Transcript: Weekly Wrap 22 March

Australia is a powerhouse in the iron ore industry, supplying roughly half the world’s iron ore – a key ingredient for steel that underpins construction, vehicles, and power generation. This is especially relevant considering the recent fluctuations in the Australian stock market. China, as always, is a big buyer, taking in around 70% of all seaborne iron ore. Three Australian miners are major players on the world stage: BHP Group (ASX:BHP), Rio Tinto (ASX:RIO) and Fortescue Metals (ASX:FMG). While FMG is all-in on iron ore, BHP and RIO are more diversified in their mining operations. It’s worth keeping an eye on these companies as the iron ore market continues to influence the Australian market. And investors may consider if now is a good time to buy in. Fortescue is currently down 9.56% over the past month, Rio Tinto down 2.59% and BHP down 0.34% the past month.

These three companies have been sold off since the price of iron ore started to decline in early January. Prices started the year near US$145 per tonne but have since tumbled to 7-month lows at approximately US$100 per tonne, a hefty 24% drop so far. Yesterday, the iron ore price did recover some earlier losses, which saw the mining giants move higher.

While mine production can affect the price, China’s economic health is often the bigger driver. Even with some loosening of China’s property market restrictions, investment is still down, and people just aren’t buying houses like they used to. There is a glimmer of hope, though. China is ramping up stimulus efforts to jumpstart its sluggish economy. An infrastructure spending boom could potentially offset the weakness in the property market, but it remains to be seen.

Iron ore prices have fallen significantly in 2024, reflecting a confluence of factors. China, historically the dominant buyer, is experiencing an economic slowdown, leading to decreased demand for iron ore used in construction and infrastructure projects.

Beyond China, broader market shifts are also impacting prices. The US dollar, a key global reserve currency, is exerting a strong influence on commodity prices, including iron ore. The Federal Reserve’s recent decision to maintain high interest rates, coupled with mixed signals on future rate cuts, adds further complexity. Rising interest rates can generally put downward pressure on commodity prices. However, the economic rationale behind rate adjustments, such as slower retail sales and a rising unemployment rate in the US, also needs to be considered. The interplay of these factors creates uncertainty regarding the future direction of both interest rates and iron ore prices.

Overall, iron ore is an interesting commodity to watch right now.

