And the worst performing newcomer to the share market in 2023 since debut has been ACDC Metals (ASX:ADC), which is trading 56.50% below its listing price at $0.09/share.

With the cash rate now at 4.1%, the impact on the risk-free premium means that the required return from equities needs to be higher to justify the higher risk compared to leaving the money in the bank. Given this higher hurdle it is not surprising then that investors are slightly more risk averse. In addition, the higher interest rates will impact those businesses which are capital intensive and in some instances not yet profitable.

So when it comes to investing in IPOs there are a few key things to consider.

- understanding the risks associated with the business and sector it operates in,

- understanding the capital structure and reviewing the financials,

- You may see a company like Acusensus in the right thematic – AI – but when assessing its revenue outlook and growth, it may not be the right investment for you compared to other companies in the same space.

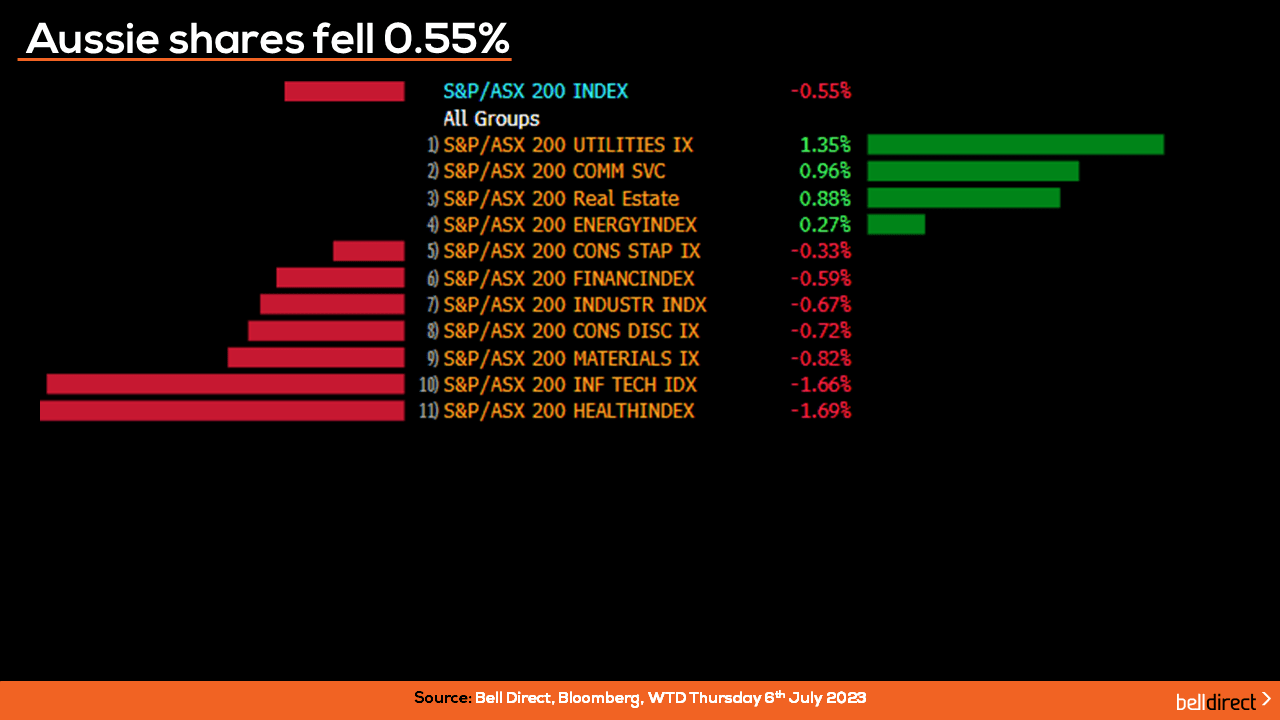

Locally from Monday to Thursday the ASX200 fell 0.55% weighed down by the healthcare sector losing 1.7%, information technology stocks falling 1.66% and the materials sector falling 0.82%. Market volatility was driven this week by outlook for future rate hikes out of the RBA and Federal Reserve alongside recessionary concerns amid signs of slowing economic growth.

