Transcript: Weekly Wrap 14 July 2023

Thank you for joining me this Friday the 14th July, I’m Grady Wulff, a Market Analyst with Bell Direct and this is the weekly market update.

Over the last 12-months REIT or Real Estate Investment Trusts have taken a hit. The sector is down 3.4% over the last 12-months as investors shift away due to rising interest rates. REITs feel the full brunt of every interest rate hike as cost of debt increases impact their balance sheets, reduce the value of properties and increase the cost of operating the real estate properties owned by the REIT companies.

The REIT sector as a whole can often be categorised as a poor investment decision in a rising interest rate environment. However, there are some investment opportunities within the sector that stand out in the current macro and market environment that may offer a long-term, stable addition to your portfolio.

Firstly, let’s address the segment of REITS that are doing it tough in the current market, that being the REITs that own and manage office spaces and retail shops. Since the introduction of hybrid working, office vacancies in CBDs have risen thus decreasing the value of such assets in certain REIT portfolios. The supply of office buildings has surpassed demand especially for Sydney and Melbourne where the vacancy rates of offices in CBD has risen to 11.3% and 13.8% respectively as new offices are built, and hybrid working has become a staple in some business organisations.

The retail sector is another space that has been hit particularly hard in the rising interest rate environment from declining consumer spend. For retail-focused REITs it is also tough times in 2023 as we have seen an increasing number of retailers closing physical stores either in favour of cost-cutting by switching to an online-only model, or due to demand falling and input costs rising. This was the case recently for Domino’s Australia (ASX:DMP) which closed 20 stores across the country. Charter Hall (ASX:CQR) and Scentre Group (ASX:SCG) are two retail focused REIT stocks that are down over 6.4% and 4.7% respectively in 2023.

Now let’s dive into the REITs that are thriving, namely, industrials REITS, or REITs that manage warehouses, supermarkets and other key properties that are growing in demand and value this year.

Goodman Group (ASX:GMG) is leading the pack in the REIT sector for 2023, with shares in the integrated property group specialising in industrial and commercial properties, up over 18% in 2023. The company has attracted a buy rating from 5 brokers including Macquarie and Citi due to strong demand for warehouses and industrial spaces for data storage and manufacturing.

Goodman Group (ASX:GMG) is experiencing strong tailwinds in upside demand for warehouses against rising prices in the current rental market.

Dexus (ASX:DXS) is another REIT that is performing well in 2023, with shares in the company up 3.84% YTD. Dexus is one of Australia’s leading fully integrated real asset groups, managing a high-quality real estate and infrastructure portfolio valued at $62.3bn, including $17.8bn in Australian office, industrial, healthcare and infrastructure assets. The staple nature of the assets owned and managed by Dexus is what has attracted investors to consider investing in the company this year.

And one REIT that is trading at a discount in 2023 but has attracted a buy rating from Credit Suisse, UBS and Ord Minnett is RAM Essential Services Property Fund (ASX:REP) for its continued strong leasing outcomes, low vacancy rates with occupancy at 98%, the 7-year weighted average lease expiry (WALE) across the portfolio and the staple-nature of its portfolio in high-quality Australian medical and essential retail real estate assets.

When investing in REITs it is important not to assume all REITs will underperform in a rising interest rate environment. It is also recommended that you to understand the nature of the properties it owns and manages to determine how well its assets may perform both in the short and longer terms.

