed data centres like NextDC late this week.

On the local market, investors are still reacting to corporate trading updates that were released throughout the week.

Telstra (ASX:TLS) shares rose on Tuesday after the telco giant reaffirmed FY25 guidance, expecting to hit the top end of free cash flow and capex targets, and launched its “Connected Future 30” strategy aiming for over 50% NPAT growth, stronger AI integration, and mid-single digit cash earnings CAGR by FY30.

Select Harvest (ASX:SHV) also posted a first half trading update this week outlining the company is back in the black with NPAT of $28.7m posted during the half thanks to tightly managed production costs, higher almond prices and improving operating cash flow.

Naturally, all eyes were on April’s all-important monthly CPI release, which came out on Wednesday. The data showed that Australia’s inflation rate rose to 2.4% over the 12 months to April, exceeding economists’ expectations of 2.2%. While still within the RBA’s target band, the upside surprise sparked concern in the markets.

Investors reacted with a sell-off, worried that inflation may be rebounding; potentially driven by the implications of renewed Trump-era tariffs and the recent rate cut by the RBA.

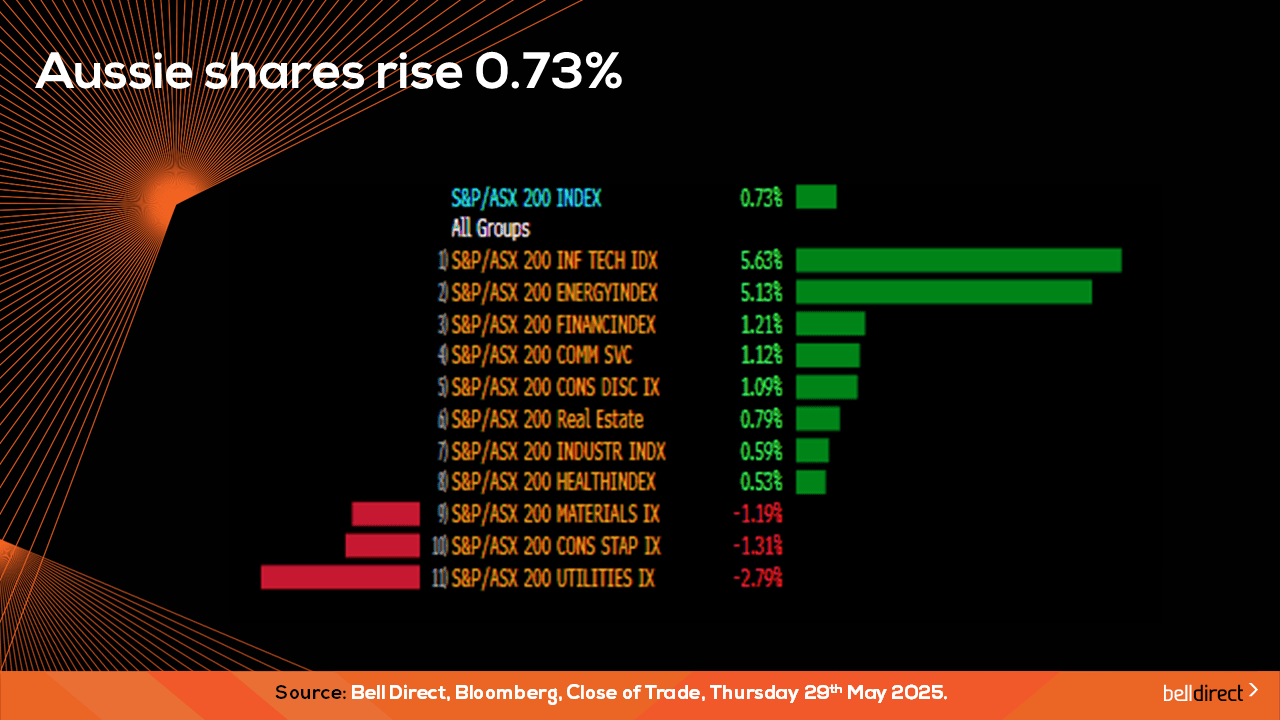

Locally from Monday to Thursday the ASX200 posted a 0.73% gain led by the tech and energy sectors rising over 5% each on the rising price of oil and growing investor appetite for growth stocks.