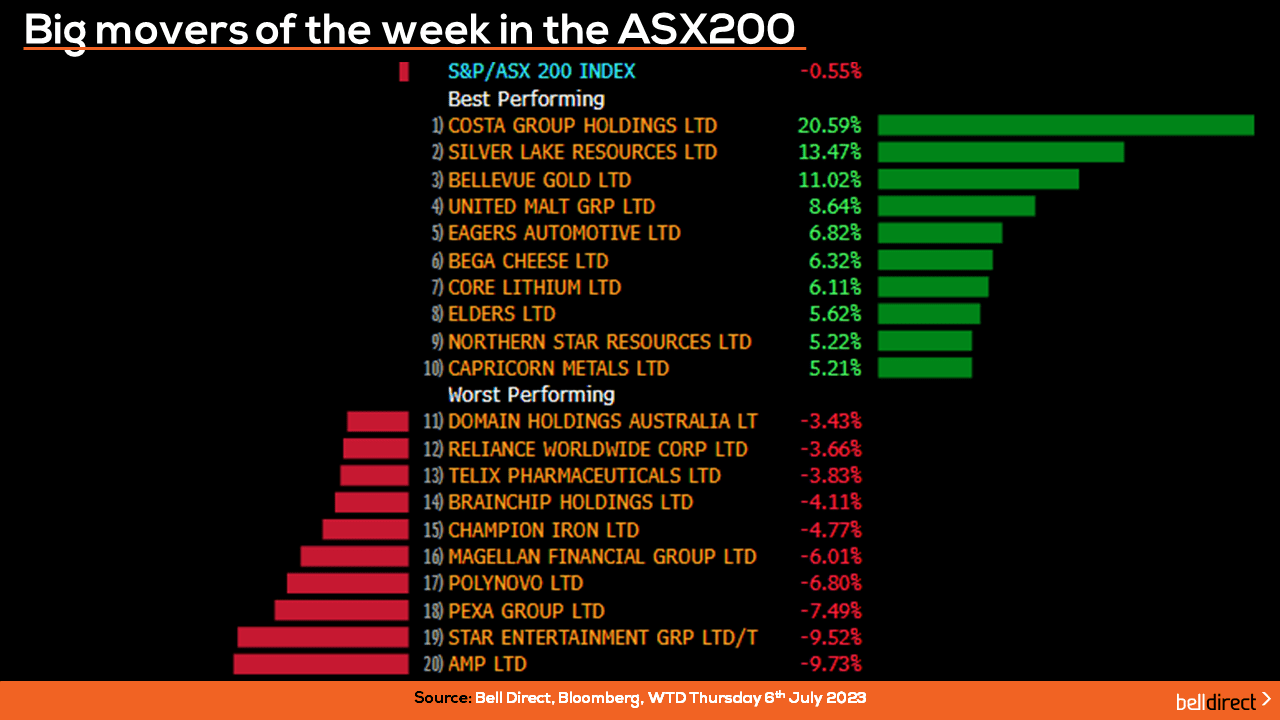

The winning stocks on the ASX200 over the four days were led by Costa Group (ASX:CGC) soaring almost 21% following the receipt of a takeover offer worth $1.6bn from Paine Swartz Partners. Silver Lake Resources (ASX:SLR) rallied 13.47% this week and Bellevue Gold (ASX:BGL) added just over 11% from Monday to Thursday.

AMP (ASX:AMP) took the biggest hit on the ASX200 this week with the company falling almost 10% as the Federal Court in Victoria ruled in favour of claimants against AMP in a class action known as the ‘buyer of last resort’ proceedings.