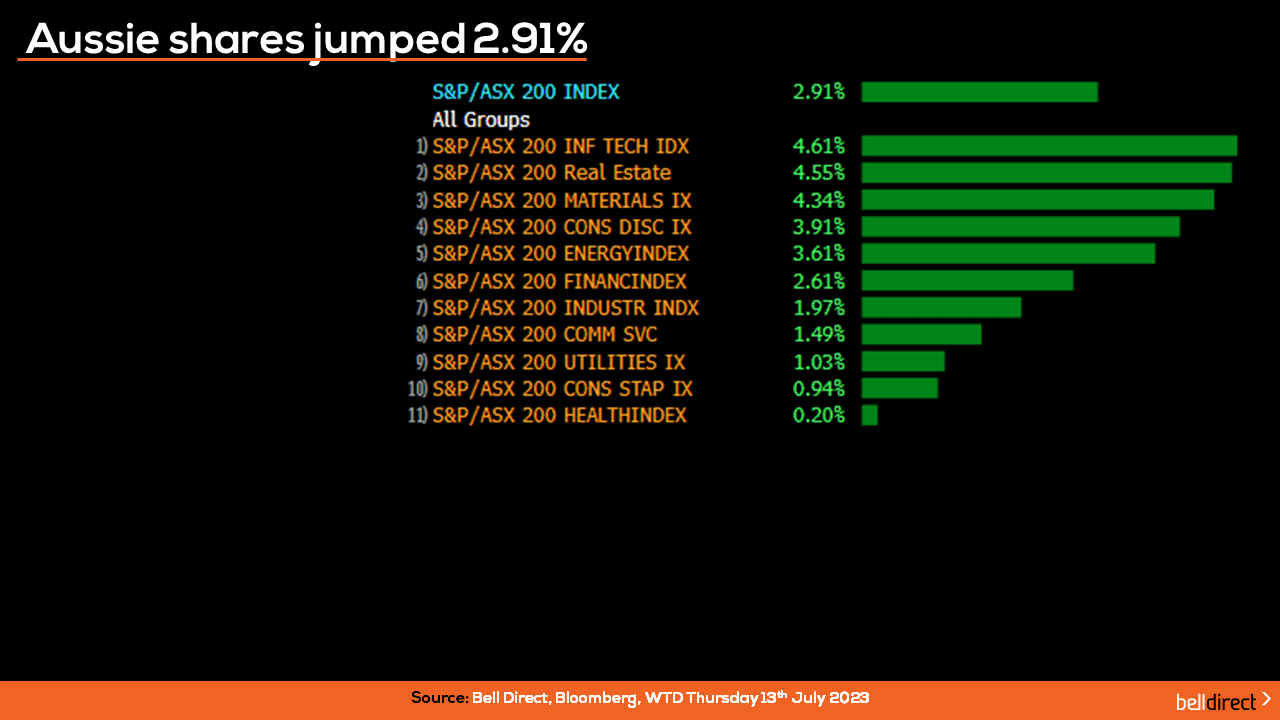

Locally from Monday to Thursday it was a very strong rally on the ASX with the key index rising 2.91% over the four-day period, and every sector posting a gain for the week. The information technology, or 2023 favourite sector, posted the largest gain for the week, rising 4.61%, while healthcare stocks rose just 0.2%.

