Thanks for joining me this Friday the 19th September, I’m Grady Wulff, Senior Market Analyst with Bell Direct and this is our weekly market update.

Commodities have been a mixed bag over the last 12-months with gold and copper running red hot while lithium remains in a depreciated price environment and uranium has re-emerged as a front runner amid the green energy transition movement. This week, I sat down with some of the industries mining magnates and newcomers to discuss the outlook for key commodities at the Resources Rising Stars conference for 2025. From a hybrid mining services and operations business to a major gold discovery in WA and even across the world to assets in Canada, I asked the executives key outlooks on commodities and updates from the helm to deliver this special edition of our weekly to you.

You can see the clips from these interviews in the Weekly Wrap video, or the full interviews on our YouTube.

I first sat down with mining magnate Tim Goyder, the Chairman of Minerals 260 (ASX:MI6) and leader across many other boards to discuss how MI6 has strategically navigated the gold run with its recently acquired Bullabulling gold project in WA.

Develop Global has been on a tear recently after announcing strong production results at its Woodlawn copper-zinc project in NSW with the company progressing rapidly toward steady state production aimed for early 2026. Managing director Bill Beament explained why the copper run still has a long way to soar and how Develop’s Woodlawn asset plays a key role in fulfilling the upcoming supply side deficit of this critical mineral.

Three newer names to hit the market in the gold space also making waves in recent months are Arika Resources (ASX:ARI) and Gorilla Gold (ASX:GG8) for their gold assets in the WA gold district and Canada.

And a copper-gold project has fuelled a 30% share price rally this year for Firefly Metals (ASX:FFM) as investors buy into the high-grade critical metals deposits owned by FFM in the attractive Newfoundland region of Canada. With an aggressive drilling strategy, there’s an exciting 12-months ahead for Firefly according to Executive Director, Mike Naylor.

As for what to watch in FY26 on the commodity cycle front, those at the helm see gold’s run is set to continue with central bank buying, interest rates easing and safe-haven nature of such investments fuelling tailwinds for the precious commodity. Copper is also expected to continue running as we face a critical supply deficit against mounting demand for the critical metal. Uranium’s role in the green energy transition is also anticipated to continue fuelling the spot price momentum for the commodity, while lithium’s depreciated price environment may recover sooner than we think – all according to executives and analysts that attended the conference this week.