Moving onto the market’s performance this week so far,

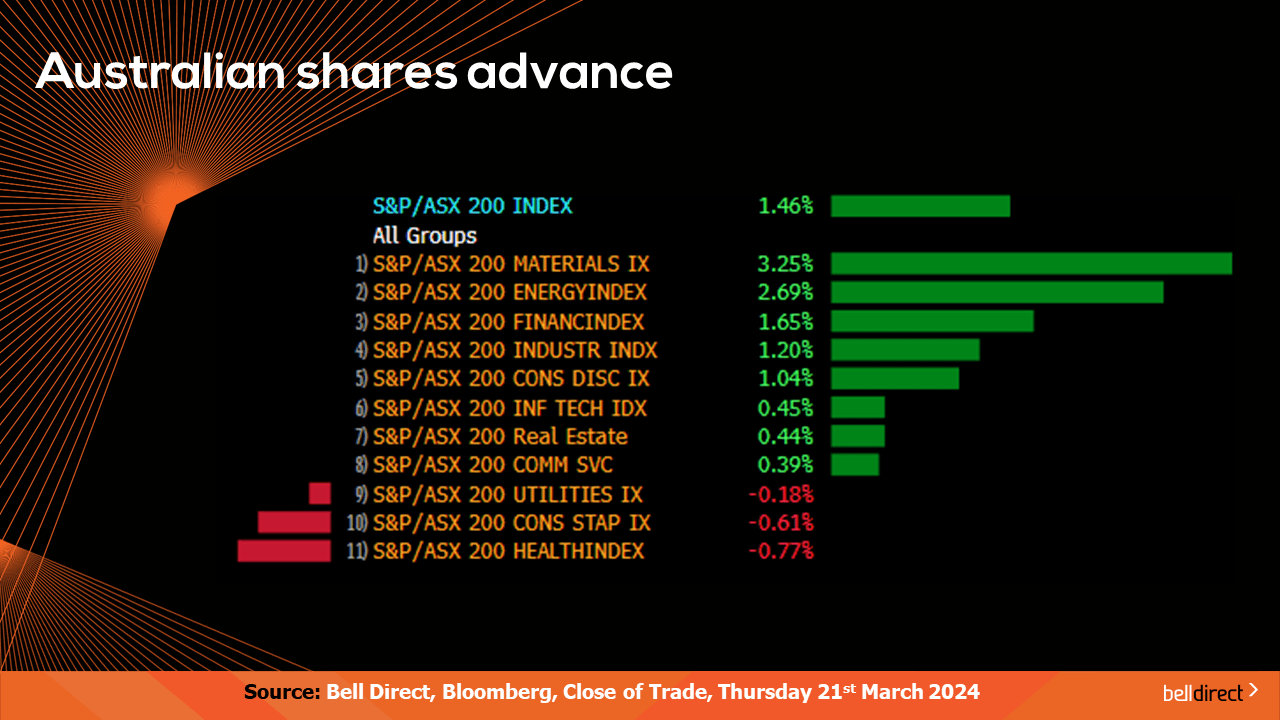

Locally from Monday to Thursday the ASX200 rose 1.46% with all but 3 sectors finishing in the green. Gains were led by the materials and energy sectors which rose 3.25% and 2.69% respectively. This was offset by the health sector, which lost 0.77% across the 4-trading days.

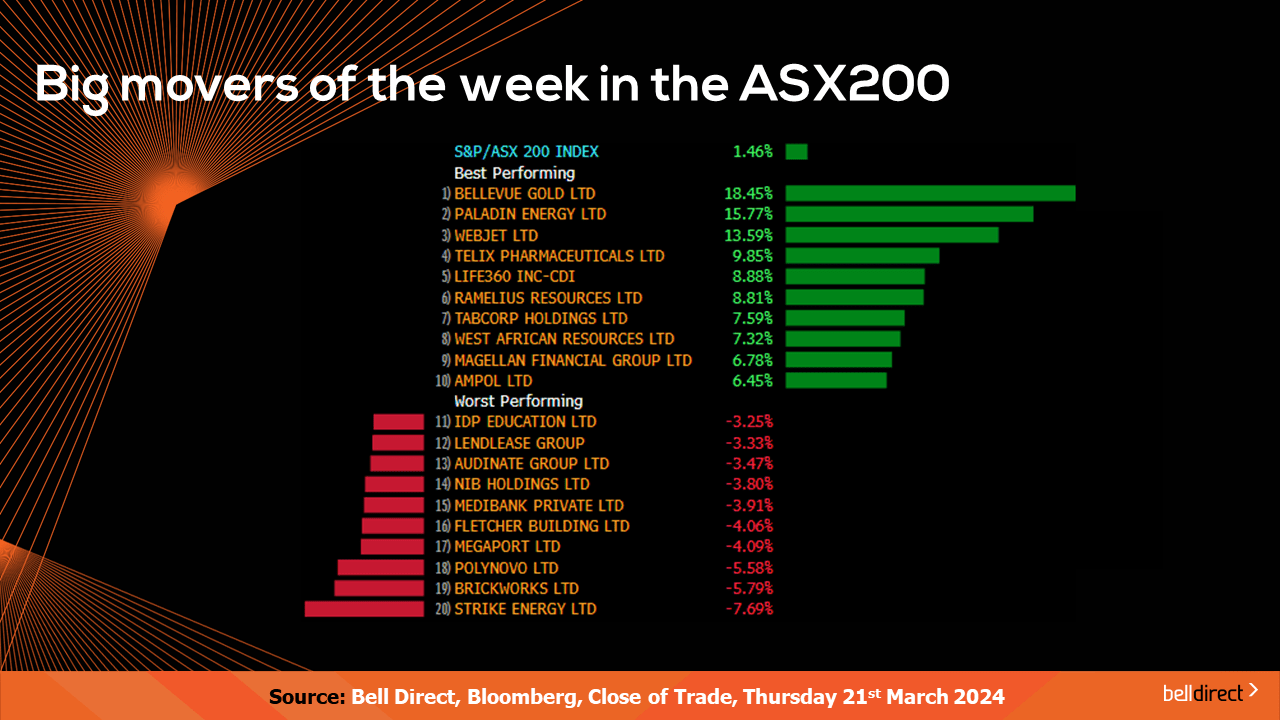

The winning stocks over the four trading sessions were led by Bellevue Gold (ASX:BGL) rallying 18.45% as the gold giant revealed that recent drilling at Deacon Main has revealed evidence of a high-grade ore shoot. Paladin Energy (ASX:PDN) rose 15.77% this week and Webjet (ASX:WEB) rallied 13.59% from Monday to Thursday.

And on the losing end Strike Energy (ASX:STX) fell 7.69%, Brickworks (ASX:BKW) lost 5.79% and Polynovo (ASX:PNV) ended 5.58% in the red.