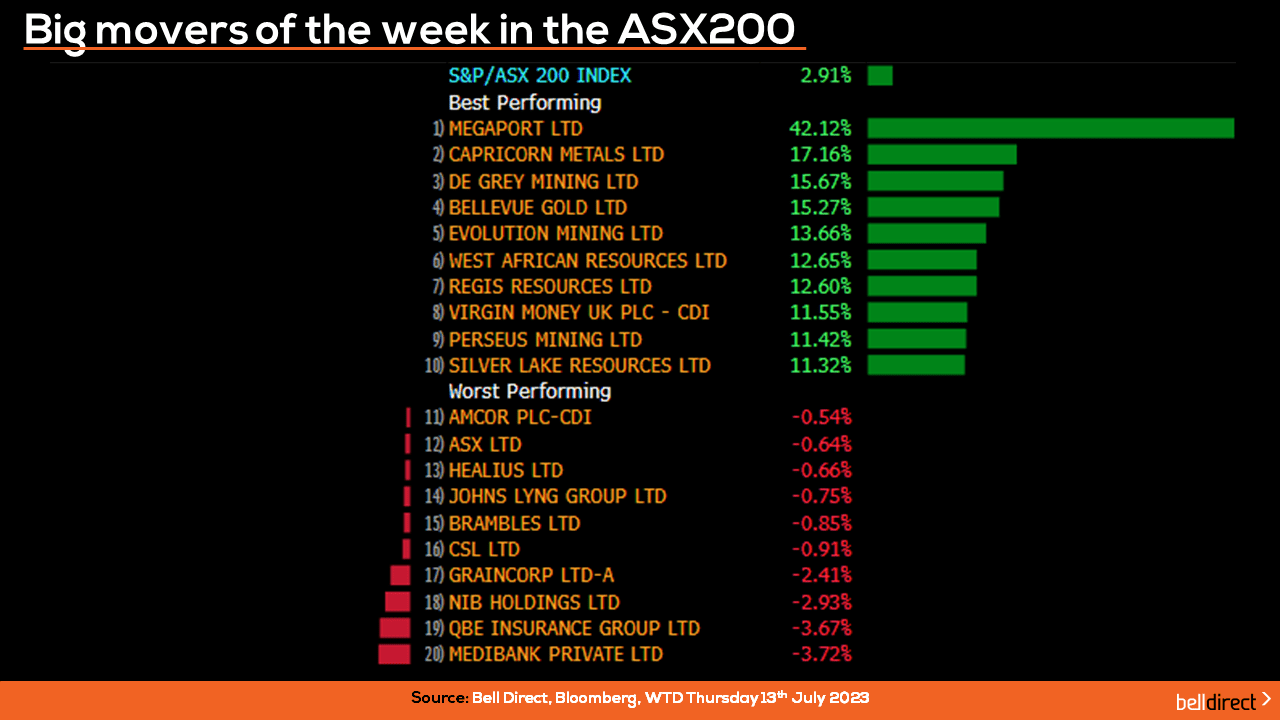

The top performing stocks on the ASX200 this week were led by Megaport (ASX:MP1) jumping 42.12% after the company revised earnings guidance upwards for FY23 following a strategic sales review and cost cutting measures. Capricorn Metals (ASX:CMM) also rose 17% for the week, while De Grey Mining (ASX:DEG) jumped 15.67% on strength among the gold miners.

On the losing end, Medibank Private (ASX:MPL) fell 3.72%, QBE Insurance (ASX:QBE) lost 3.67% and NIB Holdings (ASX:NHF) fell almost 3%.