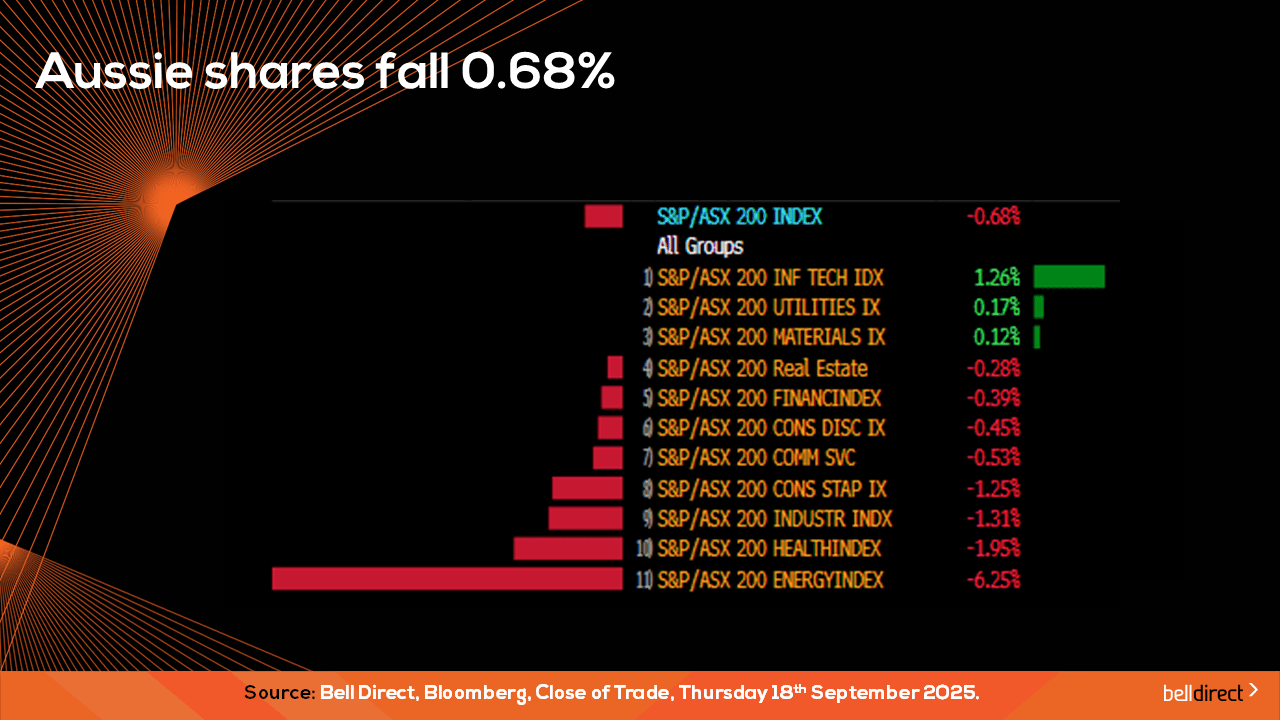

Locally from Monday to Thursday the ASX200 posted a 0.68% loss as a sharp sell-off among energy and healthcare stocks offset strength among the tech and utilities sectors this trading week. Investors have also been cautious to start September as macro uncertainty remains elevated.

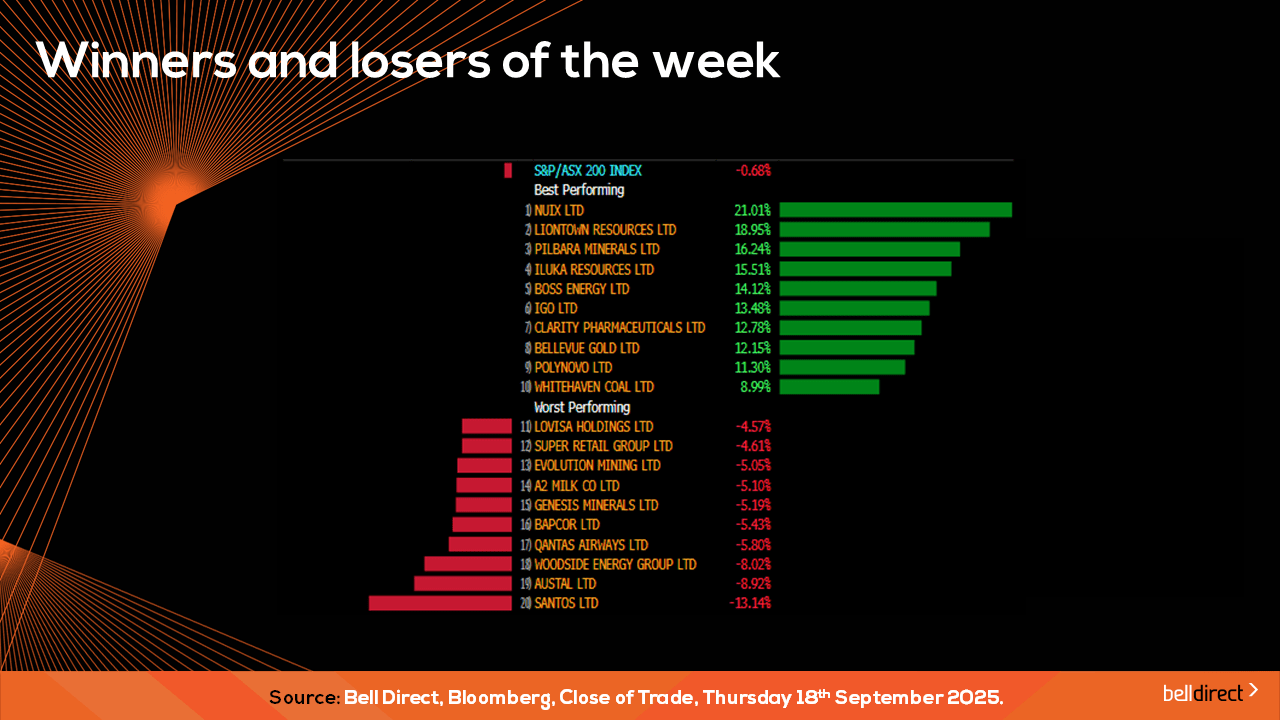

The winning stocks were led by Nuix (ASX:NXL) soaring over 21% while Liontown Resources (ASX:LTR) and Pilbara Minerals (ASX:PLS) gained 19.85% and 16.24% respectively.

And on the losing end Santos (ASX:STO) tumbled 13% after its takeover deal fell through while Austal (ASX:ASB) ended the week down 8.92%.

