Thanks for joining me this Friday the 3rd October, I’m Grady Wulff, Senior Market Analyst with Bell Direct and this is our weekly market update.

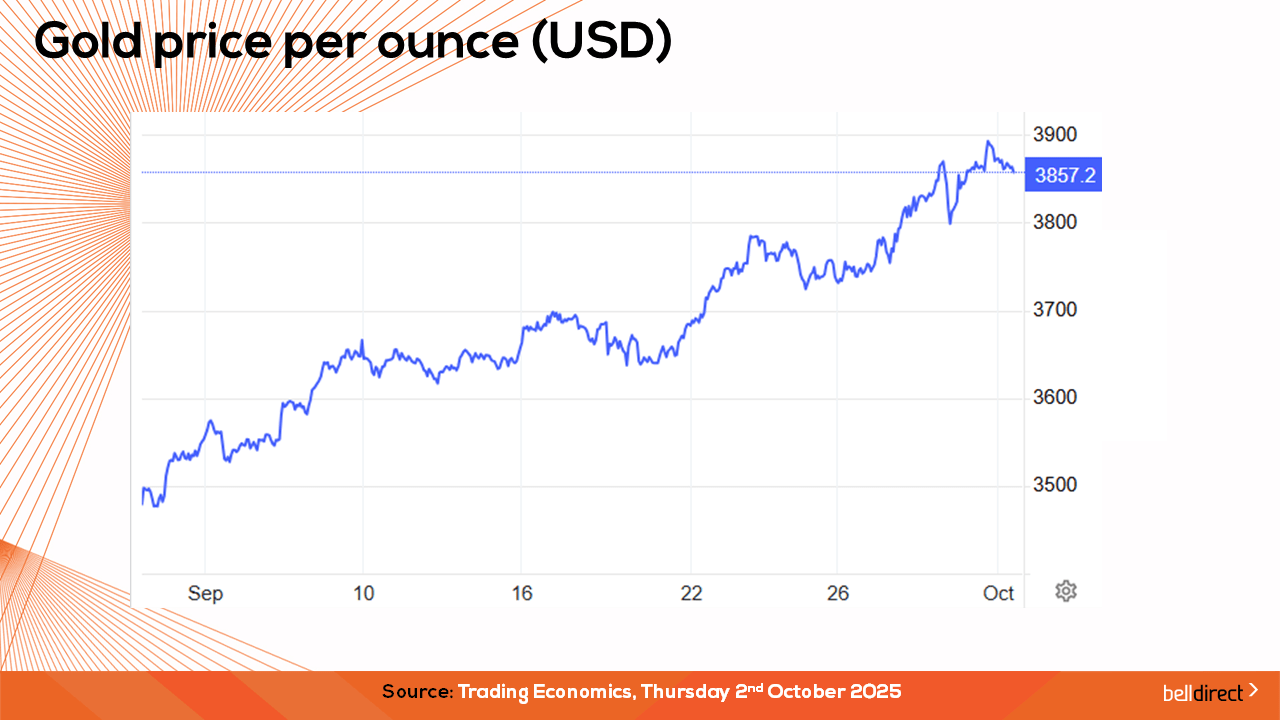

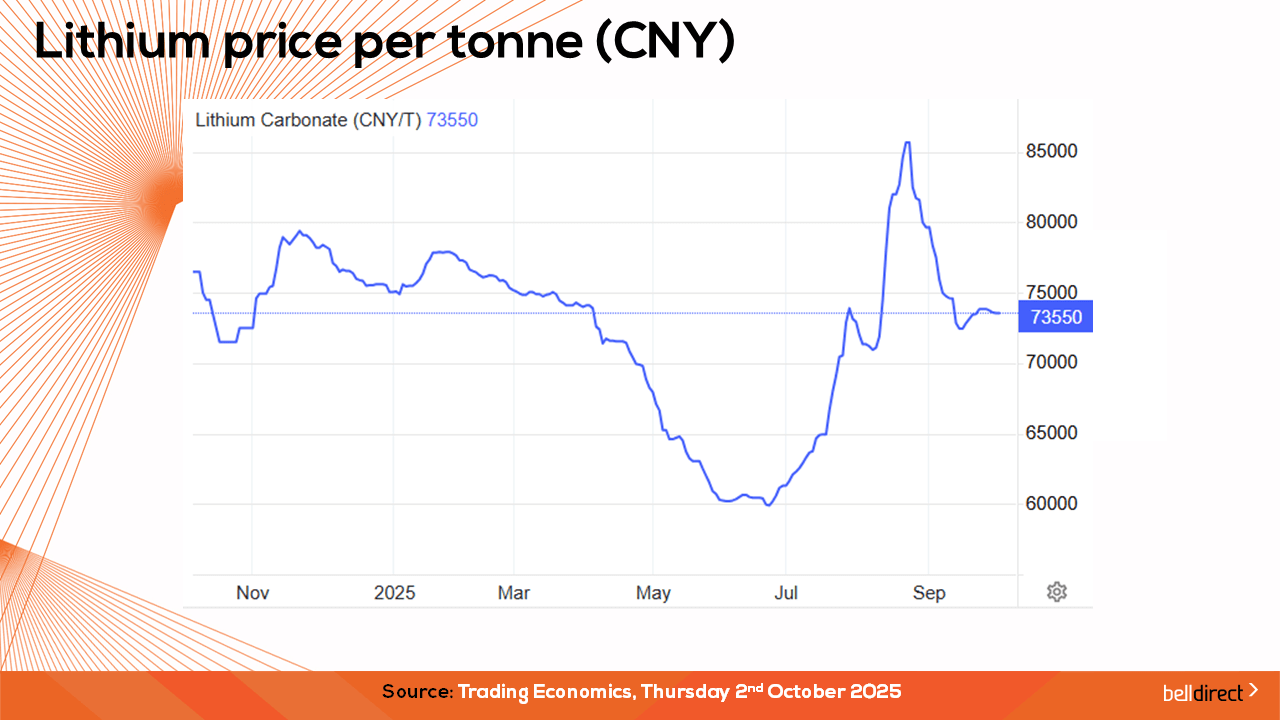

This week the spot price of gold soared to fresh record highs, iron ore miners were hit by updates out of China, and the lithium rollercoaster hit another loop-de-loop on the commodities front while investors are questioning what a US government shutdown means for your portfolios, so let’s dive into the week that was and how to navigate the currently elevated level of volatility.

Over the last month, the spot price of gold has soared almost 10% to top a fresh record this week over US$3895/ounce with key tailwinds only growing stronger in recent weeks on top of new drivers emerging to propel the price of the commodity even higher. In the US, investors have been buying up gold related investments recently following the latest unexpected drop in US private employment which drives investor concerns of economic weakness and increases downward pressure on the USD which in turn drives demand and the value of gold. The other driver of gold this week was the surprise announcement of a US government shutdown. The US government entered its first shutdown in almost 7-years as lawmakers failed to reach a deal on government funding. The shutdown further exacerbated investor concerns over the stability of the US economy and sparked investors to flee riskier assets in favour of safe havens like gold. Other drivers including central banks on a global scale buying increased amounts of the precious commodity, interest rate cuts, elevated geopolitical tensions and overvaluation of equities continue working to fuel tailwinds for the price of gold to rally for some time to come. With gold topping fresh records this week, local gold miners like Northern Star Resources (ASX:NST), and Ramelius Resources (ASX:RMS) and ETFs like GOLD and NUGG have experienced significant gains over the last trading week.

