Thanks for joining me this Friday the 10th October, I’m Grady Wulff, Senior Market Analyst with Bell Direct.

What a wild week we had on markets with investors questioning the sustainability of profit growth for AI giants after Oracle revealed slimmer margins in its AI business than were expected, the US government shut down entered a second week, the EU looked to impose tariffs on steel imports into the region and gold soared to over US$4000/ounce. Let’s dive into the tailwinds behind the gold rally, just how far it can run and some potential investment opportunities to consider in FY26.

Gold continues to shine as a standout performer in global markets, and several powerful tailwinds suggest that its rally still has room to run. Central banks around the world are driving a historic surge in demand, accumulating bullion at record levels to diversify reserves away from the U.S. dollar. This structural shift in reserve management is reinforcing gold’s role as a neutral store of value amid increasing distrust in fiat currencies and broader geopolitical instability.

Meanwhile, expectations of rate cuts in the U.S. are fuelling further momentum. With inflation showing signs of cooling and economic data pointing to a possible slowdown, the Federal Reserve may continue its pivot from its tightening stance after the first rate cut of 2025 was handed down by America’s central bank in September. Lower interest rates reduce the opportunity cost of holding non-yielding assets like gold, making it more attractive to both institutional and retail investors. In parallel, macroeconomic uncertainty from U.S. fiscal challenges to slowing global growth, continues to push investors toward safe-haven assets.

Another key dynamic supporting the rally is the growing dislocation between equity valuations and fundamentals. Key stock indices appear stretched, and the risk of a correction is driving more capital into tangible, historically reliable assets like gold. Elevated geopolitical tensions, whether in Eastern Europe, the Middle East, or the South China Sea, are also heightening risk aversion, further strengthening gold’s appeal.

While the gold price soared over US$4000/ounce for the first time this week we noticed some of the heavy hitting producers like Northern Star Resources (ASX:NST), Newmont (ASX:NEM) and Ramelius Resources (ASX:RMS) dipped midweek as investors took the opportunity to take some profits off the table in the short-term, rather than the sell-off being a shift in fundamentals. These stocks have had a strong run, and some consolidation is natural.

Importantly, many miners are actively winding down or closing their hedge books to maximise exposure to spot prices, a bullish signal that shows their confidence in sustained higher gold prices. With the right conditions in place and miners positioning themselves to capitalise, the gold rally still has meaningful upside from both a macroeconomic and sector-specific standpoint.

At the recent Resources Rising Stars conference on the Gold Coast, I spoke to some emerging names in the gold sector that may be of interest to you in FY26.