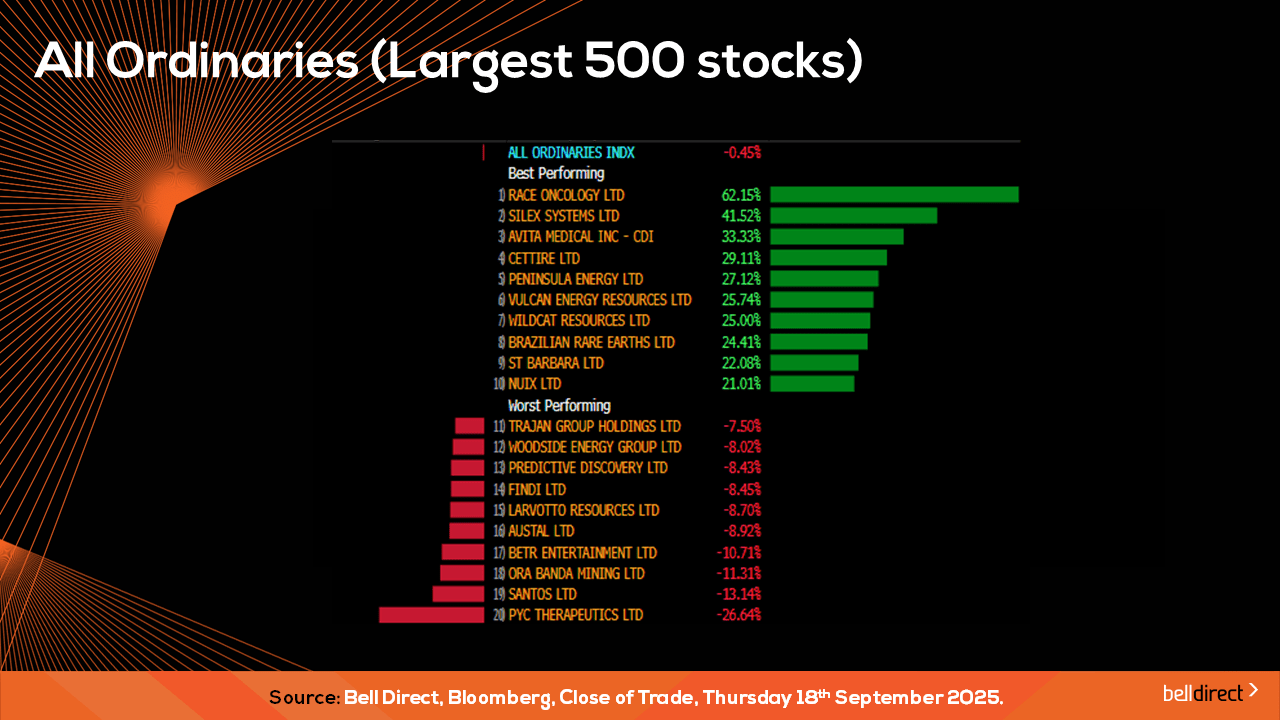

On the broader market index, the All Ords posted a 0.45% decline as PYC Therapeutics (ASX:PYC) tumbled 26.64% while Race Oncology (ASX:RAC) rocketed 62%.