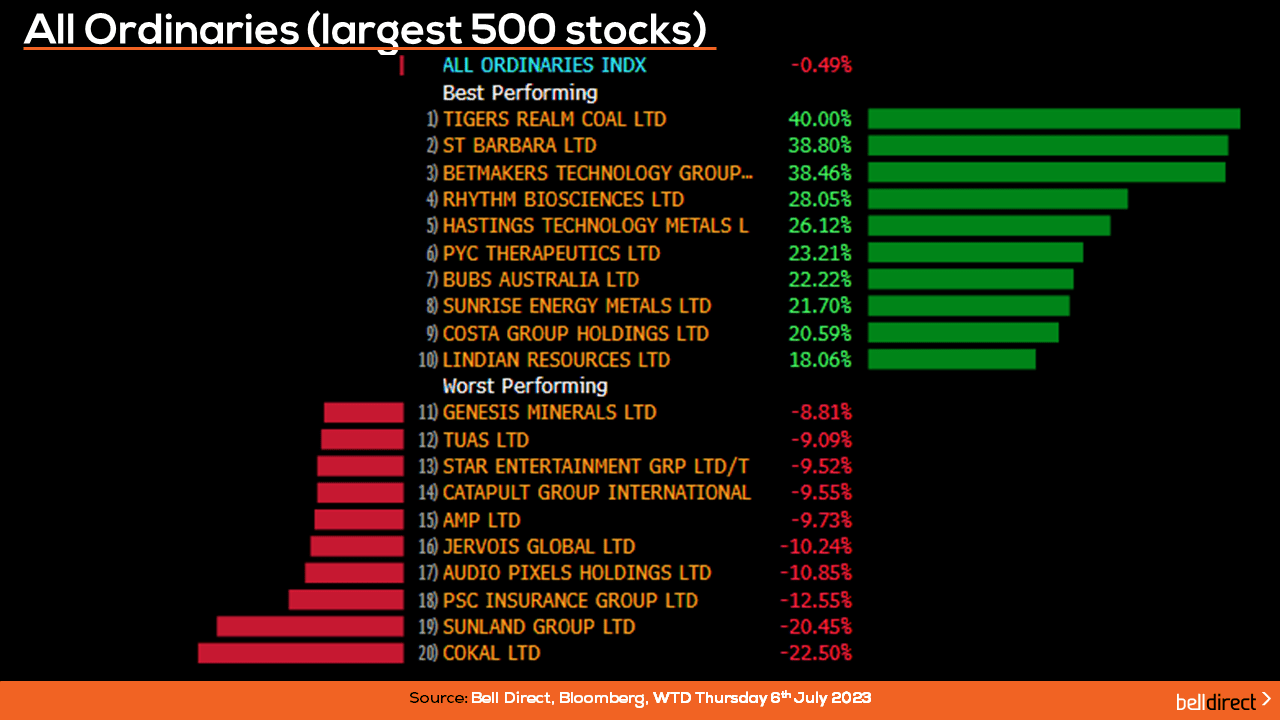

On the broader All Ordinaries, the winning stocks were led by Tigers Realm Coal (ASX:TIG) soaring 40%, while St Barbara (ASX:SBM) jumped 38.38% and Betmakers Technology Group (ASX:BET) rose 28.05%.

At the other end of the All Ords, Cokal (ASX:CKA) fell 22.50% this week, Sunland Group (ASX:SDG) dropped 20.45% and PSC (ASX:PSC) Insurance lost 12.55%.

