Thanks for joining me this Friday the 6th June, I’m Grady Wulff, Market Analyst with Bell Direct and this is our weekly market update.

Uranium stocks have been on a tare this week following Meta’s announcement of a 20-year agreement to purchase 1,121 megawatts of electricity from Constellation’s nuclear facility in Illinois, with supply set to begin in 2027.

With growing demand for cleaner power, why are the magnificent 7 and many other corporations diving into nuclear power now, what does this mean for supply and pricing of uranium and how will this move impact you as an investor? Let’s dive straight in.

This marks the second deal of its kind to enter the market, with Microsoft announcing a 20-year agreement to purchase electricity from the Three Mile Island nuclear power plant in Pennsylvania. Although the facility is currently inactive, plans are in place to restart operations by 2028.

Google and Amazon have also signed similar long-term nuclear power agreements in recent times as the Magnificent 7 move to a cleaner source of electricity to power the intense requirements of the AI revolution. The primary driver behind this trend is the near-zero carbon footprint of nuclear-generated electricity. The move is a strategic one, aligning with the global shift toward clean energy.

Nuclear energy has become one of the key beneficiaries of the AI-driven spike in electricity demand from data centres.

Nuclear power generates minimal carbon emissions, making it a valuable component in efforts to decarbonize electricity supplies. For companies like Meta, these deals also support diversification of energy sources and bolster long-term power reliability.

This wave of adoption by tech giants like Meta and Microsoft is creating strong tailwinds for listed uranium producers; particularly Boss Energy, which holds a stake in a uranium mine in South Texas. Shares in Boss Energy rose 8% today.

Additionally, the development of new nuclear reactors is driving significant growth in uranium demand.

Uranium is the primary fuel source for most nuclear power plants, with around 10% of the world’s electricity currently generated from uranium nuclear reactions, amounting to over 2500TWh (terawatt-hours) according to the World Nuclear Association. Approximately 60,000 to 67,500 tonnes of uranium annually are currently required to power nuclear reactors globally. This amount is anticipated to grow to reach over 83,000 tonnes by 2030 and over 130,000 tonnes by 2040 due to 70 nuclear reactors currently under construction around the world and about 100 further reactors in the pipeline for construction in the coming years.

What this means for the spot pricing of the commodity is Bell Potter’s analysts expect the price of uranium to peak around US$130/pound in 2026 before moderating around US$95/pound beyond FY29. Bell Potter Resources Analyst Regan Burrows said “we see supply tightness peaking around the end of the decade, and typically utilities contract two years out from delivery so hence why the spike comes through in 26-27”.

As an investor, how can you capitalise on the tailwinds for uranium driven by the AI-driven demand surge for nuclear power?

Bell Potter has a buy rating on Boss Energy (ASX:BOE), Paladin Energy (ASX:PDN) and Deep Yellow (ASX:DYL) for the reasons that follow.

Bell Potter rates Boss Energy a Buy for strong cost performance, reliable delivery, and growth catalysts. 3QFY25 unit costs beat estimates (A$33/lb vs A$40/lb), with steady production and sales at US$84/lb. Backed by A$63.7M cash and A$165M in inventory/investments, and with CY25 expansion ahead, Boss offers upside supported by uranium fundamentals and a South Texas mine interest. Target remains A$4.85/sh.

Bell Potter rates Paladin a Buy after a strong 3QFY25, with production, grade, and recovery beating forecasts. Despite weather issues, operations have stabilised, and sales exceeded output at US$69.9/lb. With limited near-term guidance, the stock offers strong value, and the target price is raised to A$6.50/sh.

Bell Potter maintains a Buy on Deep Yellow for its strong uranium leverage and phased Tumas Project strategy. Despite FID delays, early infrastructure and financing progress reduce risk. With A$227M cash, solid project economics, and adjusted valuation at A$1.45/sh, there’s upside as uranium prices rise.