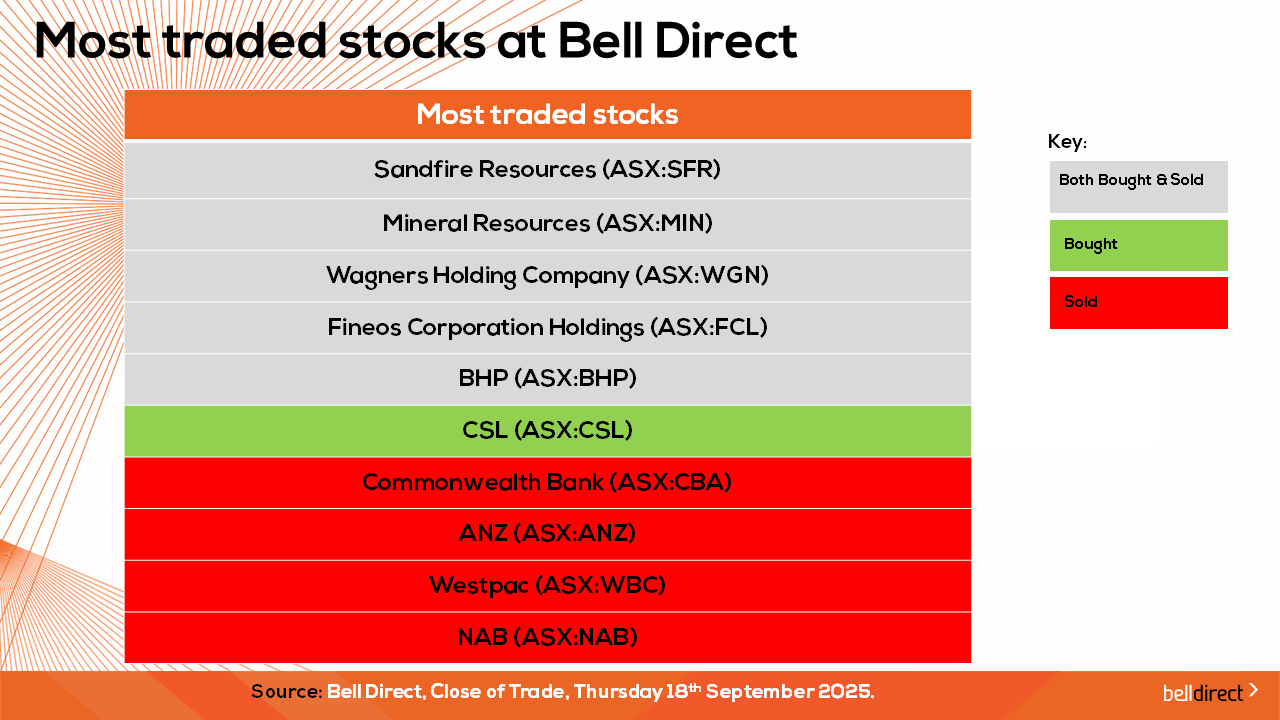

The most traded stocks by Bell Direct clients this week were Sandfire Resources (ASX:SFR), Mineral Resources (ASX:MIN), Wagners Holding Company (ASX:WGN), Fineos Corporation Holdings (ASX:FCL) and BHP (ASX:BHP). Clients also bought into CSL (ASX:CSL) while taking profits from the big banks in CBA (ASX:CBA), ANZ (ASX:ANZ), Westpac (ASX:WBC) and NAB (ASX:NAB).

