Thanks for joining me this Friday 28th August, I’m Sophia Mavridis, a Market Analyst with Bell Direct and this is our final reporting season wrap for this August earnings season.

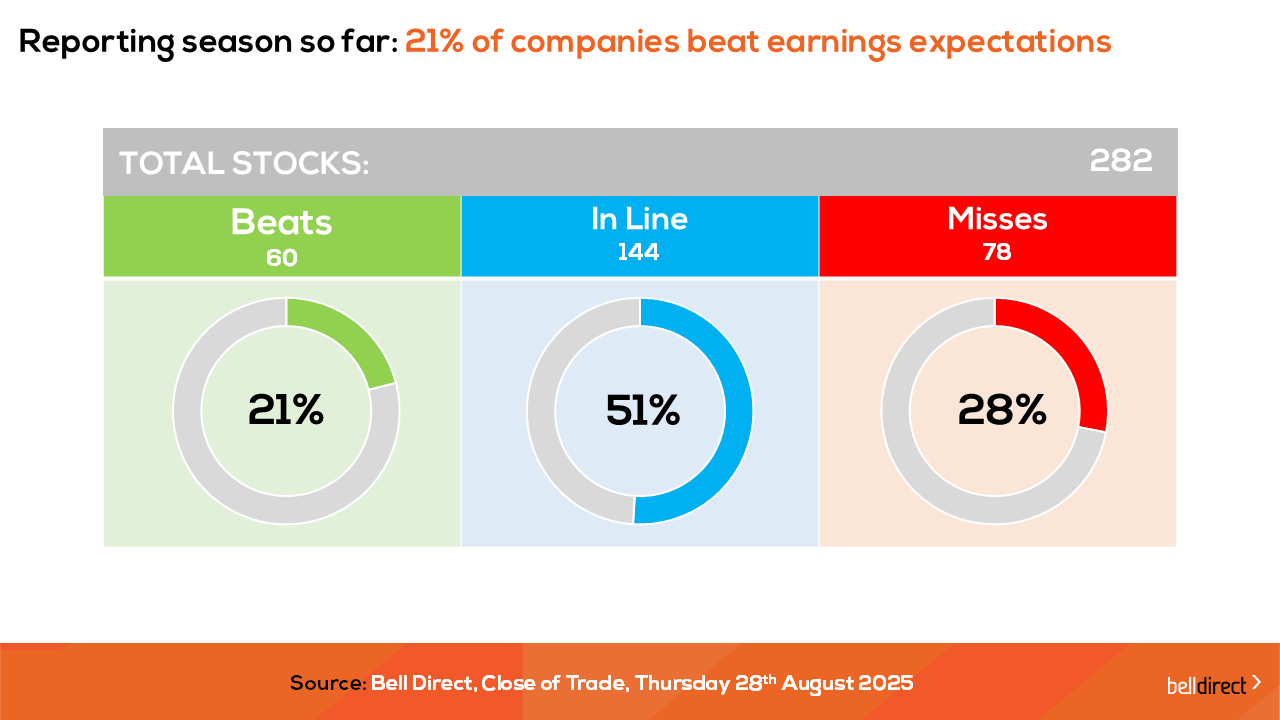

So far this reporting season, we have seen 282 companies report with 60 beating expectations, while 144 met expectations and 78 missed expectations. 42 companies have been upgraded by brokers while 64 have been downgraded. In this final week, we saw some key names experienced double digit share price movements.

