Thanks for joining me this Friday the 17th October, I’m Grady Wulff, Senior Market Analyst with Bell Direct and this is our weekly market update.

Market volatility was once again heightened this past trading week as social media posts and renewed trade war concerns between the world’s two largest economies in China and the US, reignited fears of global trade tensions disrupting economic growth and stability on a broad scale.

Markets had their worst day in months to start the new trading week after President Trump took to Truth Social to say ‘massive increases in tariffs are coming for China’ on Friday last week which naturally sparked fear and a selling frenzy among investors. He took to his social media platform once again on Monday though to say all will be fine… a contradictory and strategic move some would argue, which naturally led to markets rallying to start this new trading week.

By midweek, however, any hopes of a de-escalation were dashed. China’s Ministry of Commerce retaliated against the U.S. by sanctioning five U.S.-related entities connected to Hanwha Marine Corporation, escalating the dispute and sending a clear signal that Beijing would not remain passive amid ongoing U.S. investigations into its maritime and logistics sectors. The situation further deteriorated when Trump floated the idea of halting U.S. imports of Chinese cooking oil, a niche threat that nonetheless rattled sectors tied to consumer goods and trade, driving up prices in related US domestic stocks.

So where does this trade war stand, what will it take to reach a conclusion and what does this mean for you as an investor?

For a meaningful resolution to be reached, both sides will need to commit to a more stable and predictable negotiation path, one grounded in clear economic objectives rather than reactive and retaliatory political posturing. Until that happens, trade policy will likely continue to be used as a strategic lever in both countries’ broader geopolitical agendas. This means headline risk, the sudden market movements sparked by news or social posts, will remain a persistent feature of the investment landscape until a material deal is agreed upon.

As an investor, this environment demands heightened awareness and a flexible approach. Exposure to sectors heavily reliant on global trade, such as industrials, commodities and semiconductors, may need to be reassessed in favour of more domestically driven or defensive plays. Additionally, the possibility of sustained tariffs could benefit some U.S. industries by making Chinese alternatives less competitive, as we’ve seen in the spike in domestic cooking oil-related stocks. Ultimately, navigating this ongoing U.S.-China trade conflict requires both caution and agility, with a focus on diversification and a keen eye on policy developments that can reshape market dynamics overnight.

For ASX-listed stocks, the ongoing US-China trade war introduces a layer of uncertainty that can significantly impact market performance, particularly for companies with direct exposure to global trade or those reliant on Chinese demand. Resource and mining companies, which form a large part of the ASX, could see volatile commodity prices influenced by shifts in Chinese industrial activity or retaliatory tariffs. Similarly, Australian exporters and manufacturers that depend on the Chinese market may face headwinds if trade barriers escalate. Conversely, some sectors, such as domestic-focused businesses or companies in alternative markets, might benefit from supply chain diversifications or shifts in trade flows. Overall, the trade war heightens market risks on the ASX, underscoring the importance of closely monitoring geopolitical developments and their potential ripple effects on Australian equities.