Iron ore giant BHP (ASX:BHP) was not so lucky this week with confirmation out of China that imports from the world’s largest iron ore miner will be temporarily halted in a bid to negotiate prices. The pricing power tactic reached a head this week with China reportedly banning BHP’s iron ore to take back control of pricing in the US$130bn global iron ore market. According to reports, the freeze ordered by China Mineral Resources Group (CMRG) could see millions of dollars of US-dollar denominated cargoes from Australia stranded at sea. While Australia’s Prime Minister Anthony Albanese urged BHP and Beijing to resolve the dispute quickly, we will likely see the freeze place downward pressure on iron ore prices as demand falls and steel producers take a step back. The pricing power battle spans back to 2009 when BHP’s CEO at the time forced China to accept spot market pricing over an old fixed-price system, and as a result of the GFC and mining boom, BHP reaped the rewards of the spot price system. Fed up with the pricing battle, China’s freeze of imports from BHP is the last resort in negotiations with BHP and will likely impact the mining giant’s earnings for a period in FY26.

Lithium prices were back in the headlines this week as the on-again-off-again production nature of CATL (China’s largest battery manufacturer) hit the news again with reports of a production re-start sooner than expected. Just weeks after the news of a production halt sent local lithium producer share prices rallying, the news of a restart adding supply to an already oversupplied industry, negatively impacted share prices of Liontown Resources (ASX:LTR) and Pilbara (ASX:PLS) this week. The initial suspension of production at CATL was due to the mine’s licence being expired, but with Chinese authorities now approving CATL’s reserve report for the mine, a restart is imminent by Q4 of 2025.

And finally, the US government shutdown mentioned earlier in this report, has spooked investors back into safe-haven assets, but what does the shutdown actually mean for equity markets and how can you navigate it? Historically, government shutdowns haven’t been market moving events, but this time may be different due to already heightened economic uncertainty and a delay to key jobs data being released due to the shutdown, which is a key data point for investors to assess the outlook for the Fed’s rate journey. Key sectors of the market that have been rallying of late due to increasing government spend, like defence, can be impacted by the shutdown if contracts are paused, while tourism and travel can also suffer due to closures of key government facilities and airport delays. For our local market, the US government shut down can include weaker US growth expectations leading to reduced exports from Aussie companies to the world’s largest economy, currency volatility with the AUD strengthening against the USD, and a broad risk-off sentiment until more clarity and certainty is gained around the unfolding US debt and budget situation. On the navigation front, we have seen investors bolstering safe haven areas of the market this week like gold, while maintaining the mentality of not panic selling amid heightened volatility. Be sure to remember your investment strategy and goals when making investment decisions.