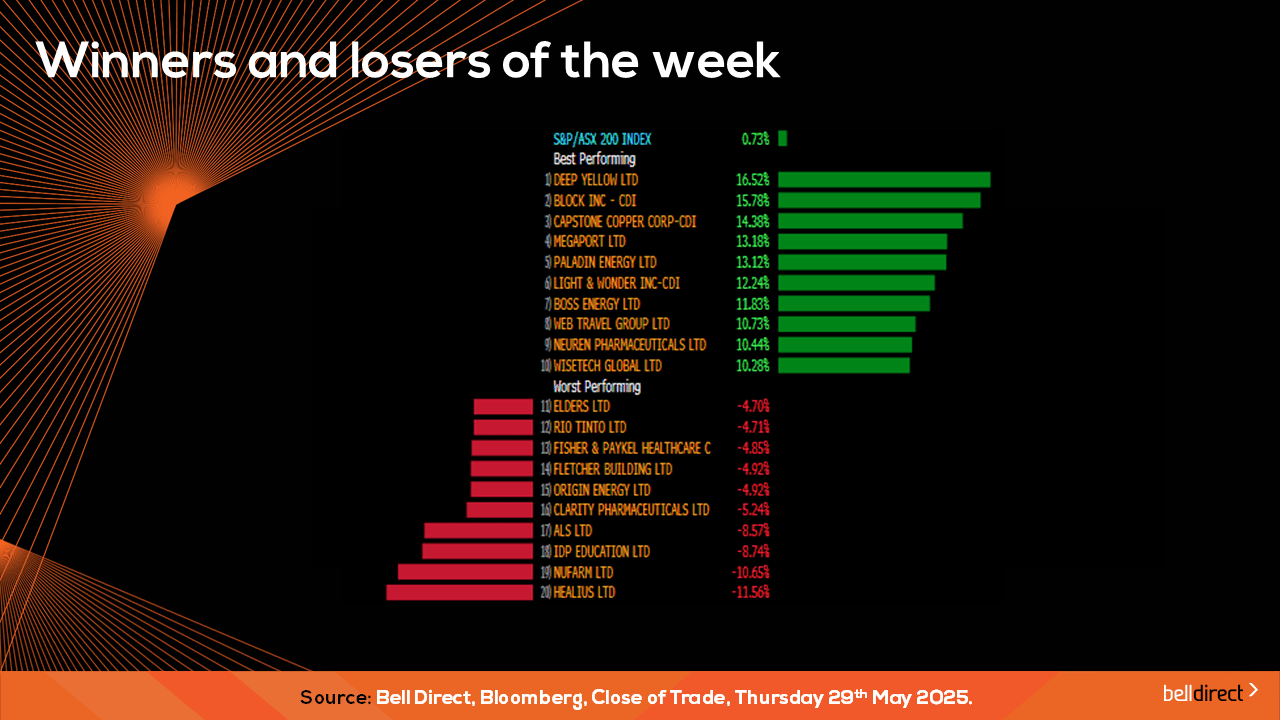

Deep Yellow (ASX:DYL) was the best performer on the ASX200 this week with a rise of 16.52%, while Block Inc (ASX:XYZ) and Capstone Copper (ASX:CSC) rose 15.78% and 14.38% respectively over the 4-trading days.

On the losing end, Healius (ASX:HLS) fell 11.56% while Nufarm (ASX:NUF) ended the week down 10.65%.