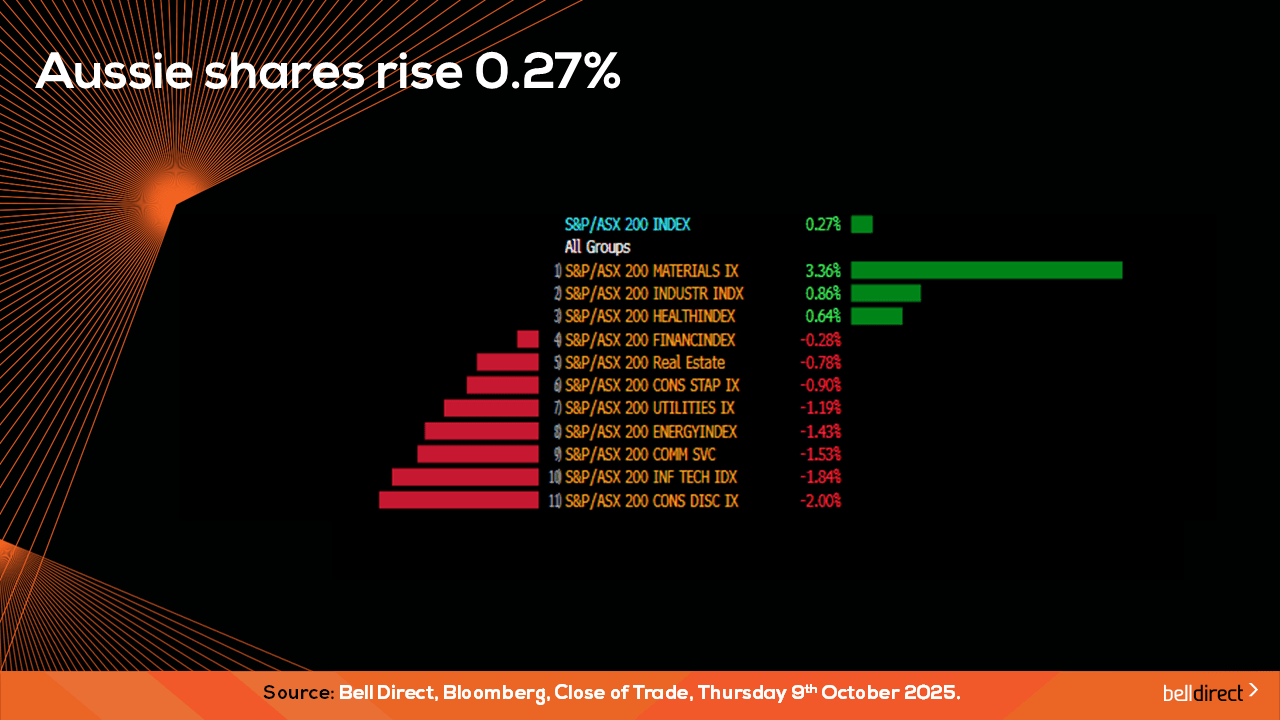

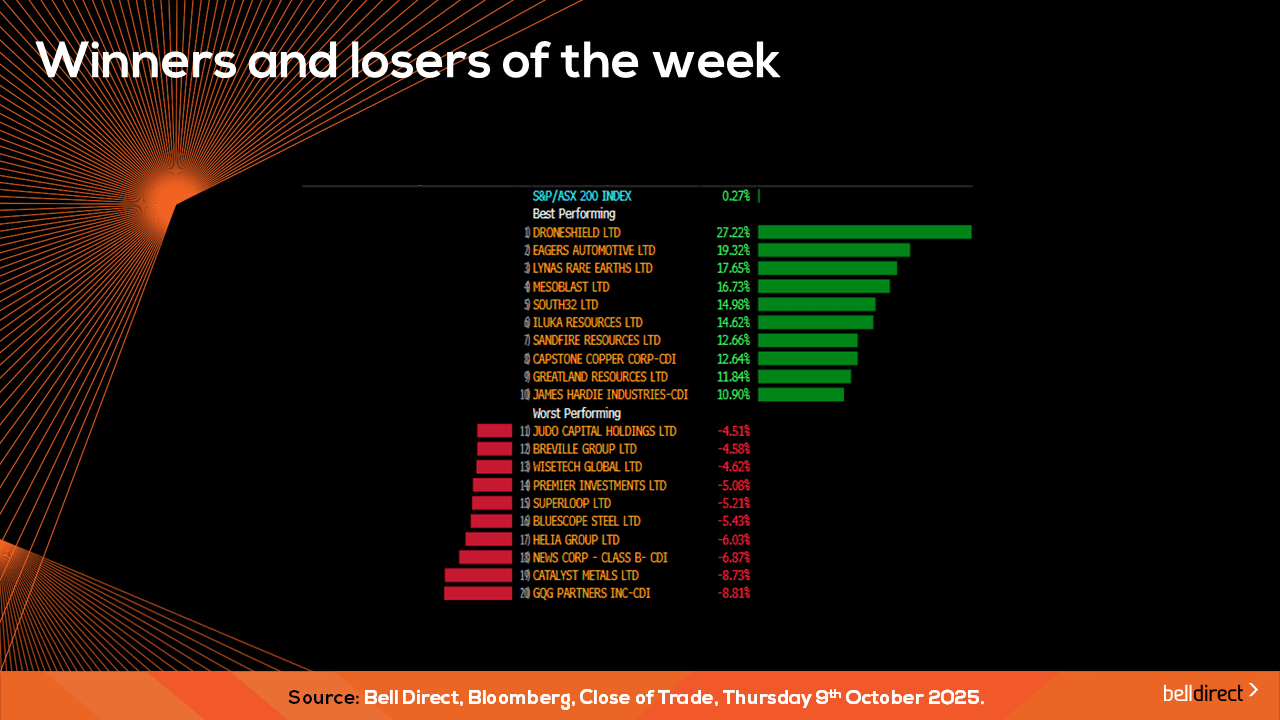

Locally from Monday to Thursday the ASX200 posted a 0.27% gain as a materials surge offset weakness among discretionary and tech stocks this week.