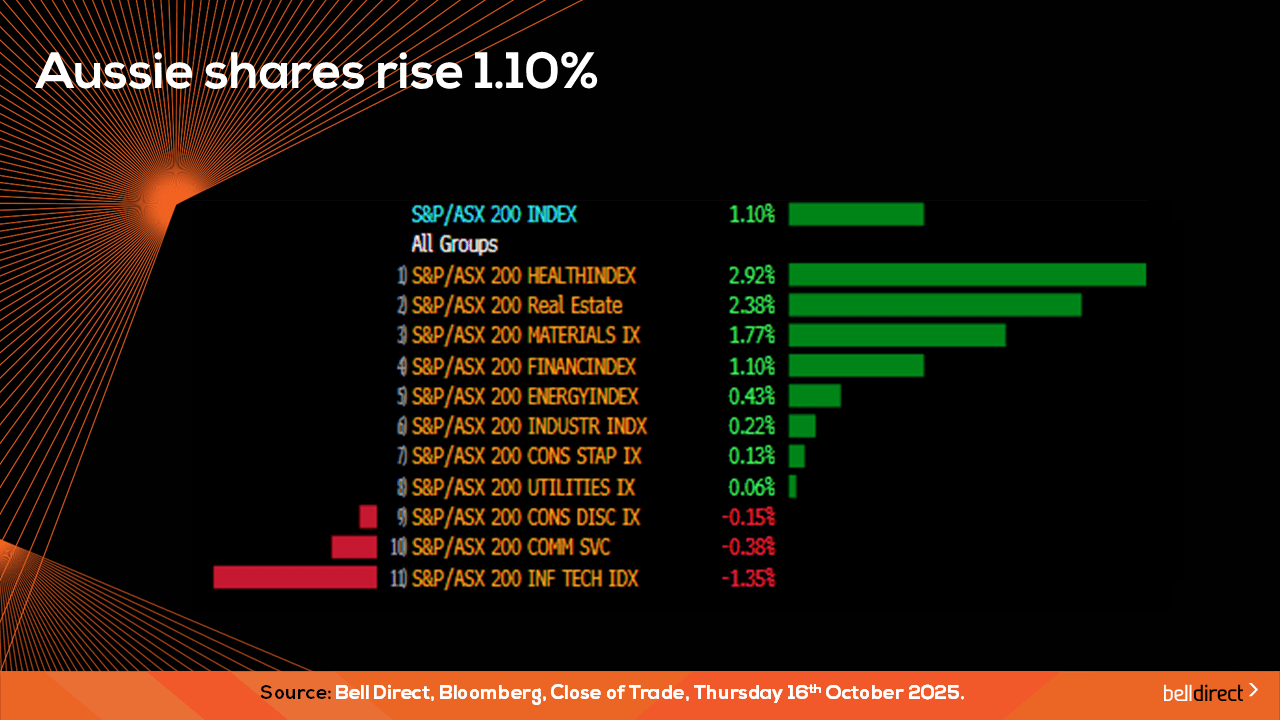

Locally from Monday to Thursday the ASX200 posted a 1.1% rise buoyed by strength among healthcare, real estate and materials stocks, while tech stocks came under pressure with a 1.35% decline over the trading week.