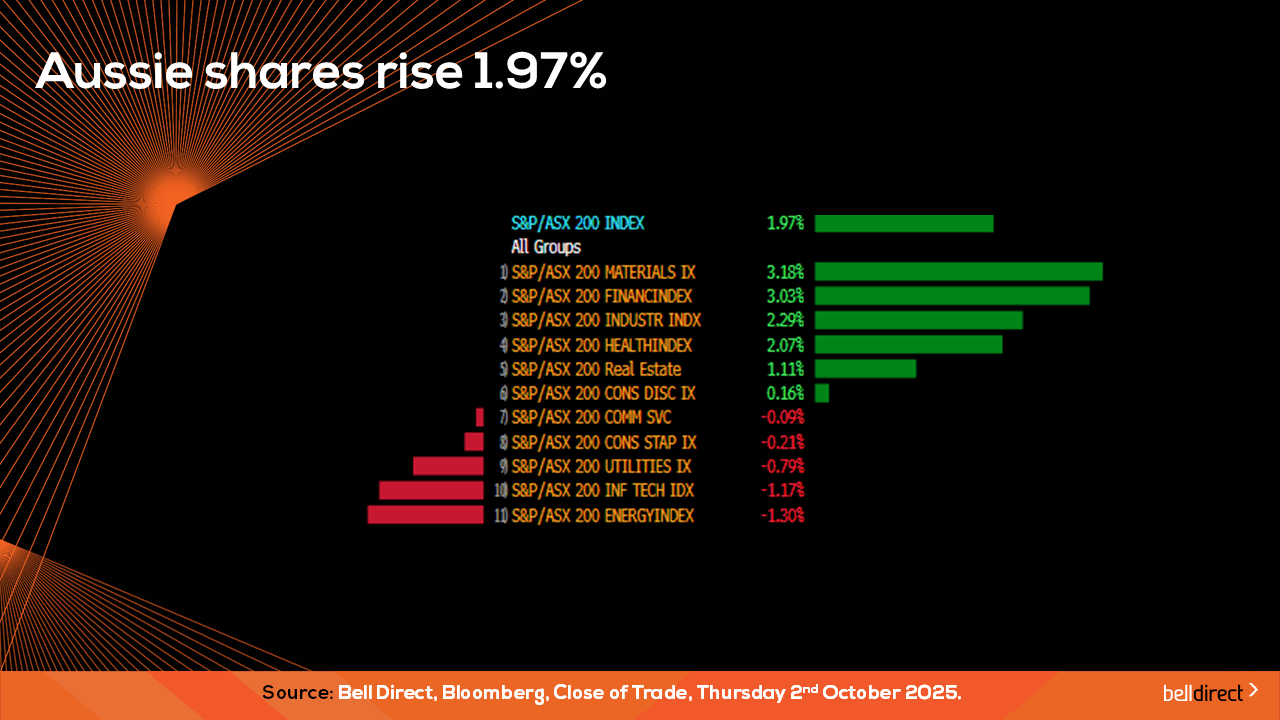

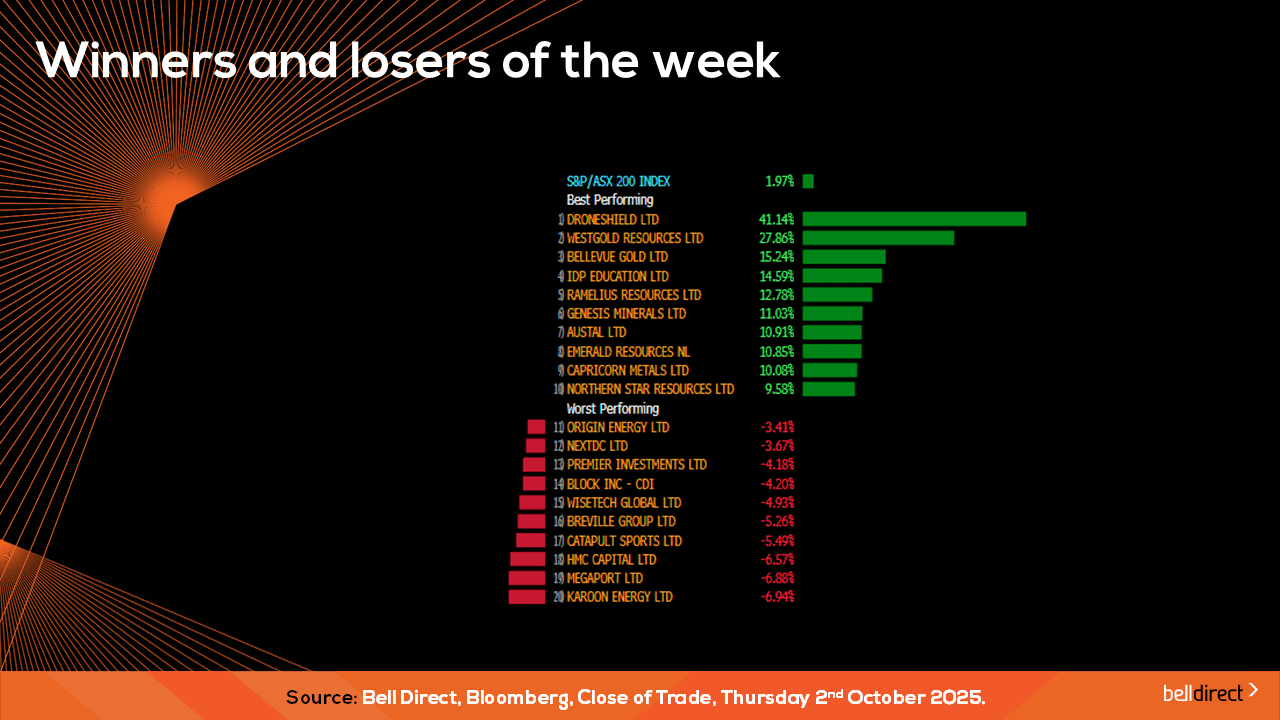

Locally from Monday to Thursday the ASX200 posted a 1.97% gain as a 3.2% surge in materials stocks and a 3% rise in financial stocks more than offset weakness among energy and tech stocks.

On the broader market index, the All Ords posted a 1.95% rally as Race Oncology (ASX:RAC) Soared 45.66% while Metal Powder Works (ASX:MPW) tumbled 15.42% over the course of the trading week.