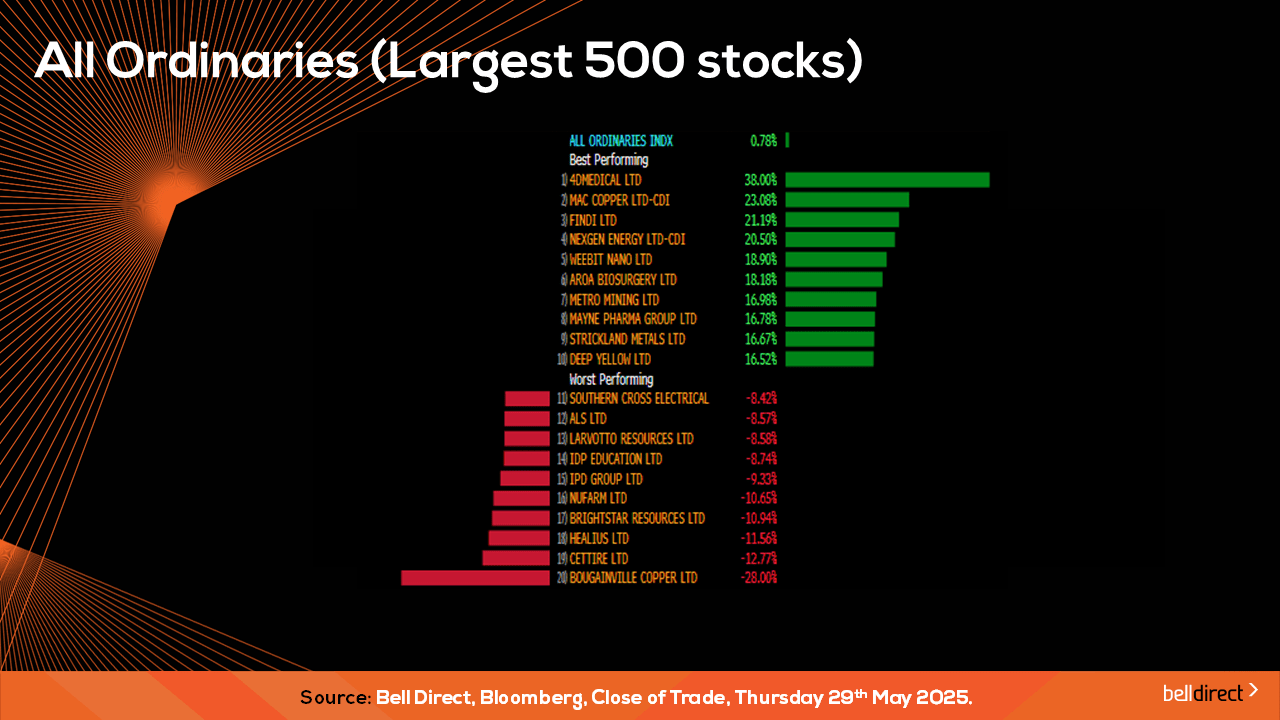

On the broader market index, the All Ords rose 0.78% this week as a 38% soar for 4D Medical on FDA submission offset a 28% tumble for Bougainville Copper.