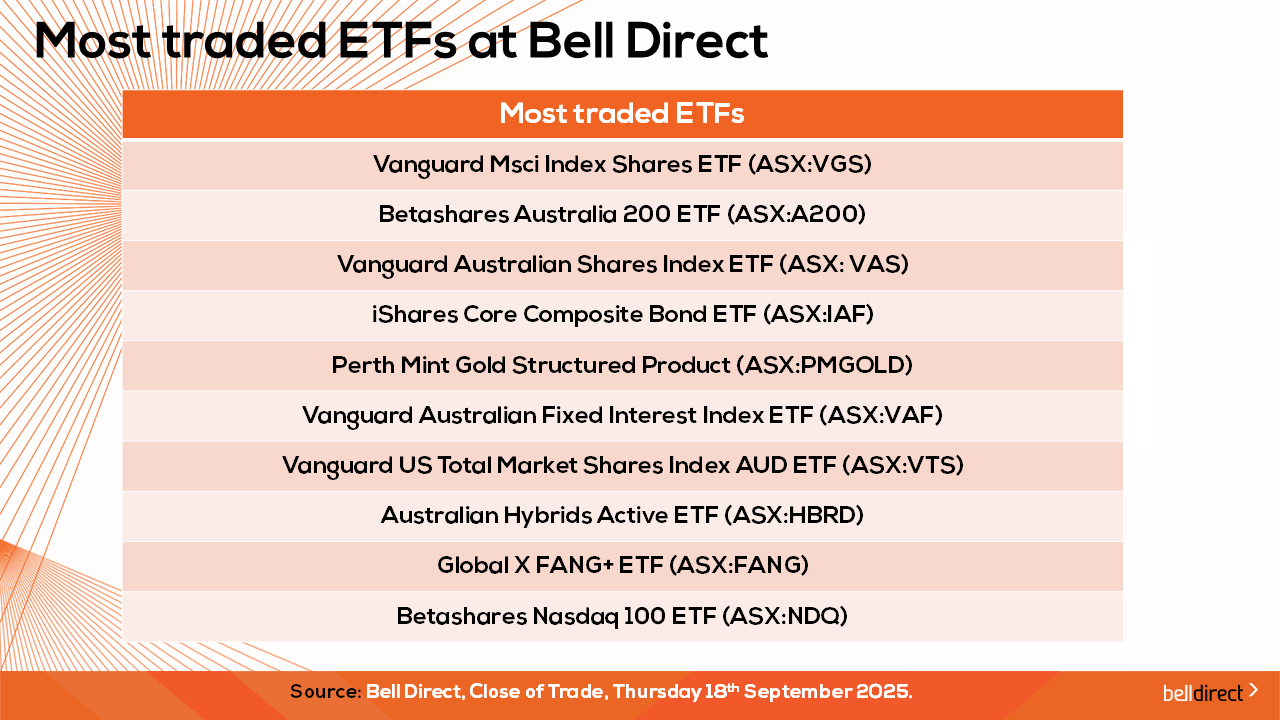

And the most traded ETFs were led by Vanguard Australian Shares High Yield ETF (ASX:VGS), Vanguard Msci Index International Shares ETF (ASX:A200) and BetaShares Australia 200 ETF (ASX:VAS).

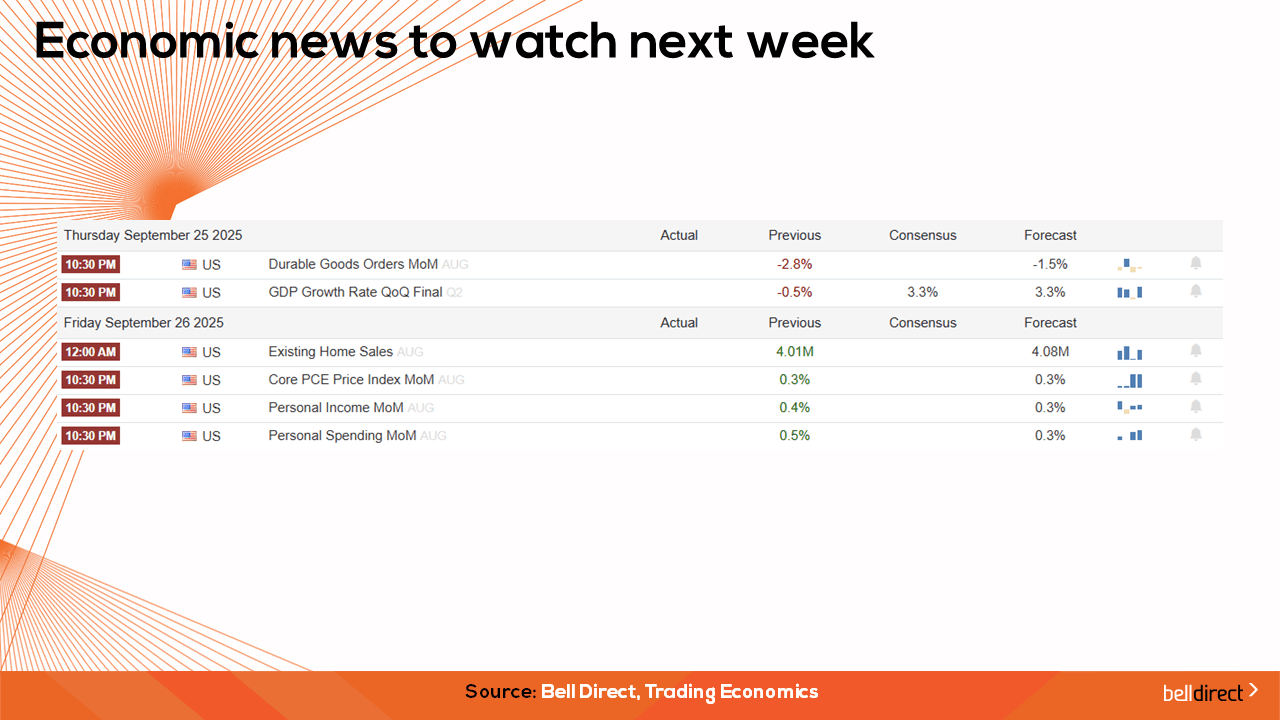

On the economic calendar front next week we may see investors react to a slew of data out of the US with durable goods orders for August, GDP growth rate data for Q2, existing home sales for August, Core PCE price index for August, personal income for August and personal spending for August will be released later in the week, which will give a greater insight into the health of the US economy.

And that’s all for this Friday, have a wonderful weekend and happy investing.