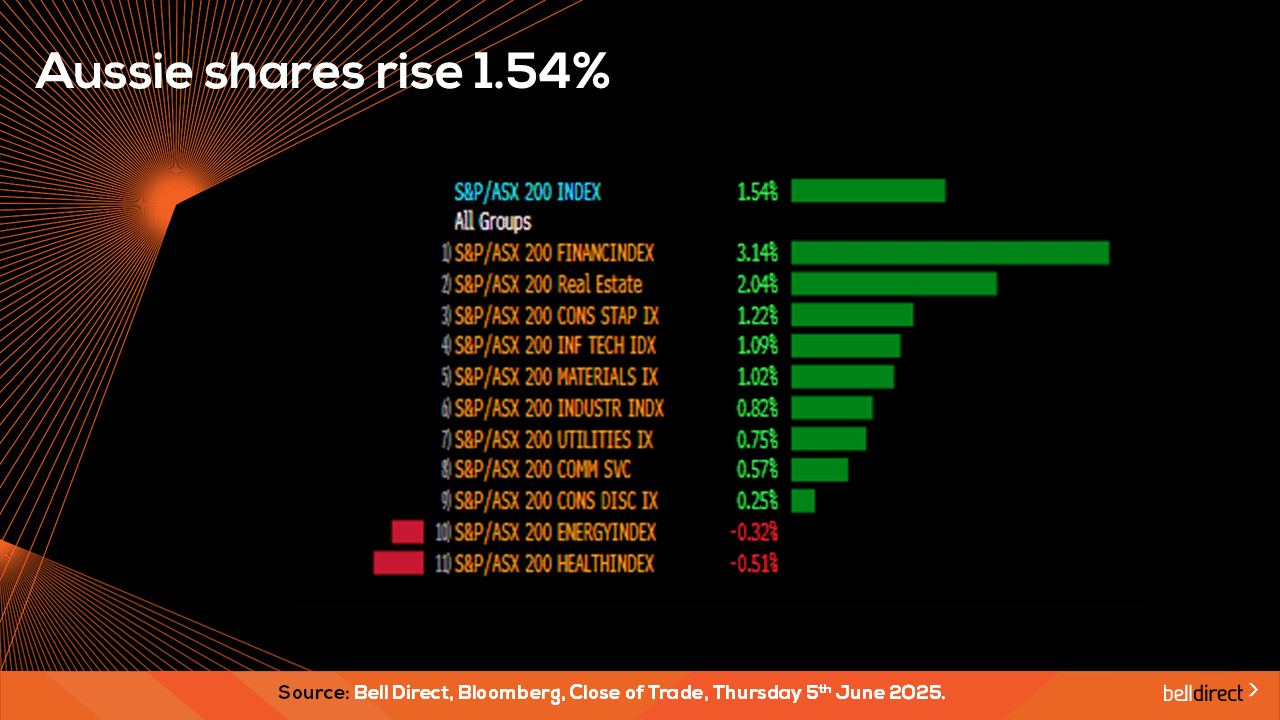

Locally from Monday to Thursday the ASX 200 gained 1.54% as 9 of the 11 sectors appreciated led by financials stocks rallying 3.14% while Real Estate stocks rose 2.04%.