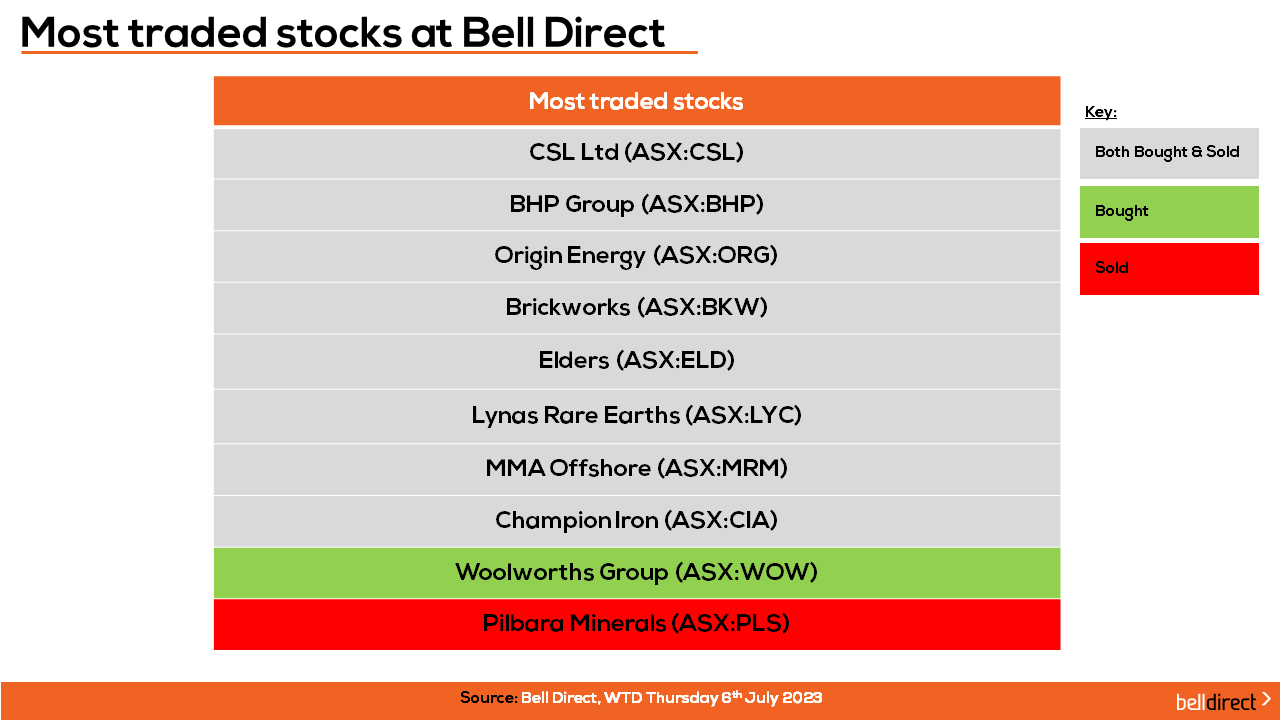

The most traded stocks by Bell Direct clients from Monday to Thursday were CSL (ASX:CSL), BHP (ASX:BHP), Origin Energy (ASX:ORG), Brickworks (ASX:BKW), Elders (ASX:ELD), Lynas Rare Earths (ASX:LYC), MMA Offshore (ASX:MRM), and Champion Iron (ASX:CIA).

Clients also bought into Woolworths Group (ASX:WOW), while taking profits from Pilbara Minerals (ASX:PLS).

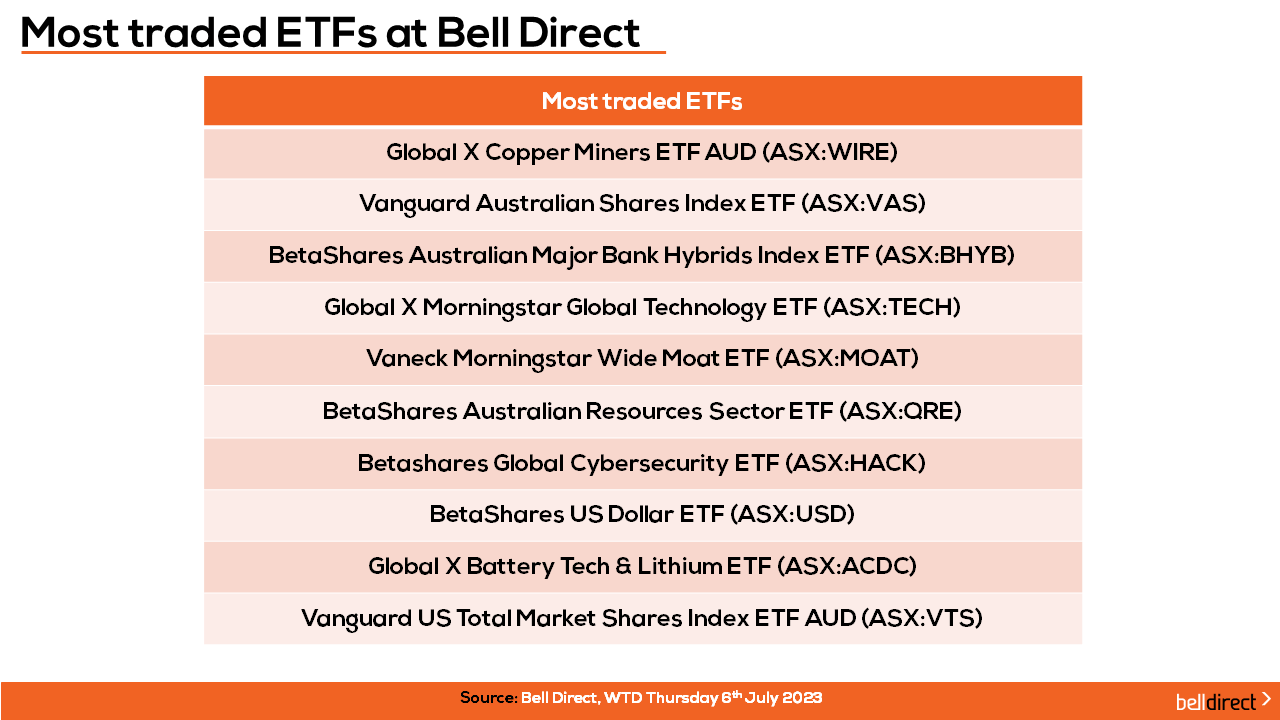

On the diversification front, the most traded ETFs by Bell Direct clients from Monday to Thursday were Global X Copper Miners ETF AUD, Vanguard Australian Shares Index ETF, and BetaShares Australian Major Bank Hybrids Index ETF.