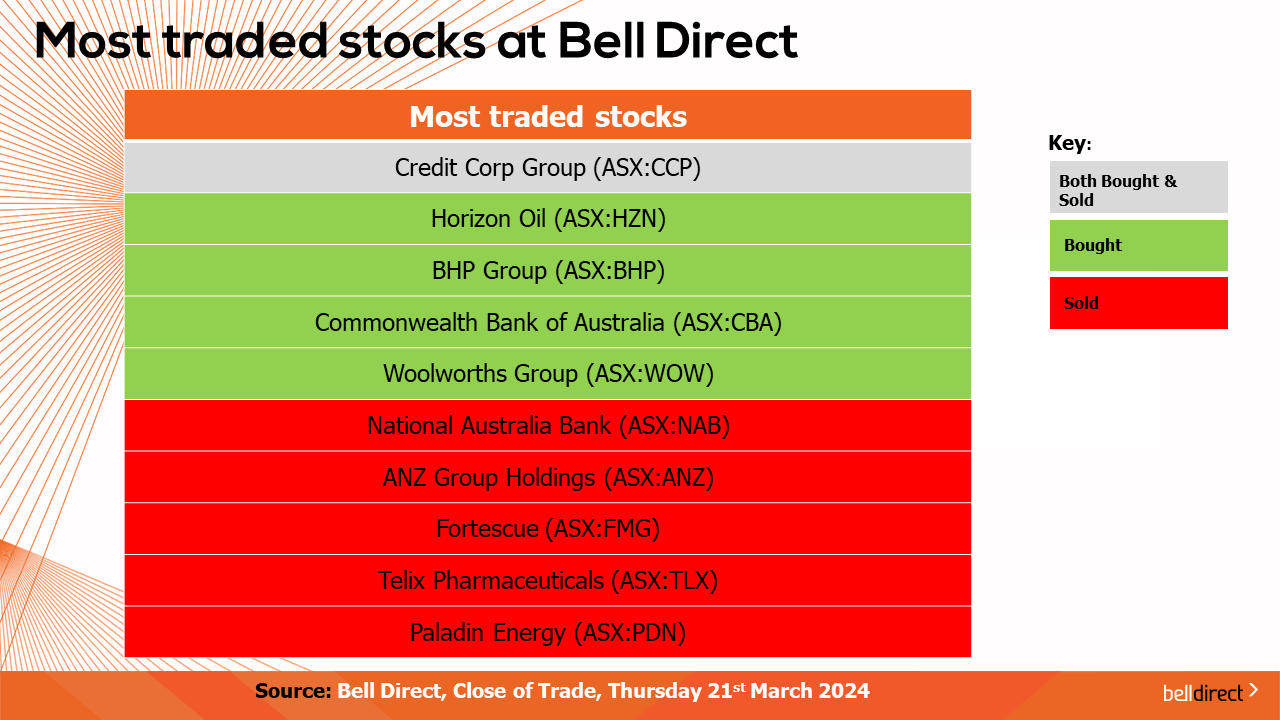

As for the most traded stocks by Bell Direct clients this week, clients both bought and sold Credit Corp Group (ASX:CCP), while bought into Horizon Oil (ASX:HZN), BHP Group (ASX:BHP), Commonwealth Bank (ASX:CBA) and Woolworths (ASX:WOW).

And this week, clients took profits from NAB (ASX:NAB), ANZ (ASX:ANZ), Fortescue (ASX:FMG), Telix Pharmaceuticals (ASX:TLX) and Paladin Energy (ASX:PDN).