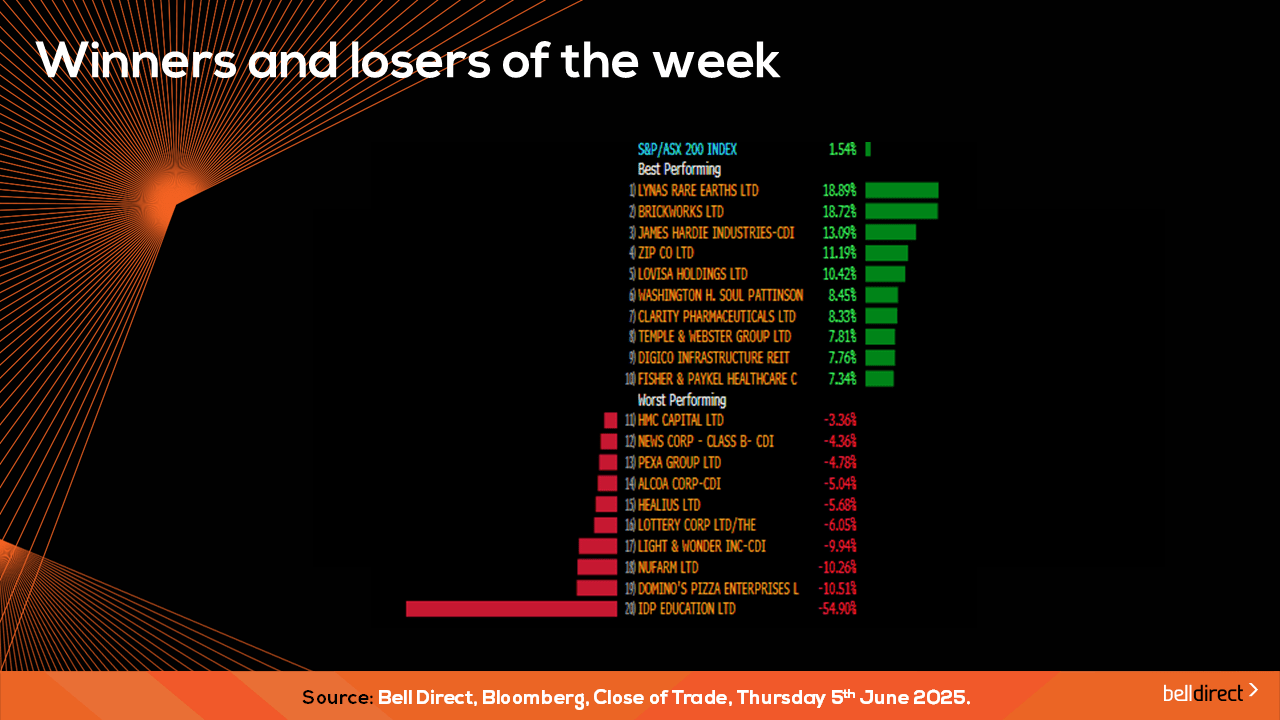

The winning stocks were led by Lynas Rare Earths (ASX:LYC) surging 18.89%, Brickworks (ASX:BKW) climbing 18.72% and James Hardie (ASX:JHX) gaining 13.1%.

And on the losing end IDP Education (ASX:IEL) tumbled over 54% while Domino’s Pizza (ASX:DMP) and Nufarm (ASX:NUF) lost 10.26% and 10.51% respectively.