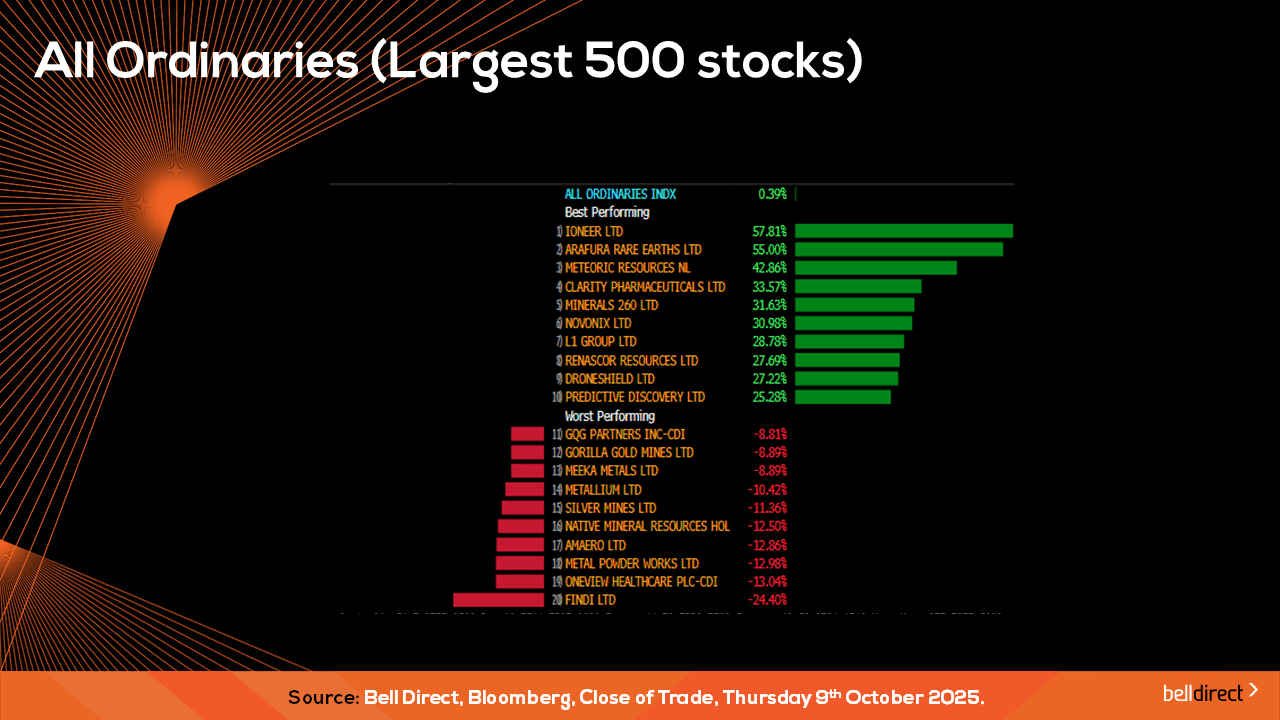

On the broader market index, the All Ords rose 0.4% this week as Ioneer (ASX:INR) soared 57.81%, while Findi (ASX:FND) tumbled 24.4%.