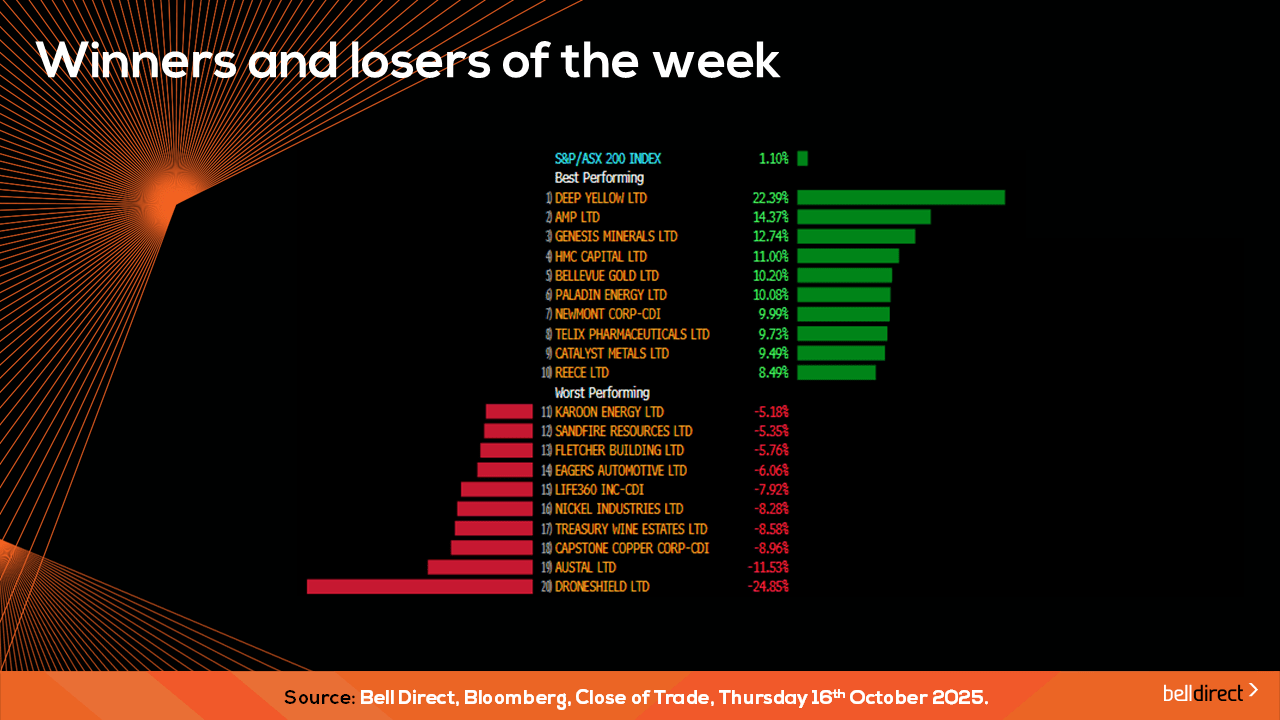

The winning stocks were led by Deep Yellow (ASX:DYL) soaring 22.39%, while AMP (ASX:AMP) added 14.37% and Genesis Minerals ended the week up 12.74%.

While on the losing end, DroneShield (ASX:DRO) tumbled 24.85%, Austal (ASX:ASB) fell 11.53% and Capstone Copper Corp. (ASX:CSC) ended the week down just shy of 9%.