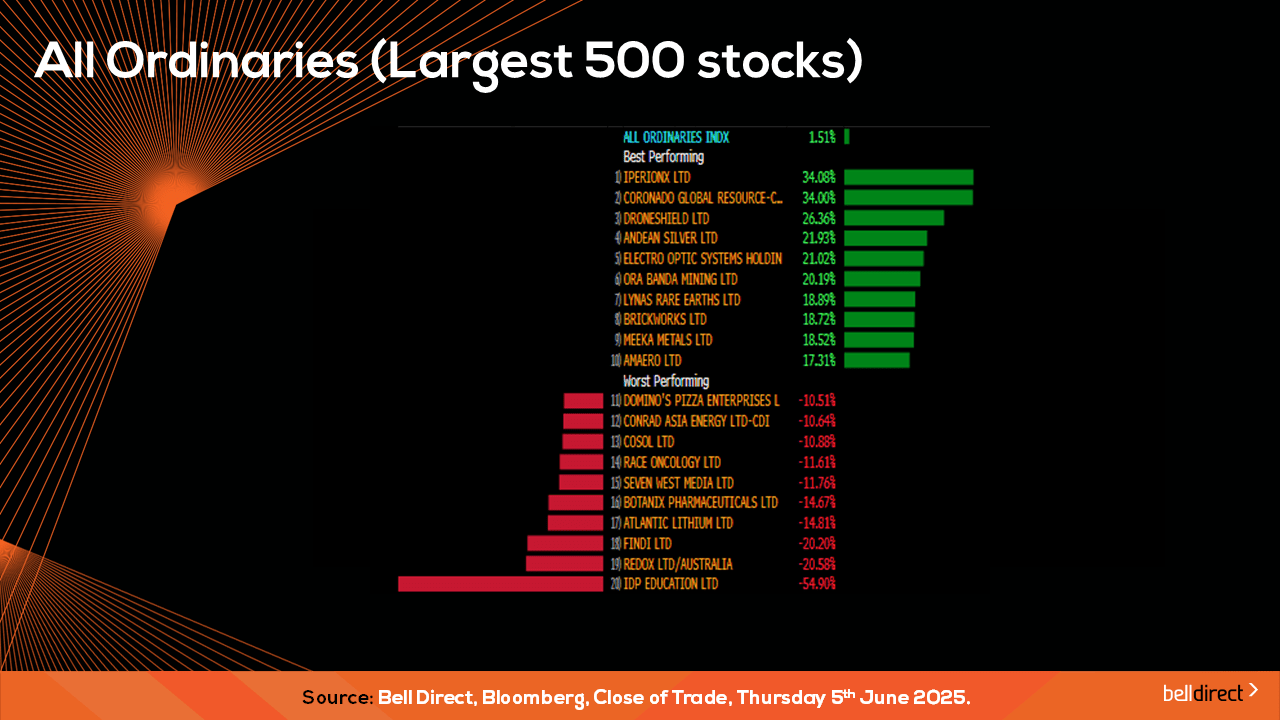

On the broader market index the All Ords rose 1.51% led by IperionX (ASX:IPX) soaring 34% after the company announced a major contract win with the U.S. Department of Defence (DoD). IDP Education at the other end of the All Ords posted a 54.9% drop on uncertain outlook for student enrolment numbers.