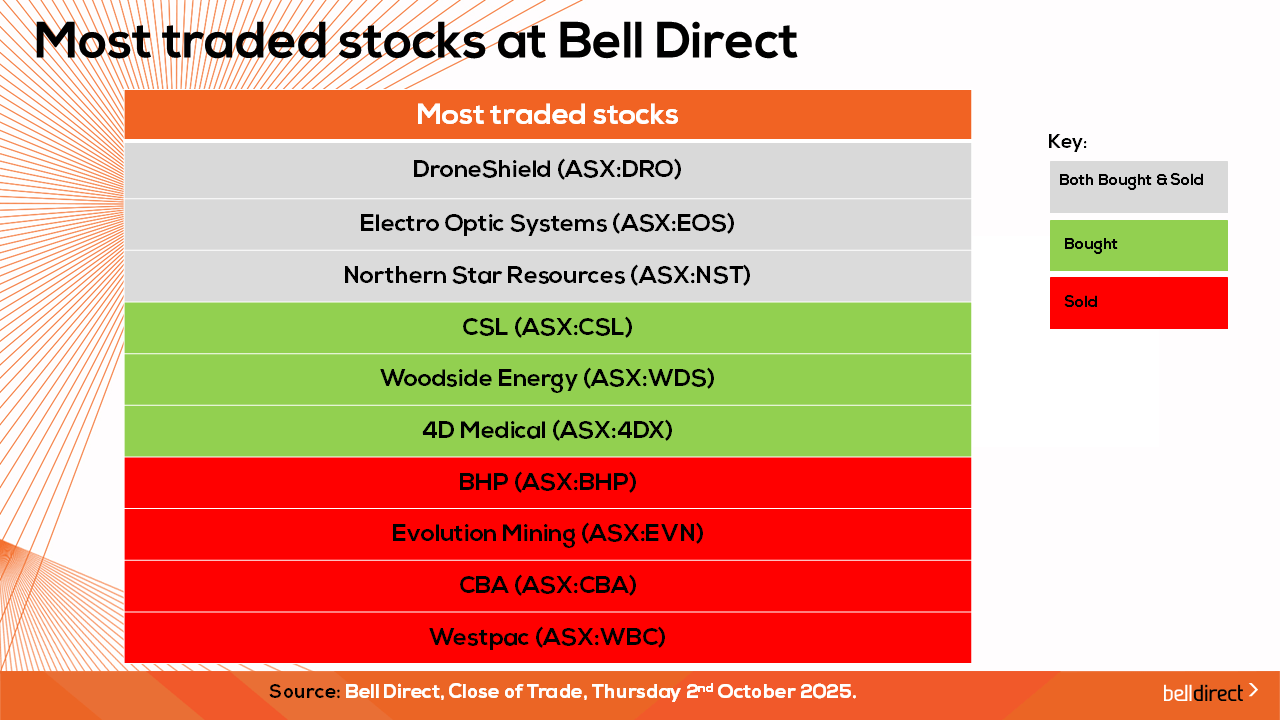

The most traded stocks by Bell Direct clients this week were DroneShield (ASX:DRO), Electro Optic Systems (ASX:EOS), and Northern Star Resources (ASX:NST). Clients also bought into CSL (ASX:CSL), Woodside (ASX:WDS) and 4D Medical (ASX:4DX) whilst taking profits from BHP (ASX:BHP), Evolution Mining (ASX:EVN), CBA (ASX:CBA) and Westpac (ASX:WBC).

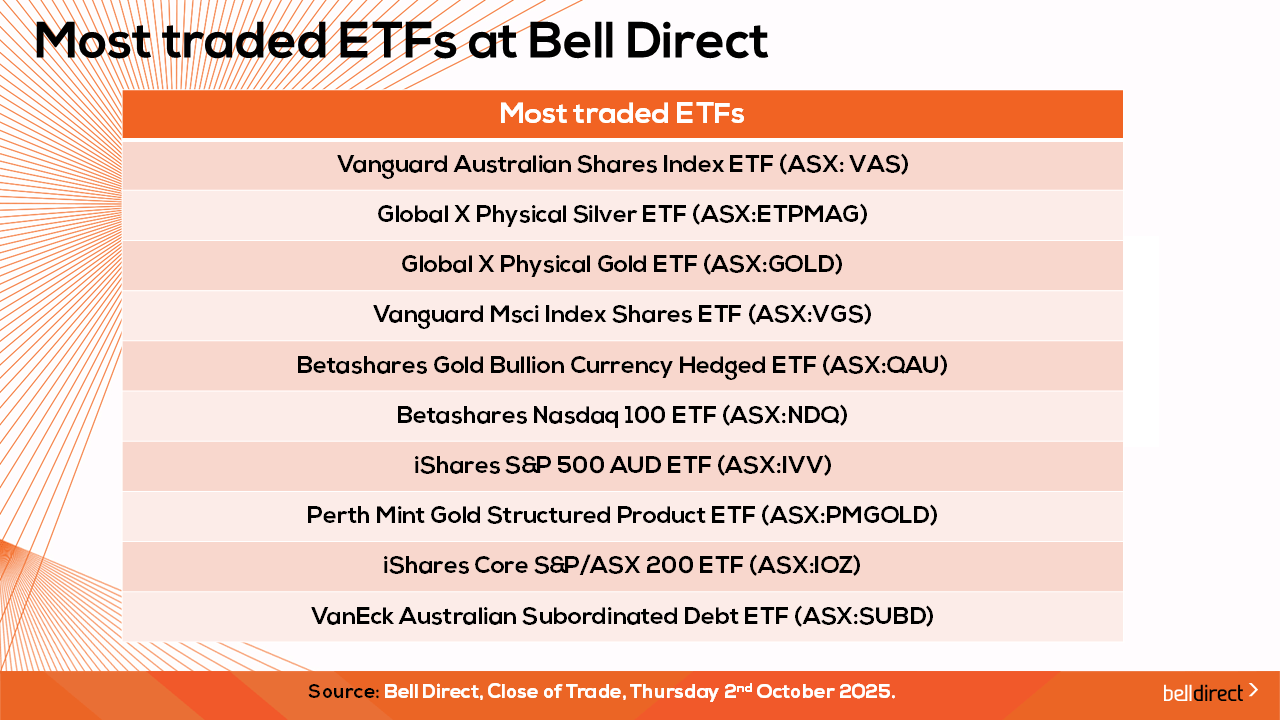

And the most traded ETFs were led by Vanguard Msci Index International Shares ETF (ASX:VGS) Global X Physical Silver Structured ETF (ASX:ETPMAG), and Global X Physical Gold Structured ETF (ASX:GOLD).