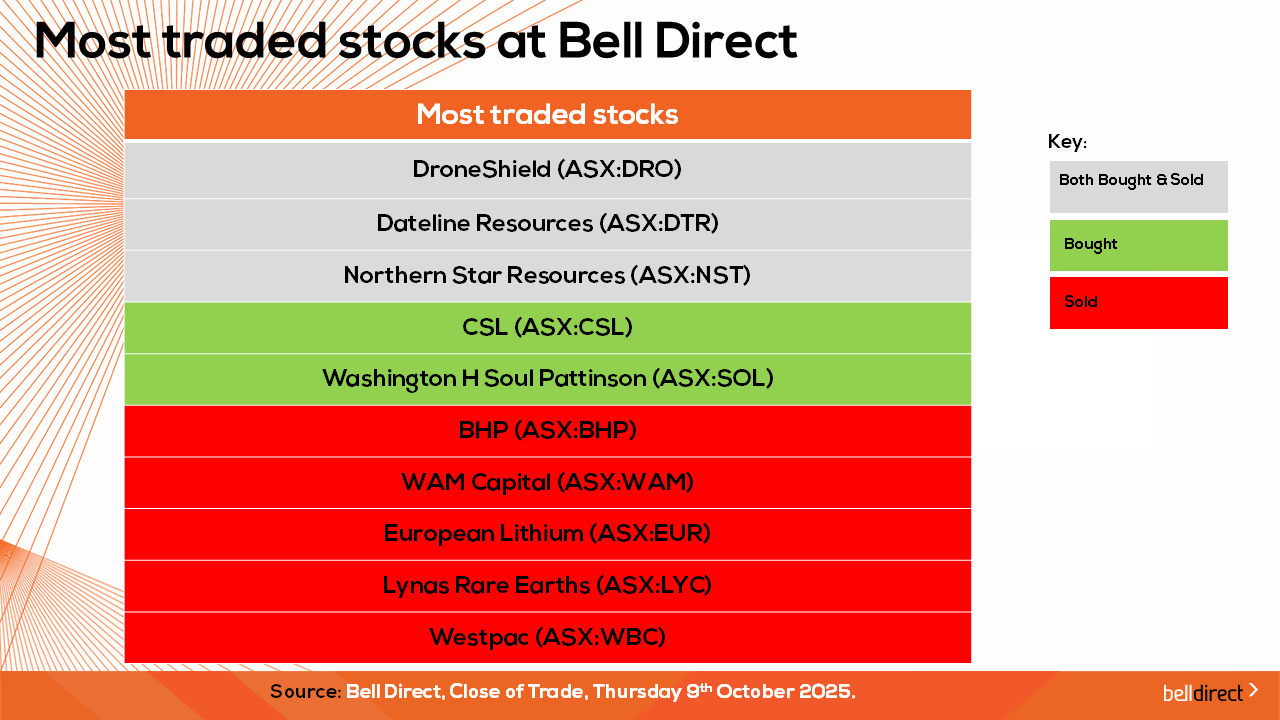

The most traded stocks by Bell Direct clients this week were DroneShield (ASX:DRO), Dateline Resources (ASX:DTR), and Northern Star Resources (ASX:NST). Clients also bought into CSL (ASX:CSL) and Washington H Soul Pattinson (ASX:SOL) while taking profits from BHP (ASX:BHP), WAM Capital (ASX:WAM), European Lithium (ASX:EUR), Lynas Rare Earths (ASX:LYC) and Westpac (ASX:WBC).

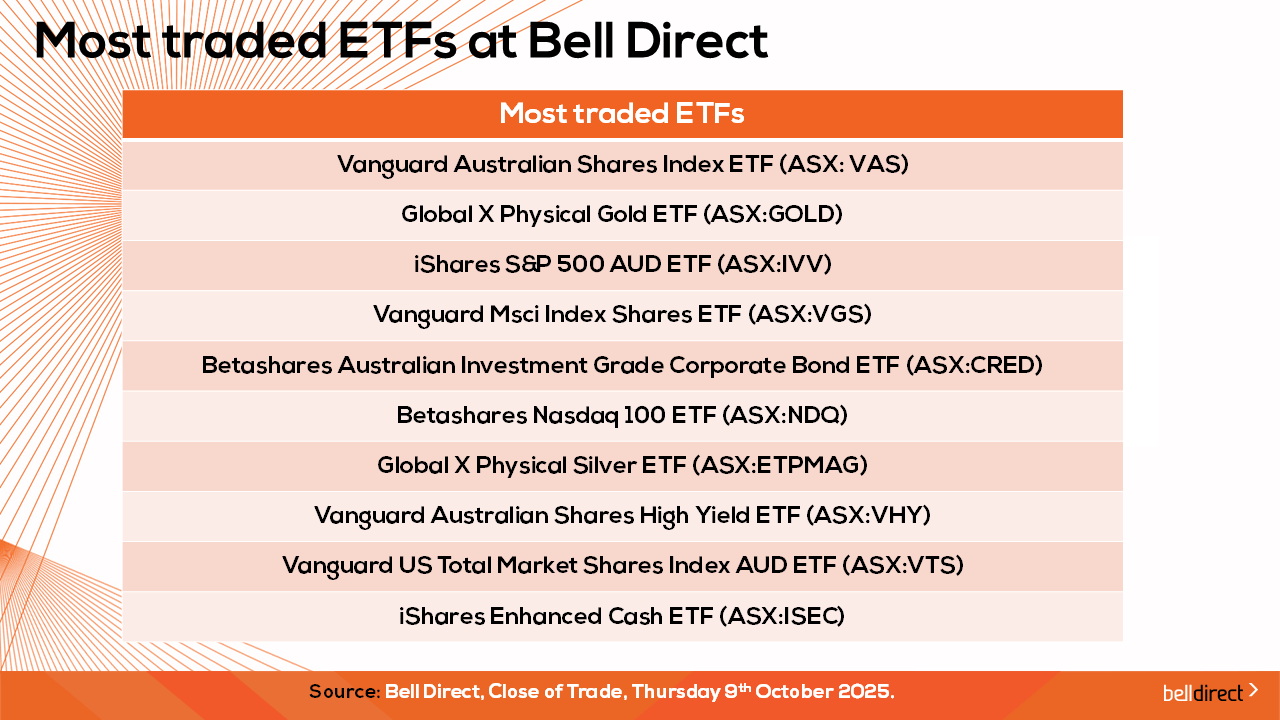

And the most traded ETFs were led by Vanguard Australian Shares Index ETF (ASX:VAS), Global X Physical Gold ETF (ASX:GOLD), and iShares S&P 500 AUD ETF (ASX:IVV).