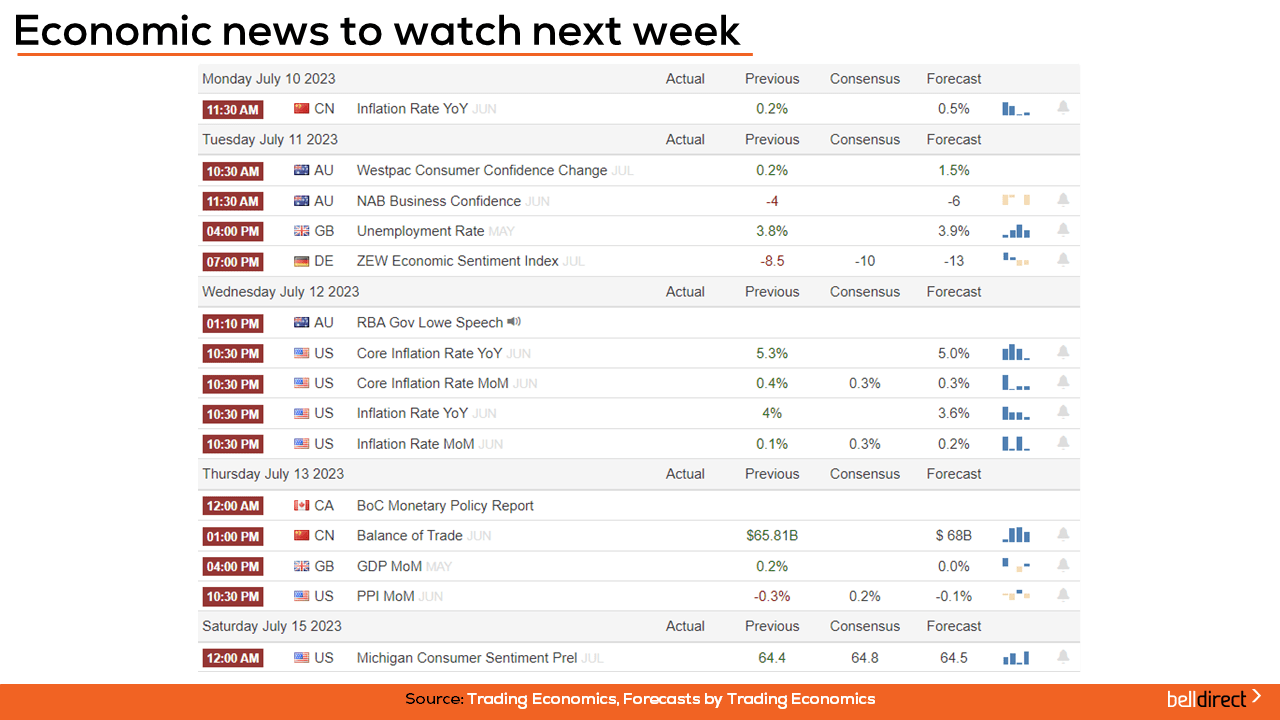

Looking at the week ahead, Westpac consumer confidence data for July is out on Tuesday with the forecast of a rise to 1.5% for the month ahead, up from 0.2% in June as investor confidence is boosted by the RBA’s rate pause for July amid signs of easing inflation down under.

NAB Business confidence data for June is also out on Tuesday with the expectation of a decline to minus 6 points, down from minus 4 points in May.

Overseas, US inflation rate data for June is out on Wednesday with consensus expecting a slight dip to 0.3% for the month of June down from 0.4% in May, while the inflation rate YoY is expecting to slide to 3.6% for June on an annual basis from 4% in May.

China’s trade balance data for June is also out on Thursday next week, with the expectation for an increase in trade surplus to $68bn from $65.81bn in May.

And that’s all we have time for today, have a wonderful weekend and as always, happy investing!