Transcript: Weekly Wrap 30 June 2023

Thanks for joining me this Friday the 30th June, I’m Grady Wulff, a Market Analyst with Bell Direct and this is the weekly market update.

The last trading week of the FY23 financial year kicked off with escalating geopolitical tensions in Russia… this time not with Ukraine, but within its own country through the rise of a rebellion from the ‘Wagner Group’, a private mercenary group used by the Russian government in their conflict with Ukraine. Over 36-hours, the Wagner rebellion pushed toward Moscow, shooting down Russian military jets and killing at least 13-Russian soldiers in the process, before the rebellion turned back around 125-miles from Moscow allegedly to avoid bloodshed.

There are always two sides of the coin when thinking about the impacts of these type of events. On the negative side, the impact it may have on your portfolio is through the stocks that have direct exposure to sectors or areas affected by rising tensions like the energy sector. However, there are stocks that are positively impacted by armed conflict. The recent volatility in commodity prices escalated early in the week with the price of oil risingas a result of the fallout from the Wagner rebellion. Russia is a major OPEC+ producer and Gas traders are bracing for heightened volatility as these events posed yet another risk to gas supply from the region.

The rise in oil prices fuelled a rally early in the week for ASX listed domestic oil producers like Woodside Energy (ASX:WDS) and Santos (ASX:STO).

This was reversed later in the week with some downside volatility from global growth concerns. But for you as an investor, understanding the flow on impact of escalating tensions in war onto commodity prices and local producers is key to navigating the geopolitical impacts in 2023. On the flipside, there are also opportunities that arise with rising geopolitical tensions. The invasion of Ukraine and tensions in the Asia-Pacific are forcing most developed nations to reassess their military capabilities and increase investment in their national security according to Bell Potter industrials analyst, Danial Laing.

DroneShield (ASX:DRO) and Austal (ASX:ASB) are two names that deliver products and services for the defence markets both in Australia and around the world. Bell Potter has a buy rating on Australian shipbuilder and defence contractor Austal for the company’s leadership position as Australia’s largest defence exporter having contracted more than 350 vessels across 59 countries. Bell Potter sees structural tailwinds are driving growth for Austal which is set to enter FY24 with a record contract book of ~$11bn.

On the AI side, DroneShield (ASX:DRO) has also attracted a buy rating from Bell Potter because of its strong start to 2023. The company operates as an Australian defence manufacturer specialising in counter-drone technology using an end-to-end AI software and hardware combined solution. Bell Potter sees multiple material contracts and the raising of $40.3m via a placement in March as the key drivers of a strong start to the year. For both Austal and DroneShield, the escalation of tensions geopolitically drive a need for the products and services offered by these defence focused companies.