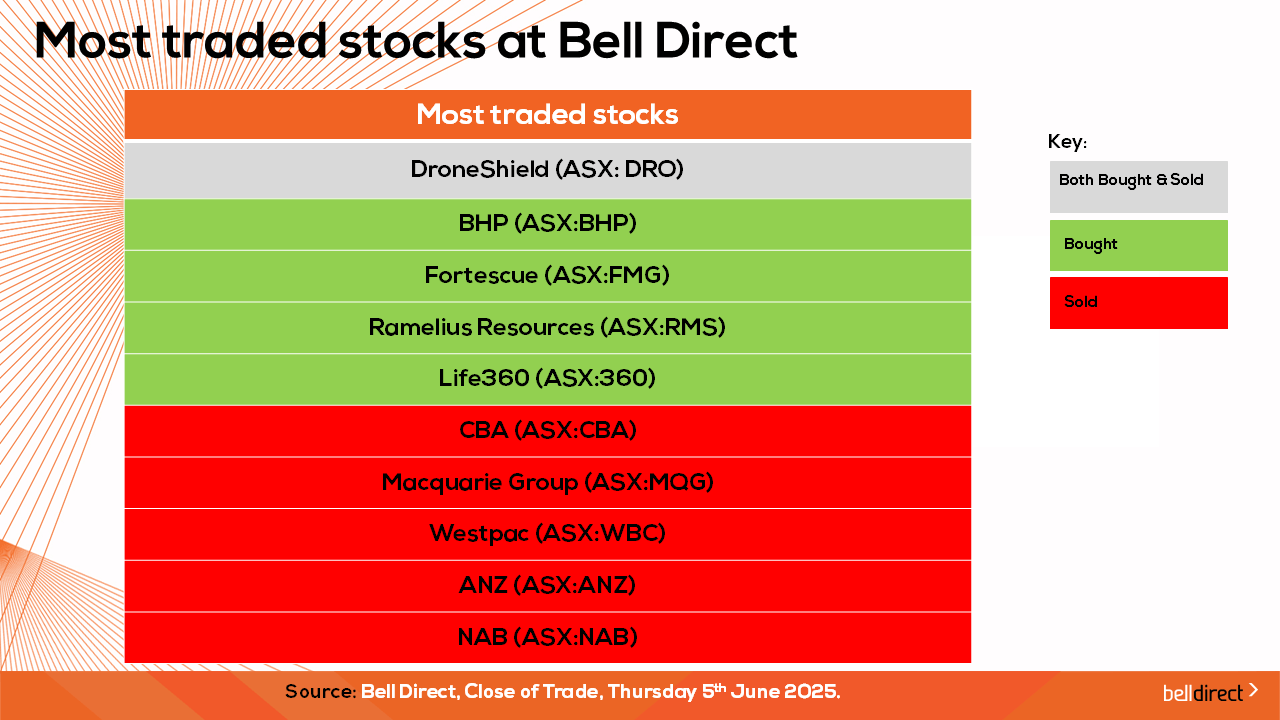

The most traded stock by Bell Direct clients this week was DroneShield (ASX:DRO). Clients also bought into BHP (ASX:BHP), Fortescue (ASX:FMG), Ramelius Resources (ASX:RMS), and Life 360 (ASX:360), while taking profits from CBA (ASX:CBA), Macquarie (ASX:MQG), Westpac (ASX:WBC), ANZ (ASX:ANZ) and NAB (ASX:NAB).

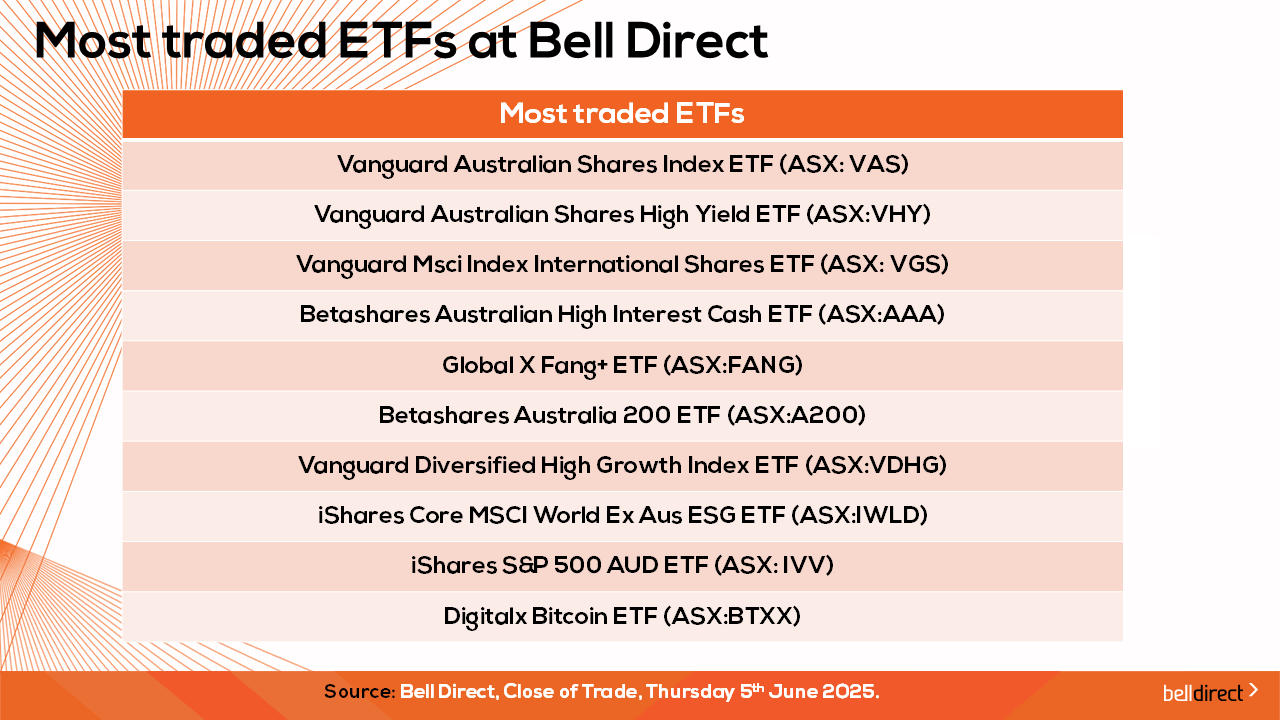

And the most traded ETFs were led by Vanguard Australian Shares Index ETF, Vanguard Australian Shares High Yield ETF and Vanguard Msci Index International Shares ETF.