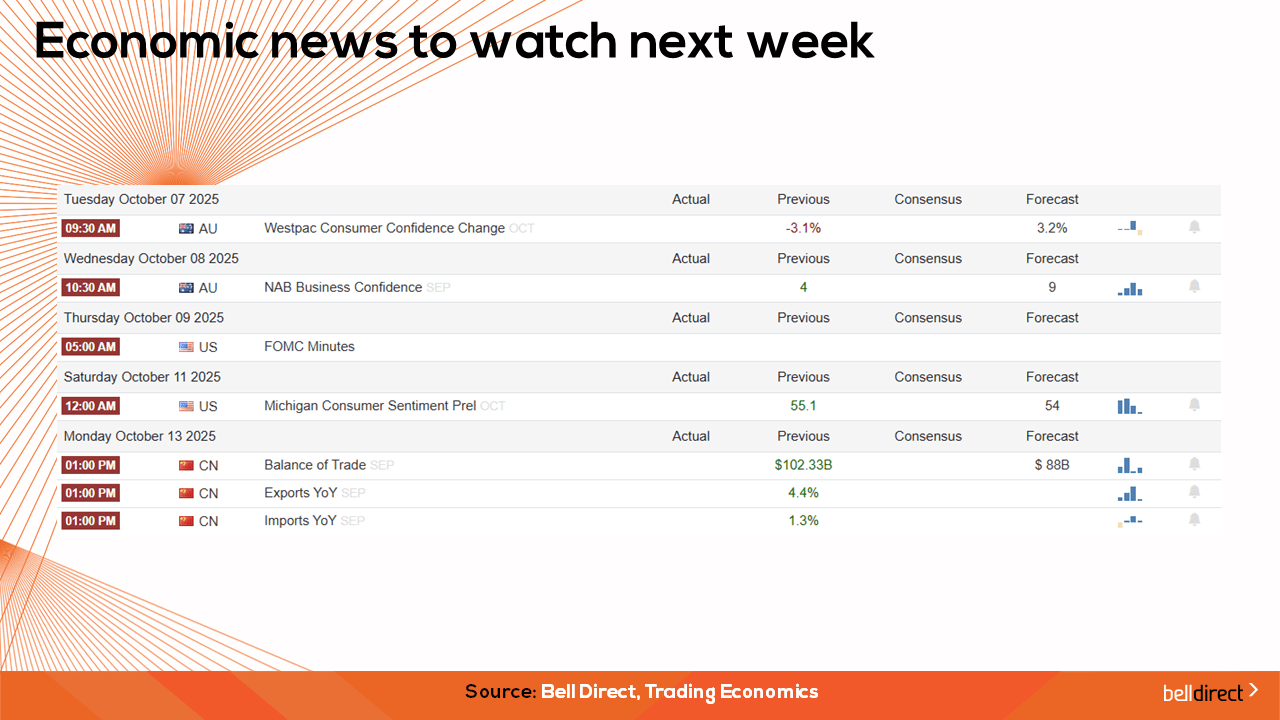

On the economic calendar front next week, we will likely see investors react to Westpac consumer confidence data for October and NAB’s business confidence data for September with the forecast of a sharp rise in both readings which will signal an uptick in confidence aligned between consumers and businesses. Overseas, the latest US FOMC meeting minutes will be released on Thursday and key trade balance data out of China will be released on Monday week.

And that’s all for this Friday, have a wonderful weekend and happy investing.

This information is general in nature and does not take into account your financial situation, objectives or needs. You should consider whether it is appropriate for you. You should read our Financial Services Guide and any relevant Product Disclosure Statements before making an investment. For more information visit belldirect.com.au or call 1300 786 199. Bell Direct is the trading name of Third Party Platform Pty Ltd ABN 74 121 227 905, AFSL 314341.