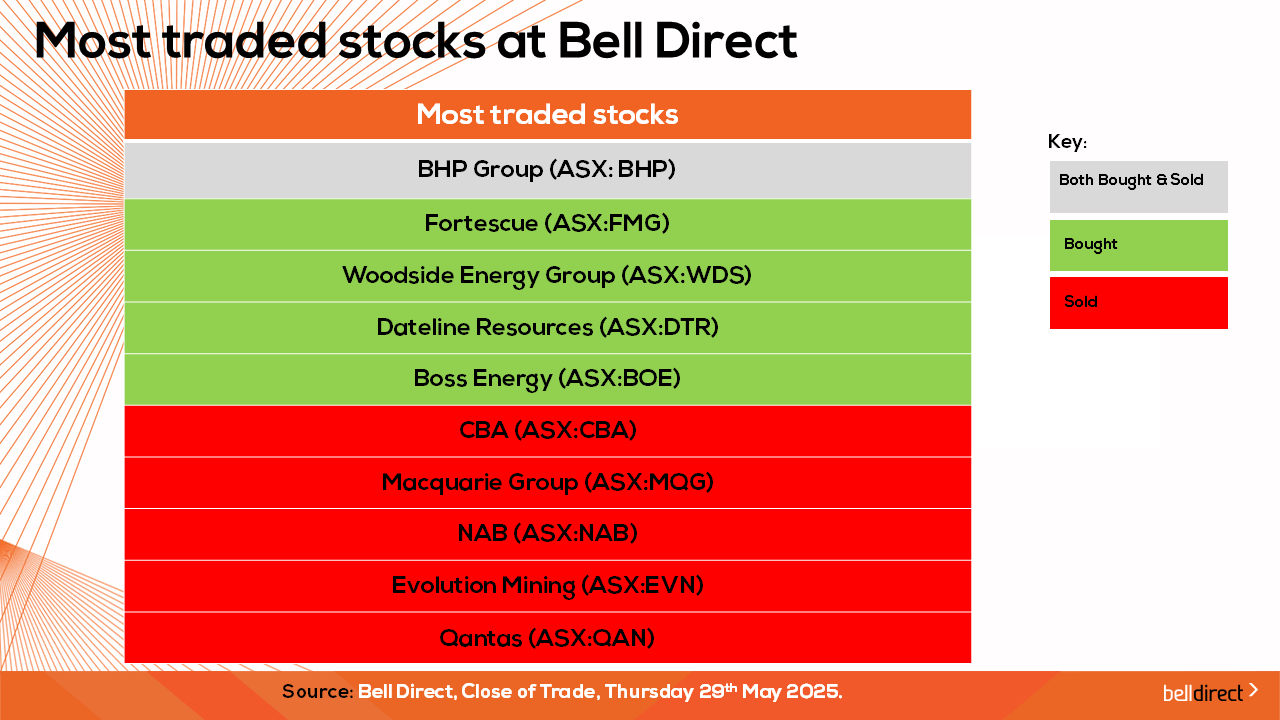

The most traded stock by Bell Direct clients over the 4-trading days was BHP (ASX:BHP). Clients also bought into Fortescue (ASX:FMG), Woodside (ASX:WDS), Dateline Resources (ASX:DTR), and Boss Energy (ASX:BOE) while taking profits from CBA (ASX:CBA), Macquarie (ASX:MQG), NAB (ASX:NAB), Evolution Mining (ASX:EVN) and Qantas (ASX:QAN).