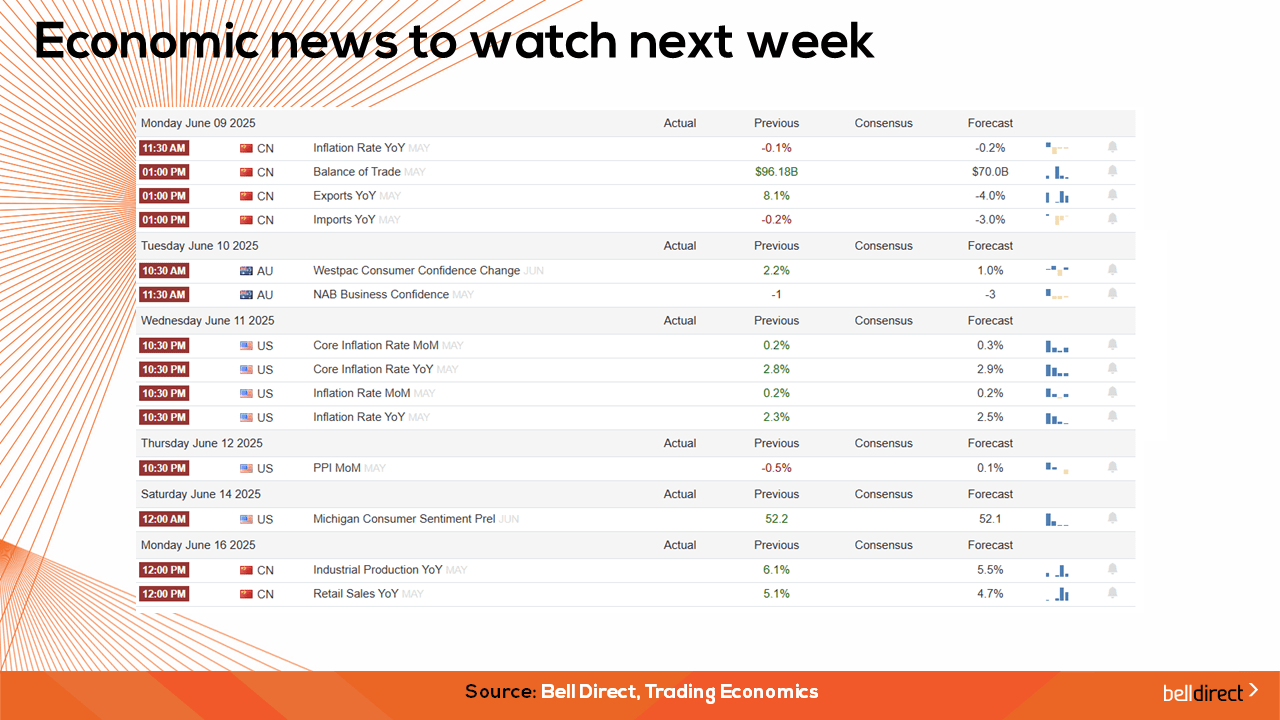

On the economic calendar front next week we may see investors respond to Westpac Consumer Confidence data for June and NAB Business Confidence data for May out early in the week with the forecast of a decline in both readings amid market and macro uncertainty.

On a global scale, key inflation and trade data out of China will paint the latest economic recovery picture out of China early in the week while later in the week key US inflation and PPI data will reveal the impact of tariffs on US inflation so far.

And that’s all for this Friday and week, have a wonderful weekend and happy investing.