Thanks for joining me this Friday the 12th September, I’m Grady Wulff, Senior Market Analyst with Bell Direct and this is our weekly market update.

We are 2 weeks into September, and the market has extended its sell off to start the new month into this trading week as investors took profits from areas of strength during reporting season and repositioned portfolios to weather renewed global macro uncertainty for at least the start of FY26.

Despite being down over 1% so far in September, the ASX hovered around record territory over the last months, and valuations remain stretched for key areas of the market that may face some headwinds on an earnings growth and cost front in FY26. This week, we hosted the first Bell Direct Webinar for 2025, ‘Managing Market Volatility’ where I sat with three of Bell Potter’s leading research analysts to discuss their take on reporting season, macro-outlook, rate insights, opportunities and tactics to navigate the currently elevated volatility level of the global market landscape. This weekly wrap collates the key insights from the webinar to deliver a concise overview of the analysts’ answers to guide your investment journey this September 2025.

You can watch the webinar here

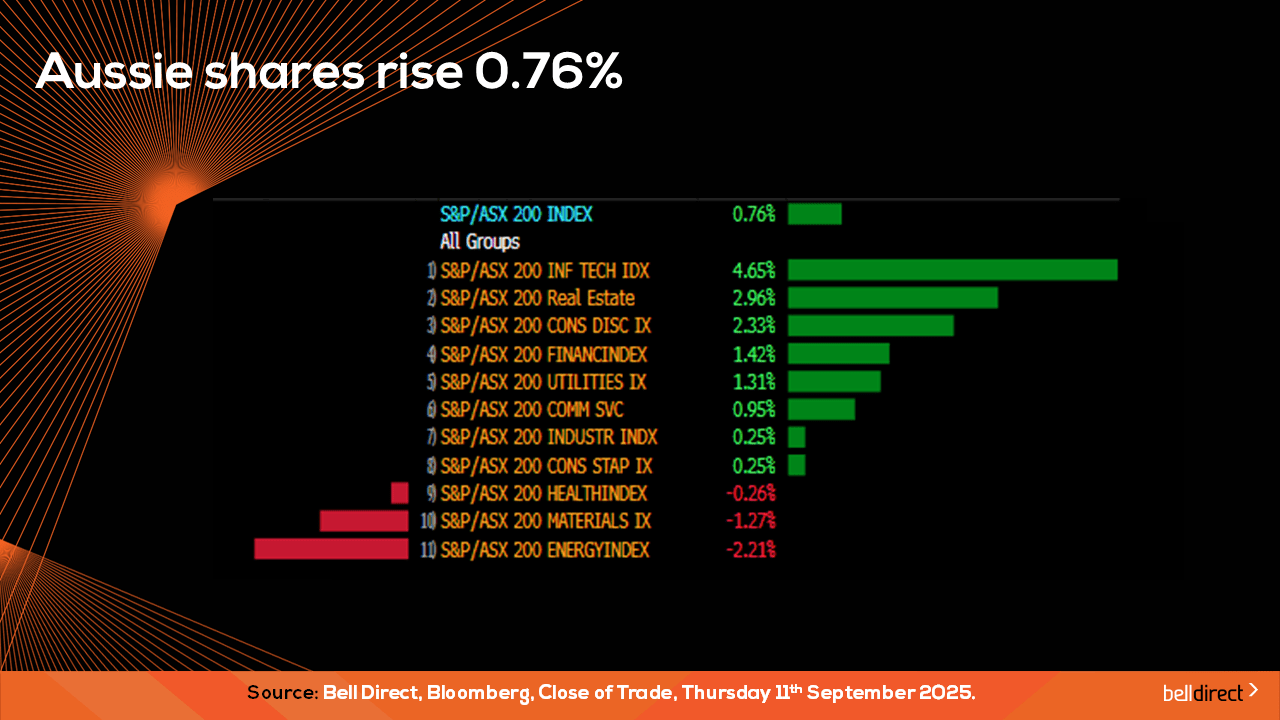

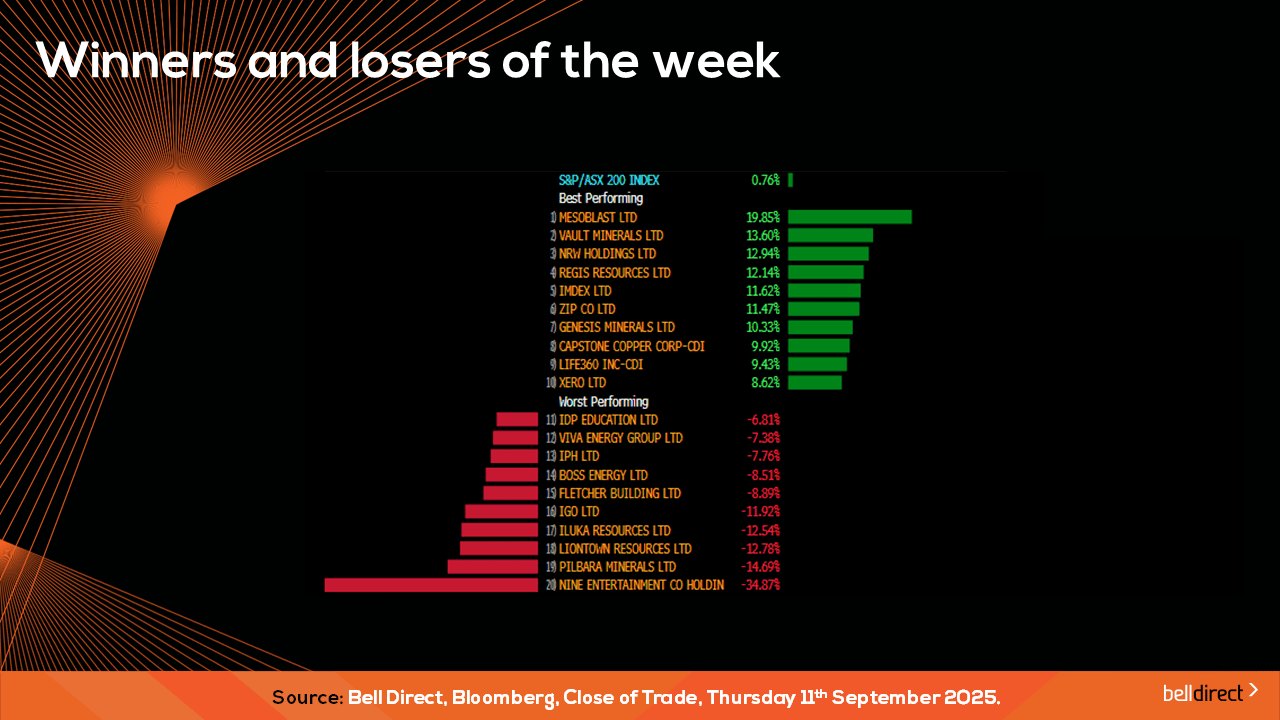

In a turn around week, locally from Monday to Thursday the ASX200 posted a 0.76% rise as the rate sensitive sectors in tech sector and Reit stocks rose 4.65% and almost 3% respectively.