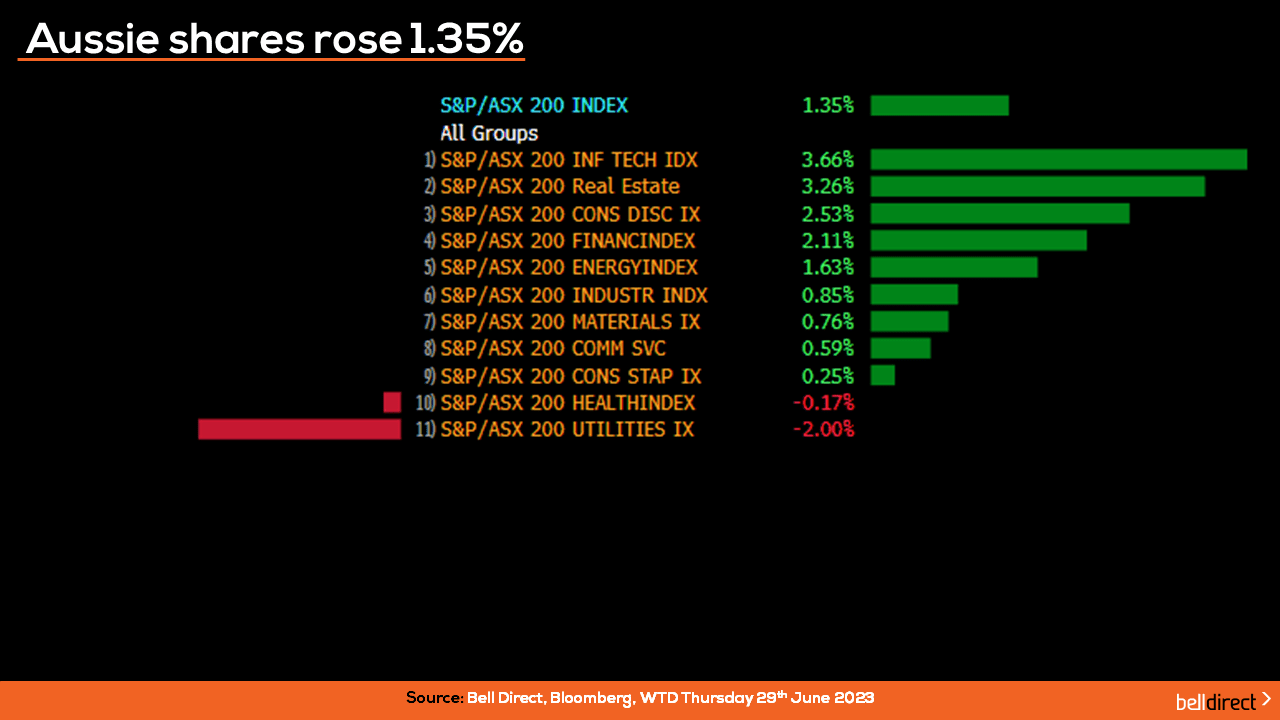

Locally from Monday to Thursday, the ASX200 rose 1.35% buoyed by the tech sector surging 3.66% as investor appetite for the high growth sector continues to grow. The tech sector is up almost 30% YTD. Real estate stocks also had a strong week ending the four-day period up 3.26%, while utilities and health care stocks were sold off this week.