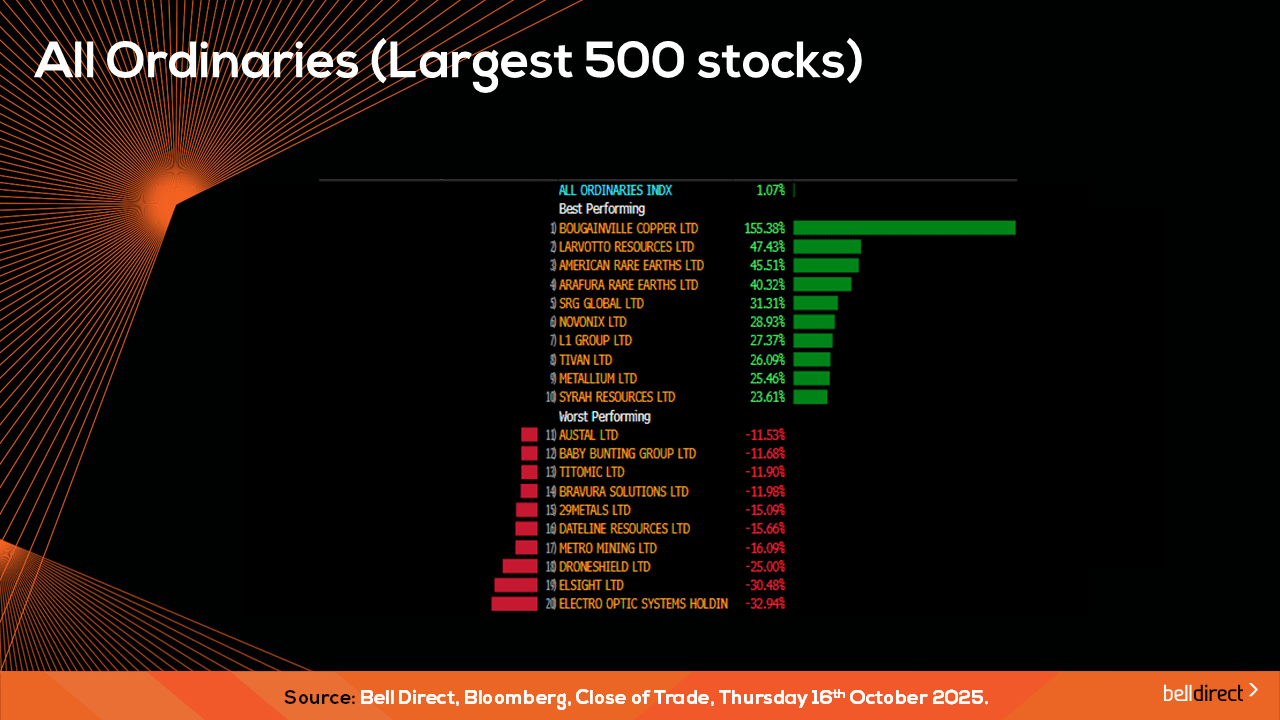

On the broader market index, the All Ords posted a 1.07% rise as Bougainville Copper (ASX:BOC) rocketed over 155%, while Larvotto Resources (ASX:LRV) jumped almost 50%. Electro Optic Systems (ASX:EOS) and Elsight (ASX:ELS) dropped over 32% and 30% respectively at the other end of the market this trading week.