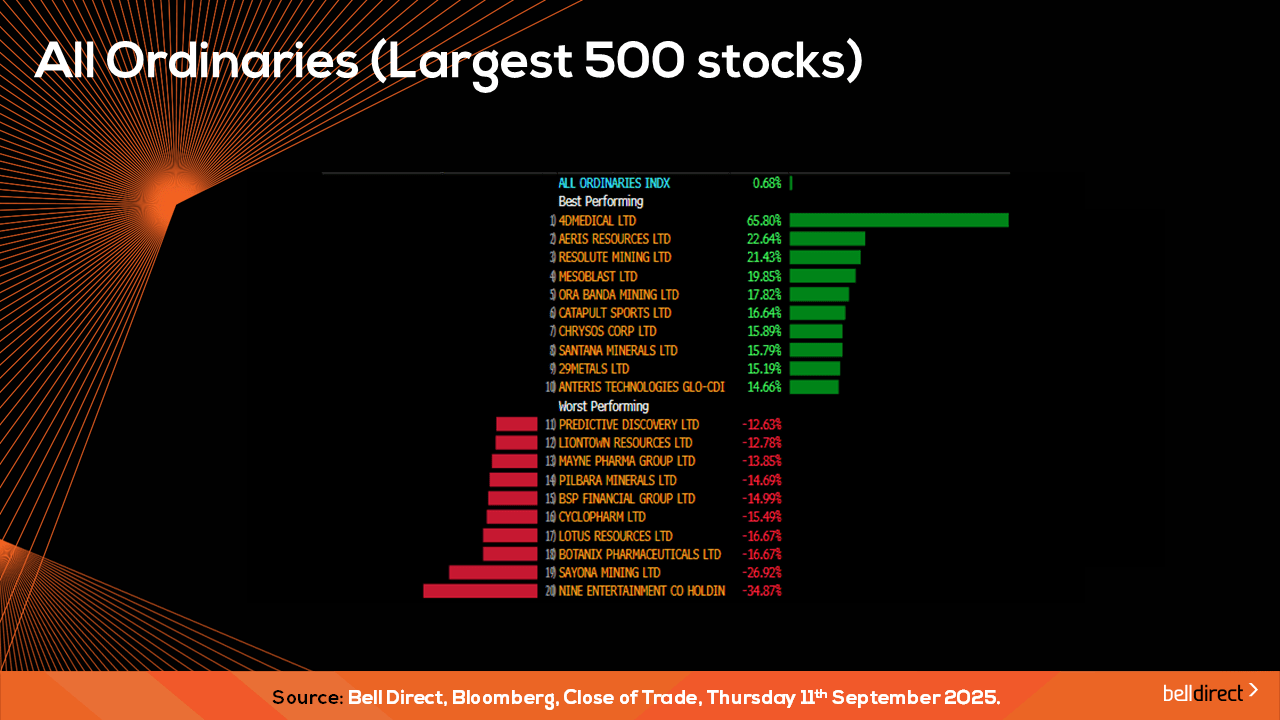

On the broader market index, the All Ords gained 0.68% as 4D Medical (ASX:4DX) soared 65.80% while Sayona Mining (ASX:SYA) tumbled 26.92%.