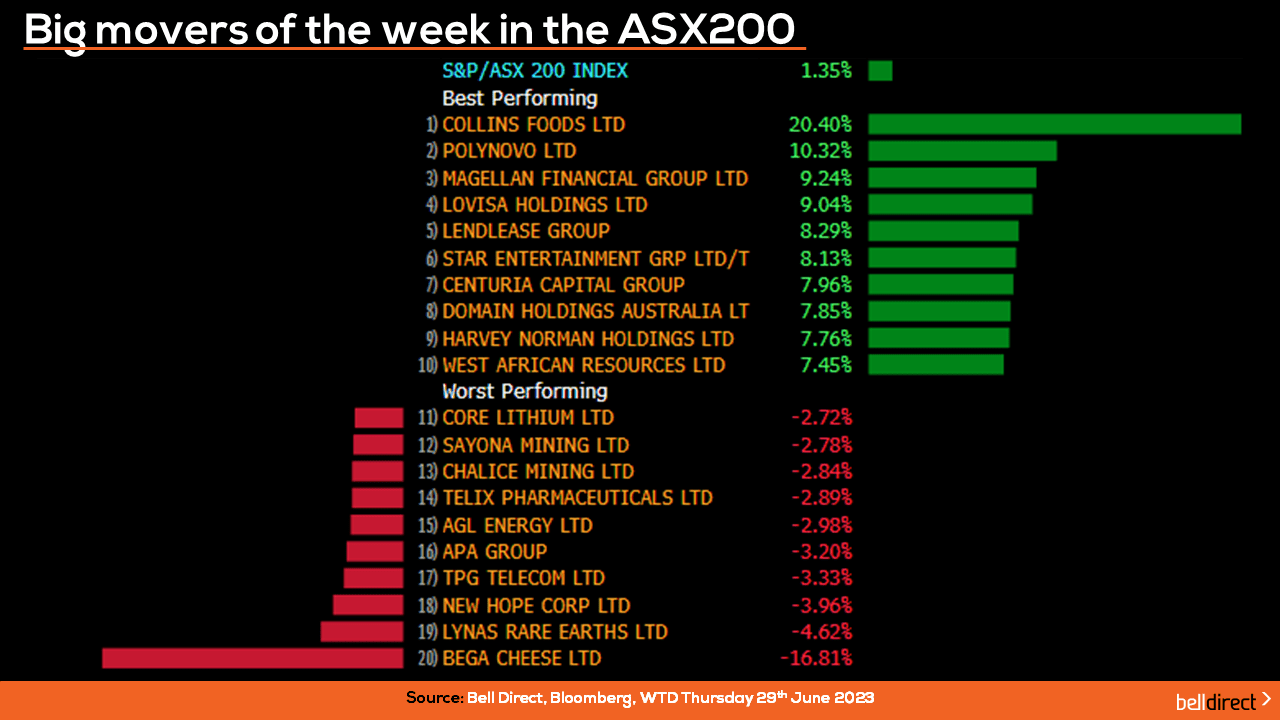

Collins Food (ASX:CKF) led the winning stocks this week with shares in the food retail operator soaring 20.40% on the release of strong full year results, while Polynovo (ASX:PNV) added 10.32% and Magellan Financial (ASX:MFG) rose 9.24% from Monday to Thursday.

Bega Cheese (ASX:BGA) weighed down the ASX200, dropping 16.8% over the week on a trading update including an impairment expected from rising Australian farmgate milk prices.

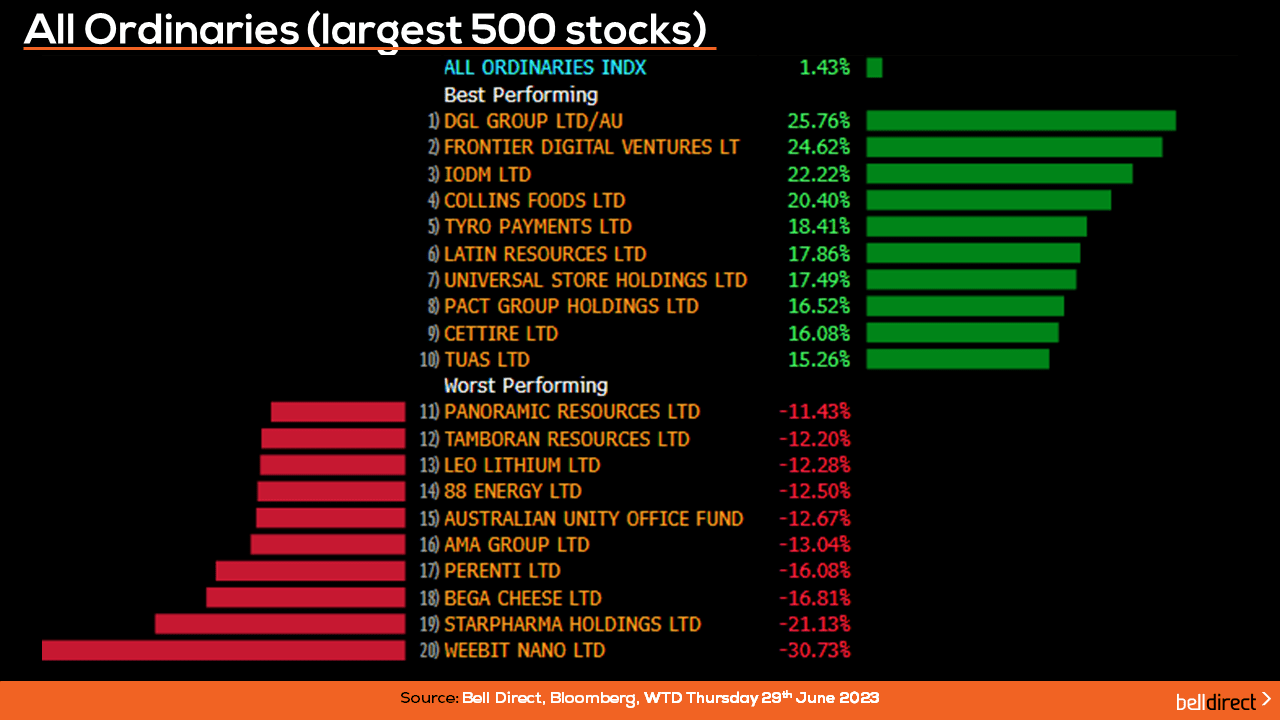

On the broader market front, the All Ordinaries advanced 1.43% from Monday to Thursday led by DGL Group (ASX:DGL) rocketing 25.76% while Frontier Digital Ventures (ASX:FDV) lifted 24.62%.