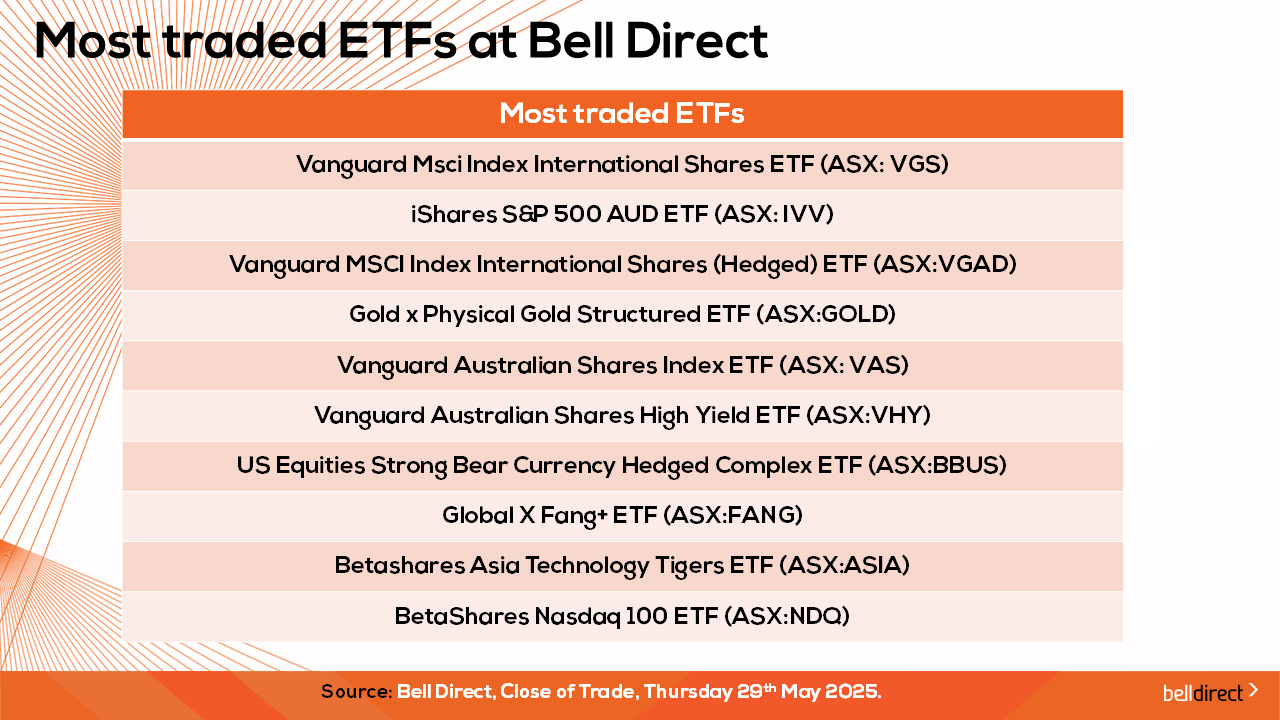

And the most traded ETFs by our clients were led by Vanguard Msci Index International Shares ETF, iShares S&P 500 AUD ETF and Vanguard MSCI Index International Shs (Hedged) ETF.

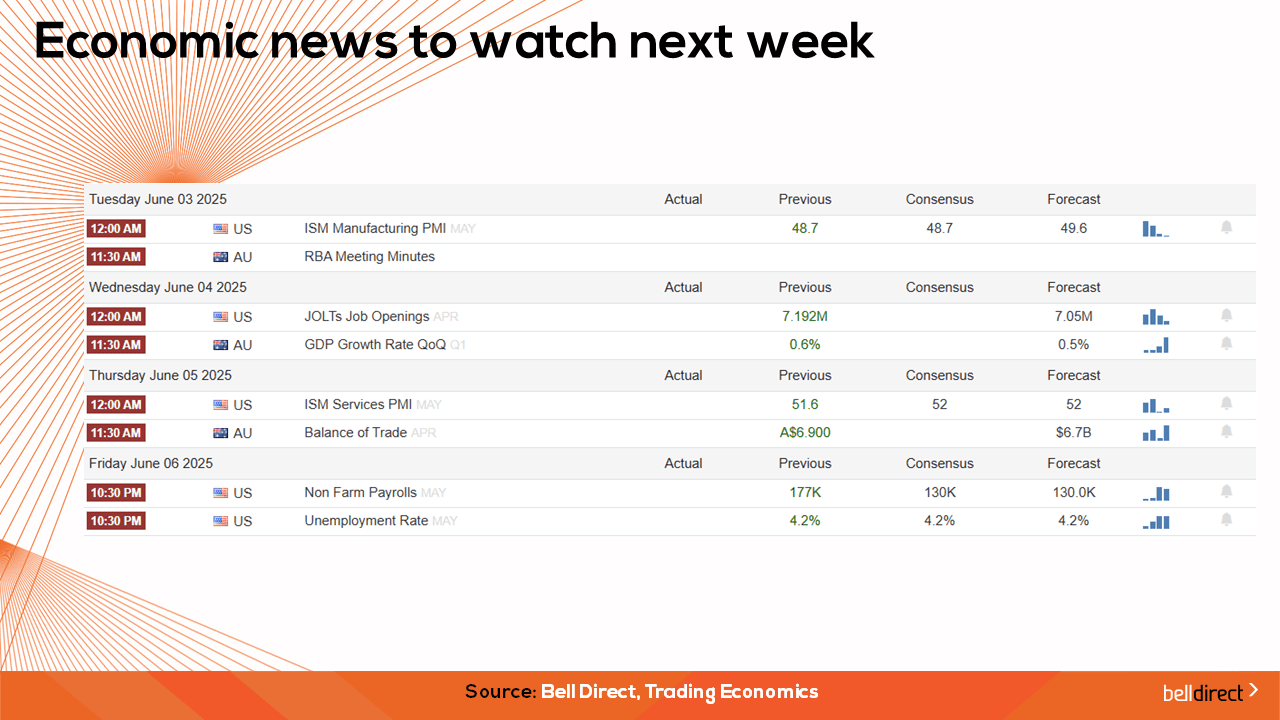

On the economic calendar front next week, we may see investors react to the latest RBA meeting minutes which are out on Tuesday, Australia’s latest GDP Growth rate data for Q1 out on Wednesday and Australia’s trade balance data for April out on Thursday. Overseas key US jobs data is out next week with the expectation of a decline in job openings.

And that’s all for this week, have a wonderful weekend and happy investing.