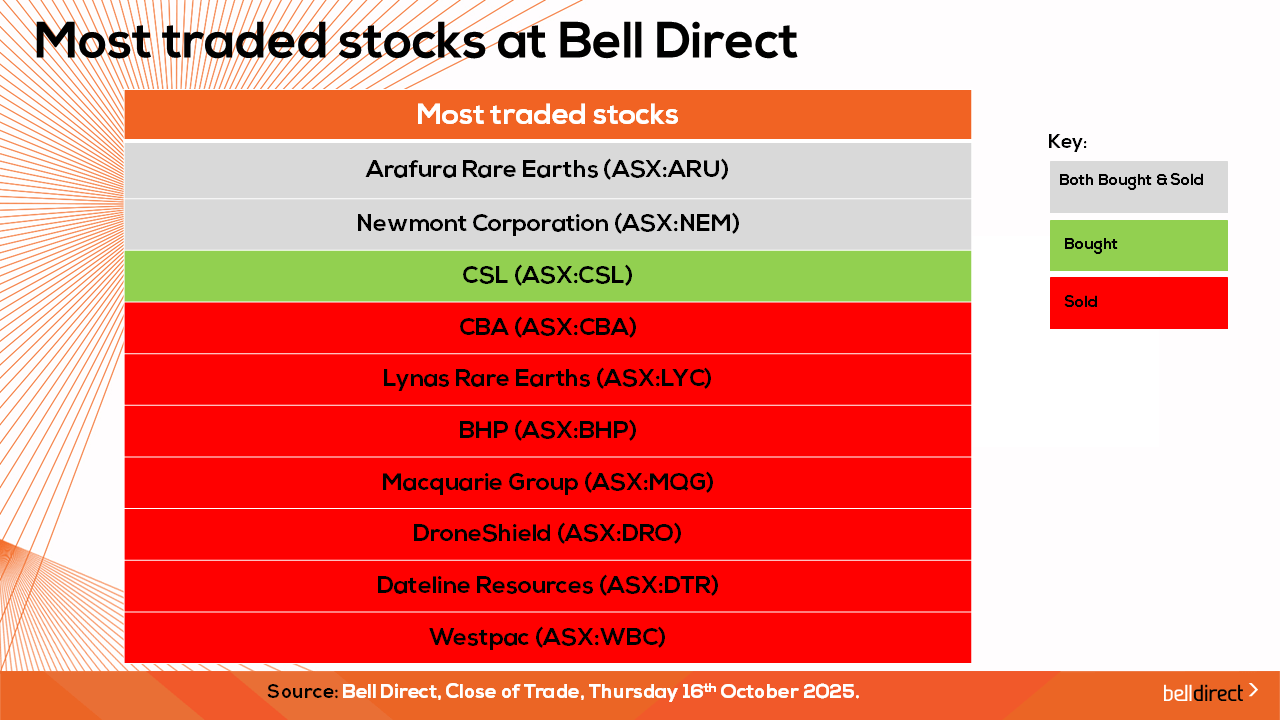

The most traded stocks by Bell Direct clients this trading week were Arafura Rare Earths (ASX:ARU), and Newmont Corporation (ASX:NEM). Clients also bought into CSL (ASX:CSL) while taking profits from CBA (ASX:CBA), Lynas Rare Earths (ASX:LYC), BHP (ASX:BHP), Macquarie Group (ASX:MQG), DroneShield (ASX:DRO), Dateline Resources (ASX:DTR) and ANZ (ASX:ANZ).

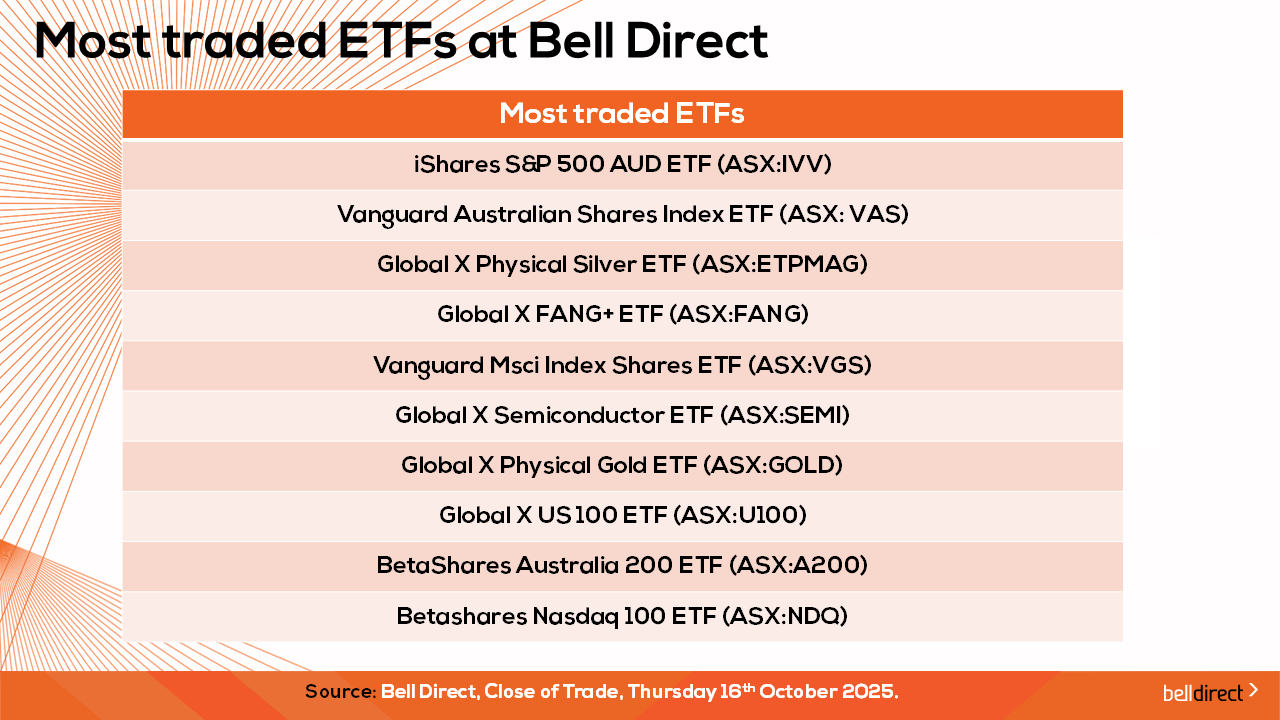

And the most traded ETFs were led by iShares S&P 500 AUD ETF (ASX:IVV), Vanguard Australian Shares Index ETF (ASX:VAS) and Global X Physical Silver ETF (ASX:ETPMAG).