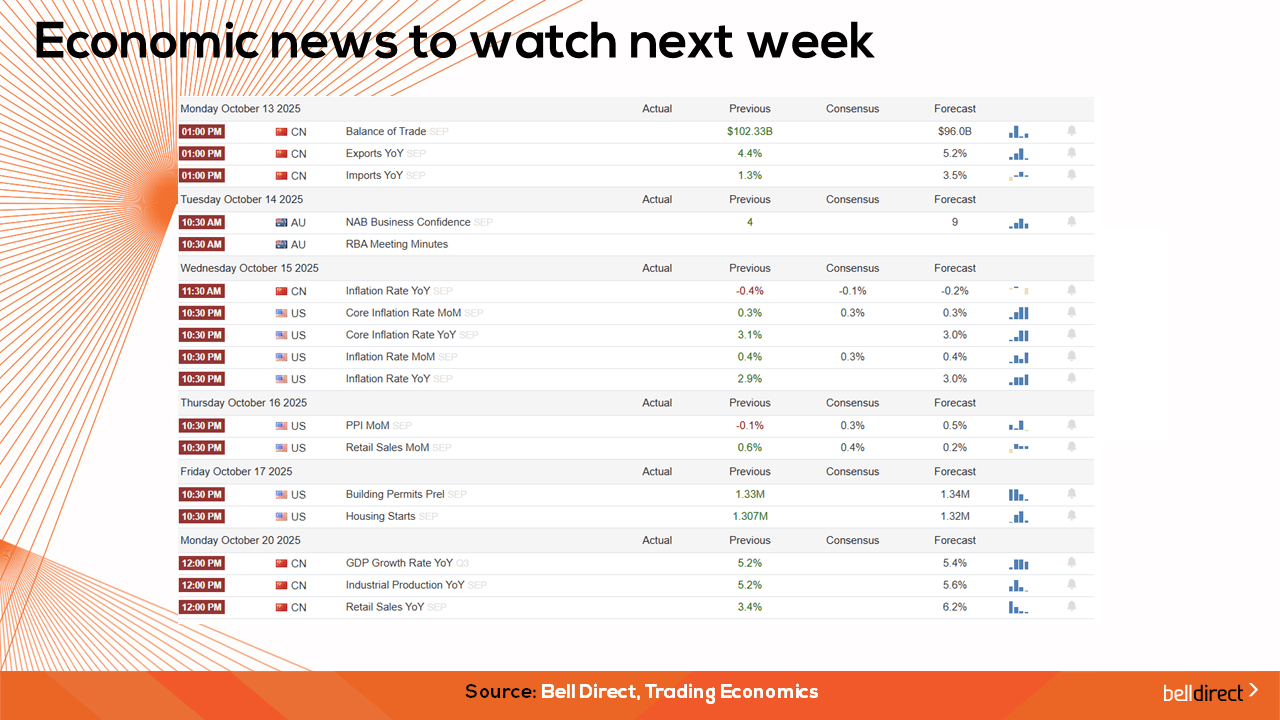

On the economic calendar next week, we may see investors react to NAB Business confidence data for September out on Tuesday with the forecast of a lift in business confidence, while the latest RBA meeting minutes are also out on Tuesday which will give investors an insight into the RBA’s rate outlook moving forward.

It is also a big week on the data front in China with trade balance data out on Monday and the country’s inflation rate for September out on Wednesday. In the US we have a data dump throughout the week with key inflation, PPI, retail sales, building permits, and housing starts data out throughout the week.

And that’s all for this Friday and week, have a wonderful weekend and happy investing.

This information is general in nature and does not take into account your financial situation, objectives or needs. You should consider whether it is appropriate for you. You should read our Financial Services Guide and any relevant Product Disclosure Statements before making an investment. For more information visit belldirect.com.au or call 1300 786 199. Bell Direct is the trading name of Third Party Platform Pty Ltd ABN 74 121 227 905, AFSL 314341.