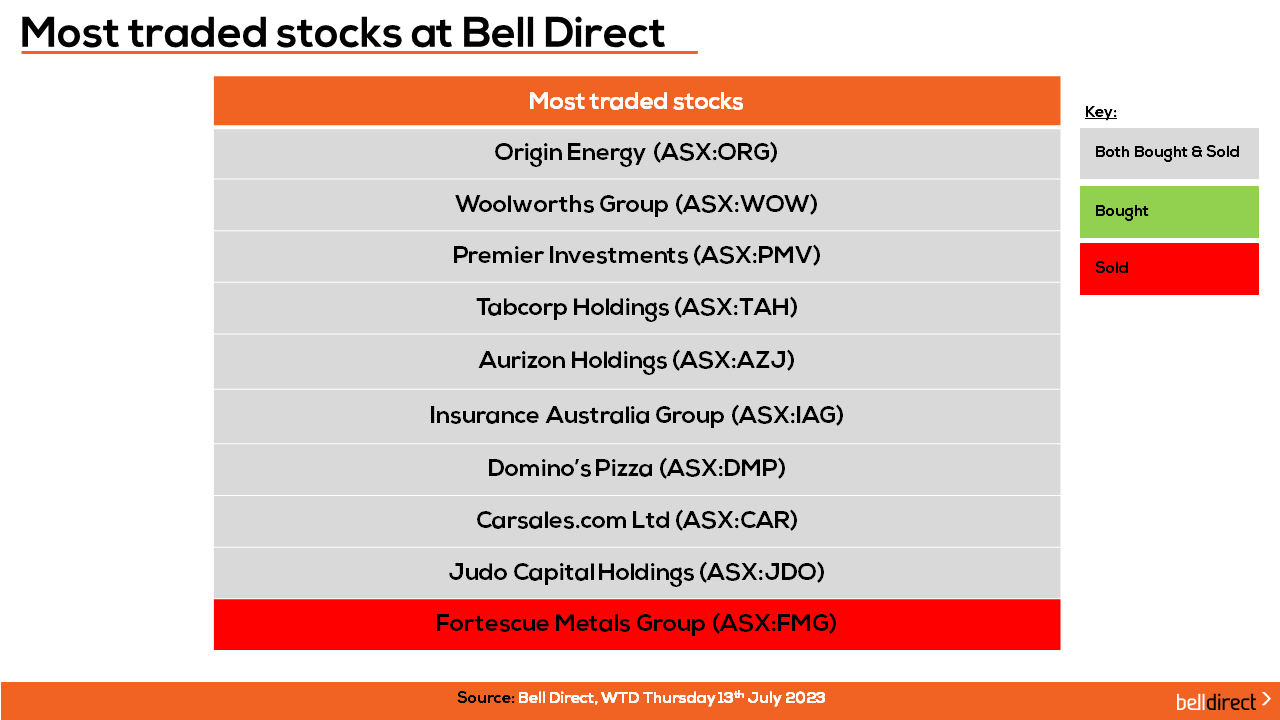

The most traded stocks by Bell Direct clients from Monday to Thursday were Origin Energy (ASX:ORG), Woolworths (ASX:WOW), Premier Investments (ASX:PMV), Tabcorp (ASX:TAH), Aurizon Holdings (ASX:AZJ), Insurance Australia Group (ASX:IAG), Domino’s Pizza Australia (ASX:DMP), Carsales.com (ASX:CAR), and Judo Capital Holdings (ASX:JDO).

Clients also took profits from Fortescue Metals Group (ASX:FMG).

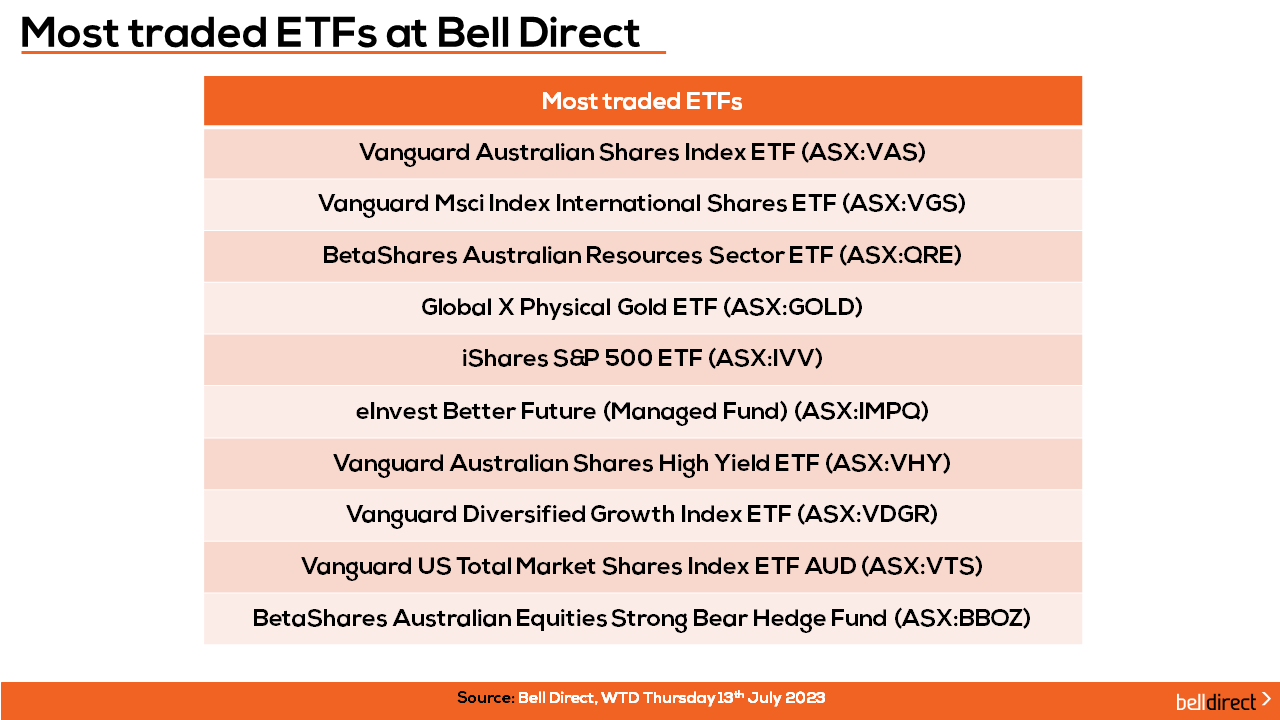

And on the diversification front, the most traded ETFs from Monday to Thursday were led by Vanguard Australian Shares Index ETF, Vanguard MSCI Index International Shares ETF, and BetaShares Australian Resources Sector ETF.