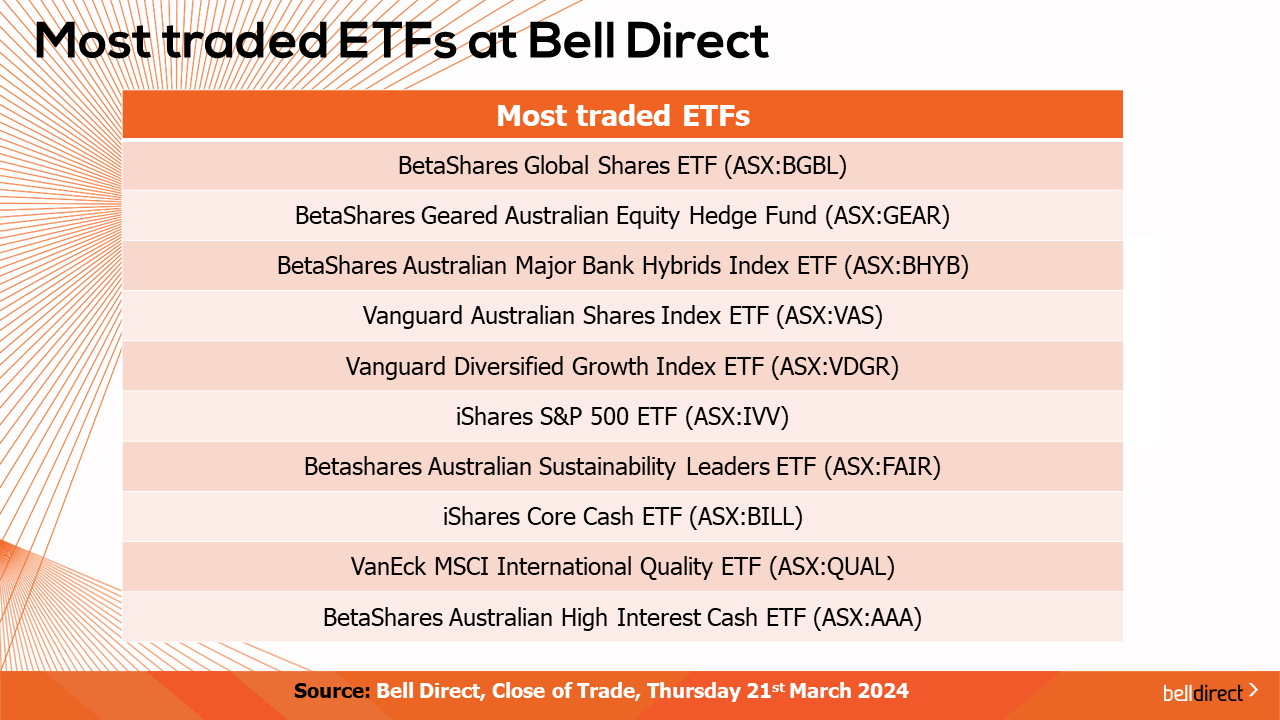

The most traded ETFs by Bell Direct clients were the BetaShares Global Shares ETF (ASX:BGBL), the BetaShares Geared Australian Equity Hedge Fund (ASX:GEAR) and the BetaShares Australian Major Bank Hybrids Index ETF (ASX:BHYB).

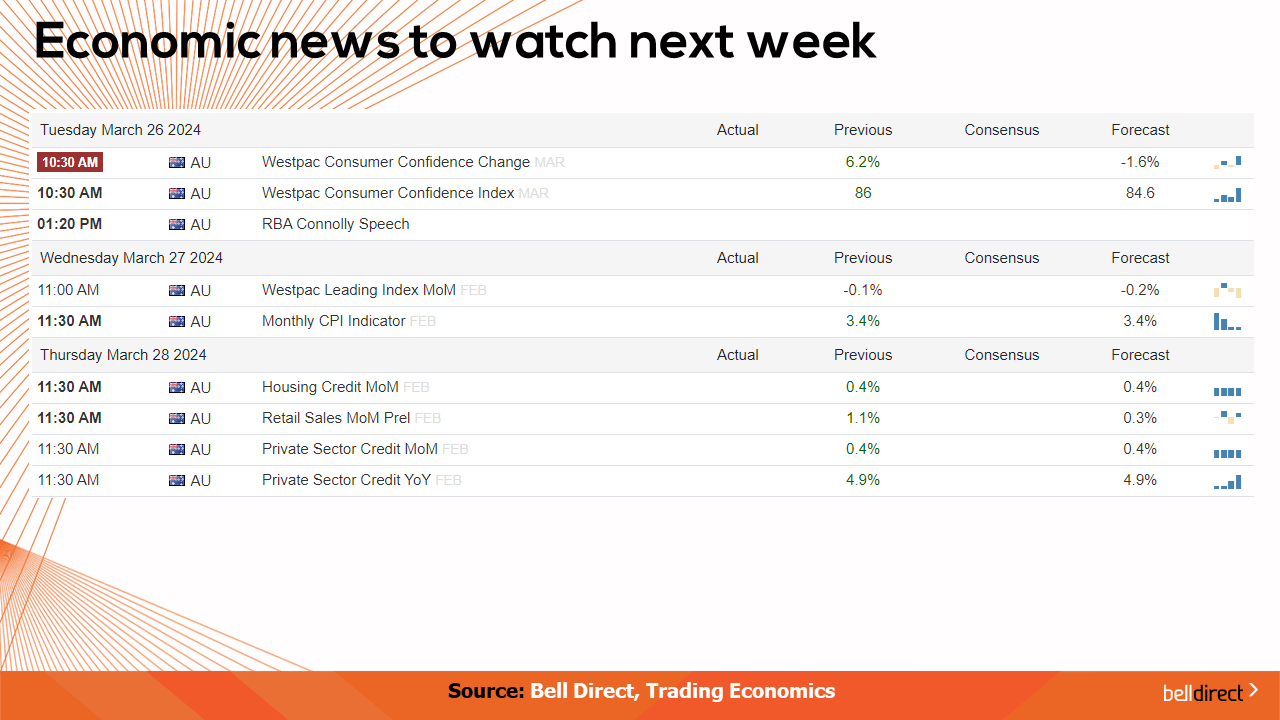

And to end, economic data to watch out for next week, on Tuesday Westpac’s consumer confidence data for March will be released and on Thursday, housing credit, retail sales and private sector credit for February will be released.

And that’s all for this week. I’m Sophia Mavridis, I’m Sophia Mavridis with Bell Direct. Have a great day and happy trading.