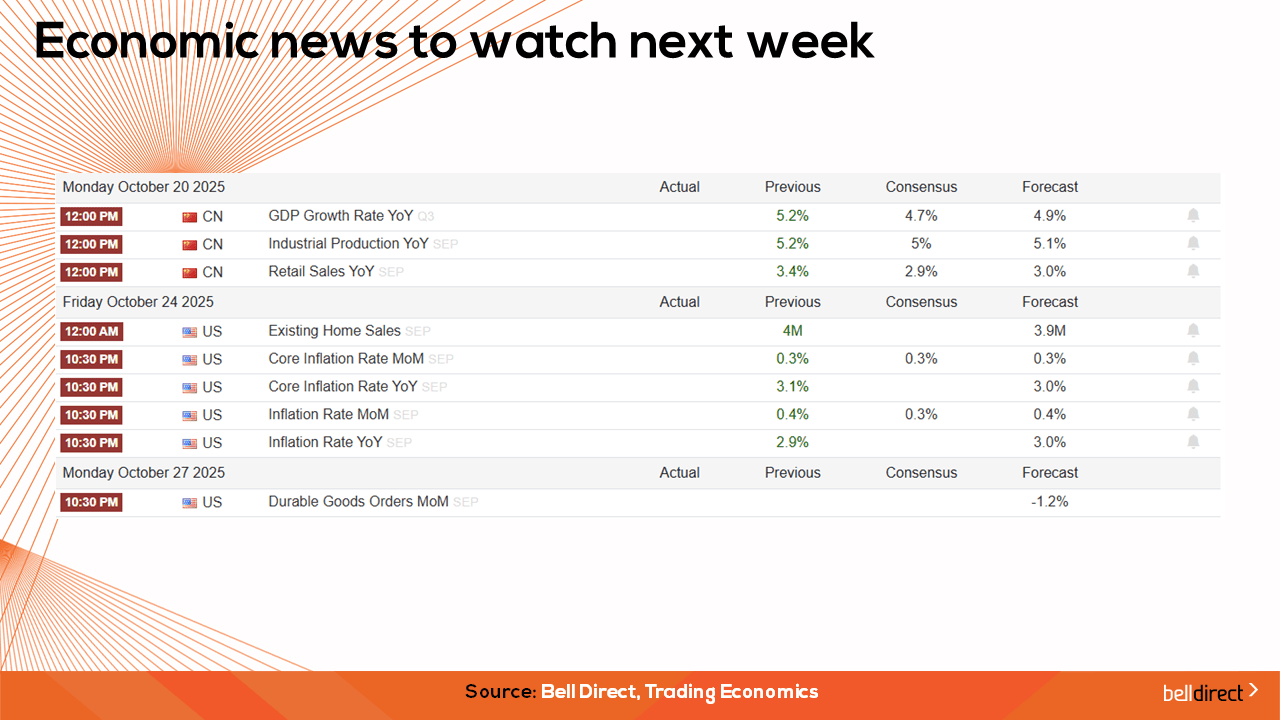

Next week on the economic calendar front we may see investors respond to GDP Growth rate, industrial production and retail sales data out of China on Monday, while key US inflation, durable goods orders and existing home sales data is also out next week which will give investors insight into how the world’s two largest economies are faring so far in 2025.

And that is all for this week, thanks for joining us and as always, happy investing.

This information is general in nature and does not take into account your financial situation, objectives or needs. You should consider whether it is appropriate for you. You should read our Financial Services Guide and any relevant Product Disclosure Statements before making an investment. For more information visit belldirect.com.au or call 1300 786 199. Bell Direct is the trading name of Third Party Platform Pty Ltd ABN 74 121 227 905, AFSL 314341.