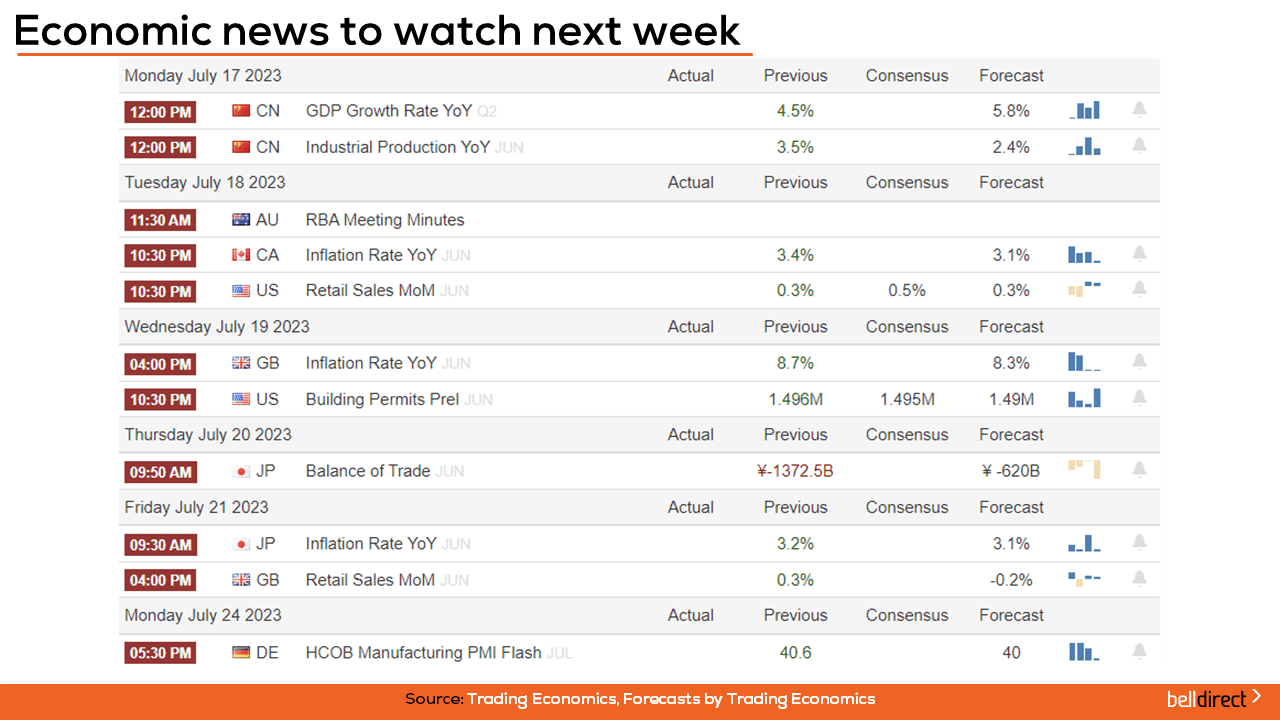

Looking at the economic calendar for the week ahead, China’s annual GDP growth rate data for Q2 is out on Monday with the forecast of a rise to 5.8% from 4.5% in Q1. China’s industrial production output for June is also out on Monday with the expectation of a decline to 2.4% from 2.5% in May.

Over in the US, retail sales data for June is out on Tuesday with consensus expecting a slight right to 0.5% for the month, which could provide further support for the Fed to raise the cash rate by a further 25-basis points at the next FOMC meeting, as retail spend is a key driver of inflation.

Locally, the RBA’s meeting minutes will be out on Tuesday which will give an insight into how hawkish or dovish our central bank is toward raising rates in months to come.

And that’s all we have time for today, have a wonderful weekend and as always, happy investing.