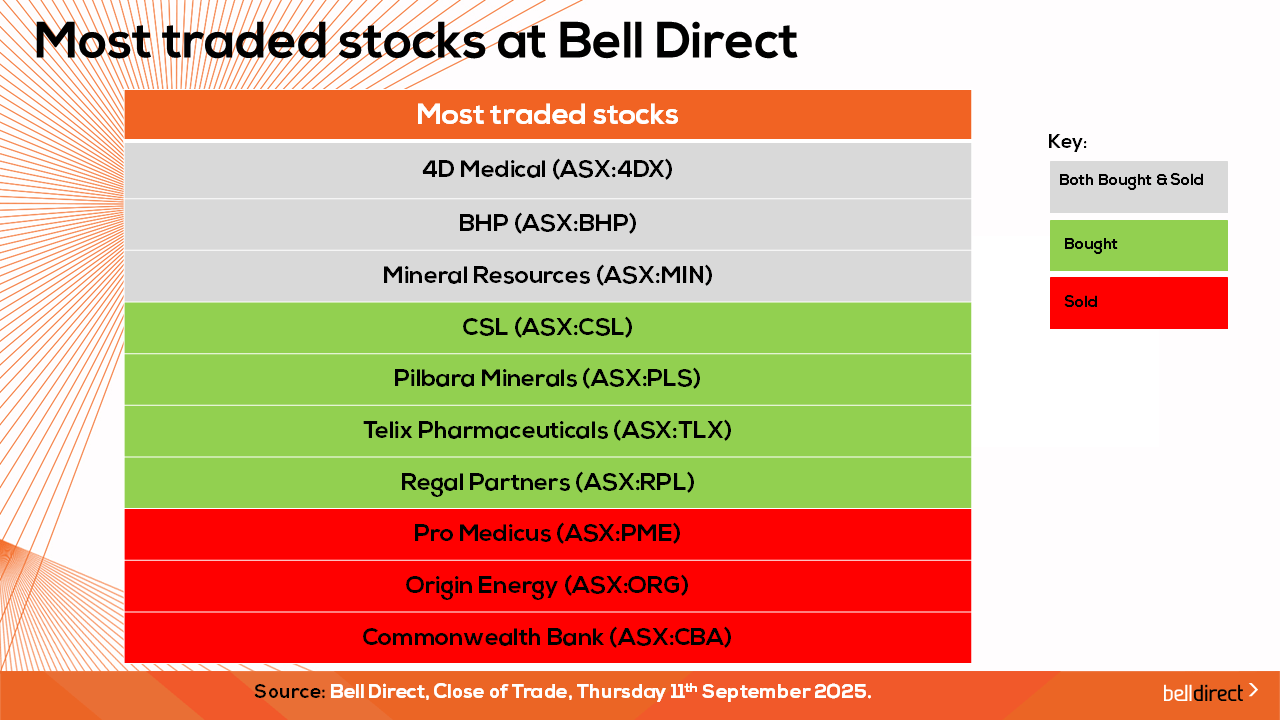

The most traded stocks by Bell Direct clients from Monday to Thursday were 4D Medical (ASX:4DX), BHP (ASX:BHP), and Mineral Resources (ASX:MIN). Clients also bought into CSL (ASX:CSL), Pilbara Minerals (ASX:PLS), Telix Pharmaceuticals (ASX:TLX), and Regal Partners (ASX:RPL), while taking profits from Pro Medicus (ASX:PME), Origin Energy (ASX:ORG) and CBA (ASX:CBA).

And the most traded ETFs by our clients this week were led by Vanguard Australian Shares Index ETF (ASX:VAS), Global X Physical Gold Structured ETF (ASX:GOLD), and Vanguard Msci Index International Shares ETF (ASX:VGS).

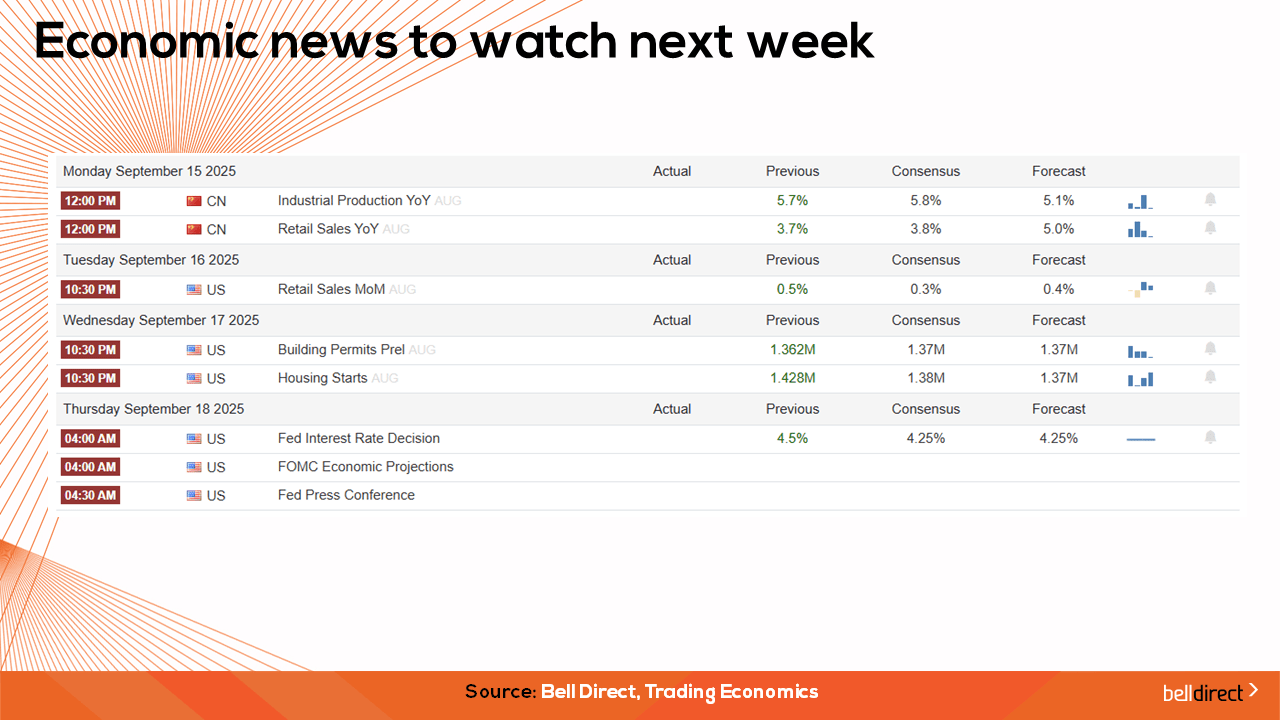

On the economic calendar next week, we may see investors respond to further key economic data from China with Industrial production and retail sales out on Monday while in the US, key housing data and the Fed’s latest rate decision will be announced later in the week.

And that’s all for this Friday and week, have a wonderful weekend and happy investing.