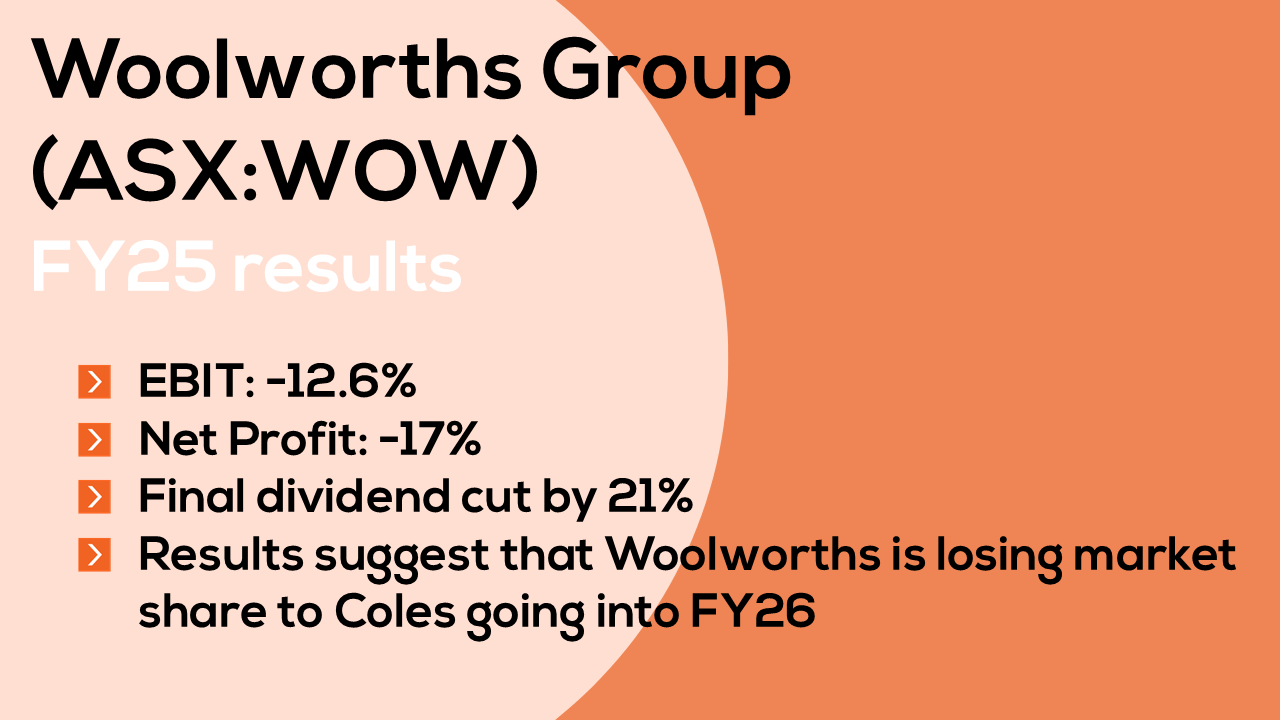

Supermarket giant Woolworths shares dropped over 10% following the release of its FY2025 results, significantly underperforming the broader ASX200, which gained 0.2%. The sell-off was driven by disappointing financials: while sales rose 3.6% to $69.1 billion and eCommerce jumped 17%, Woolworths saw a 12.6% drop in EBIT and a 17% fall in net profit due to rising operating costs and shrinking margins. The final dividend was also cut by 21%. Early FY2026 trading showed Woolworths’ food sales growing just 2.1% which was well below expectations and far behind Coles’ 7% growth suggesting that Coles is gaining market share. Coles outperformed Woolworths by maintaining stronger sales momentum and capitalizing on its rival’s cost management issues.

While healthcare was one of the worst performing sectors this week, Sigma Healthcare shares rose 7% after reporting strong FY25 results, the first key results since its merger with Chemist Warehouse. Net profit surged 40% to $579.1 million, while revenue jumped 82.2% to $6 billion, driven by strong retail sales and cost efficiencies. Chemist Warehouse retail sales grew 14% to $10.3 billion, supported by 11.3% like-for-like growth and strong performance in key categories like beauty and vitamins. Sigma also upgraded its cost synergy target from $60 million to $100 million over four years, with logistics costs per unit down 11% thanks to increased scale. With solid international expansion and strong cash flow, analysts like Bell Potter upgraded the stock to a ‘Hold,’ reflecting growing confidence in Sigma’s long-term potential.

And shares in the flying Kangaroo also took flight on results being released following a robust year of travel demand surging profits 28% to $1.61bn. Qantas posted solid results with an underlying profit of $2.39 billion, driven by strong demand and Jetstar’s impressive 55% EBIT growth. Group Domestic and International both saw gains, with Jetstar benefiting from fleet renewal and higher seat factors. Despite rising costs, Qantas maintained a strong liquidity position and announced $800 million in dividends. Looking ahead, the company expects continued growth in travel demand and Qantas Loyalty, with a 5% increase in capacity for 1H26. Strategic investments in fleet and operations set the stage for further strength despite cost pressures, as it is widely known the core Qantas brand is running an old fleet, hence capex rising 22% in FY25 to $3.9bn.

The outlook for FY26 is looking strong, with key sectors set to benefit from easing headwinds, shifting consumer preferences, rate cut outlook and eased inflationary pressures.

The themes we have identified that will pave the way for a strong FY26 include:

- Cost management driving margin maintenance if not expansion,

- Momentum is moving markets, but those with strong tailwinds are likely to experience double digit earnings growth in FY26,

- Management changes have caused mixed reactions among investors and could signal strategic shifts for key names in FY26,

- The AI boom is far from overvalued,

Investors are seeking growth opportunities in the small to mid-cap space.

Locally from Monday to Thursday the ASX200 posted a 0.43% decline, with 8 of the 11 industry sectors in the red. Consumer staples and healthcare declined the most amid key financial earnings reports, while materials and energy were boosted by commodity prices.

The winning stock was Tabcorp Holdings (ASX:TAH) saw a strong rally on well-received profit results, however Macquarie analysts are neutral on the stock, signalling that the company is at it’s early-stage execution of its turn-around strategy.

And on the losing end Dominos Pizza was the worst performer, down 24% after reporting this week that its faced significant challenges and posted its first loss in two decades in FY25 due to elevated one-off costs from store closures and restructuring. Despite meeting profit and revenue expectations, with an underlying net profit of $116.9 million, EBIT of $198 million, and network sales of $4.15 billion, the company struggled with weak performance in key markets like Japan and Germany, rising global overheads, and shifting consumer preferences toward healthier options.

The most traded stocks by Bell Direct clients this week were Aussie Broadband Ltd (ASX:ABB), CSL (ASX:CSL), and Siteminder Ltd (ASX:SDR). Clients also bought into Regal Partners Ltd (ASX:RPL), Woolworths (ASX:WOW), BHP (ASX:BHP) and WiseTech GLobal (ASX:WTC), while taking profits from Commonwealth Bank (ASX:CBA), Mineral Resources (ASX:MIN), and NAB (ASX:NAB).

And the most traded ETFs were led by the Vanguard Australian Shares high yield ETF (ASX:VHY), the Vanguard Australian Shares ETF (ASX:VAS) and the iShares S&P500 ETF (ASX:IVV).

On the economic calendar front next week we may see investors respond to key economic data out of Australia including GDP growth rate QoQ data for Q2 with the forecast of a 0.5% expansion, while Australia’s trade balance data is out on Thursday. Overseas, key US jobs data and China’s latest manufacturing PMI will give insights into the economic stability of the world’s two largest economies.

And that’s all for this Friday, have a wonderful weekend and happy investing.