At the other end of the All Ords, Weebit Nano (ASX:WBT) fell 30.73% following the sudden resignation of an Australian board member.

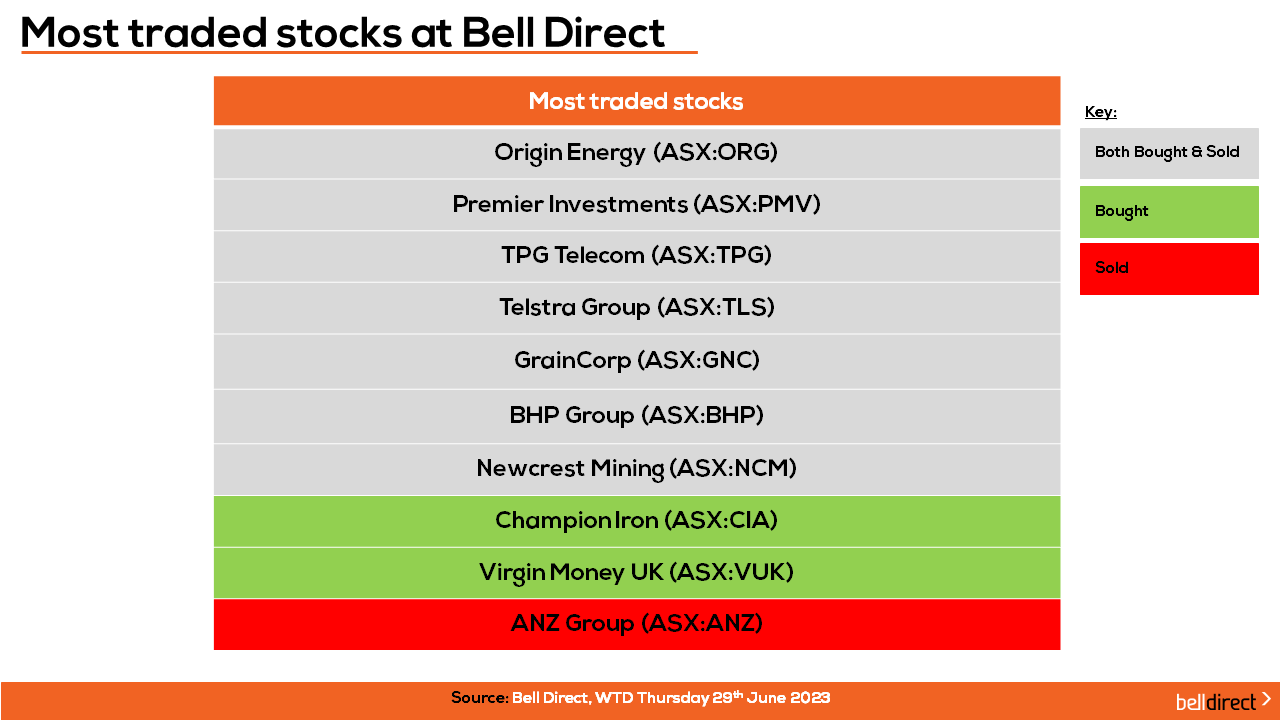

The most traded stocks by Bell Direct clients from Monday to Thursday were Origin Energy (ASX:ORG), Premier Investments (ASX:PMV), TPG Telecom (ASX:TPG), Telstra Group (ASX:TLS), GrainCorp (ASX:GNC), BHP Group (ASX:BHP), and Newcrest Mining (ASX:NCM).

Clients also bought into Champion Iron (ASX:CIA) and Virgin Money UK (ASX:VUK) while taking profits from ANZ (ASX:ANZ).

On the diversification front, the most traded ETFs by Bell Direct clients over the four days were the BetaShares Australia 200 ETF (ASX:A200), Vanguard Australian Shares Index ETF (ASX:VAS), and Vanguard Australian Shares High Yield ETF (ASX:VHY).

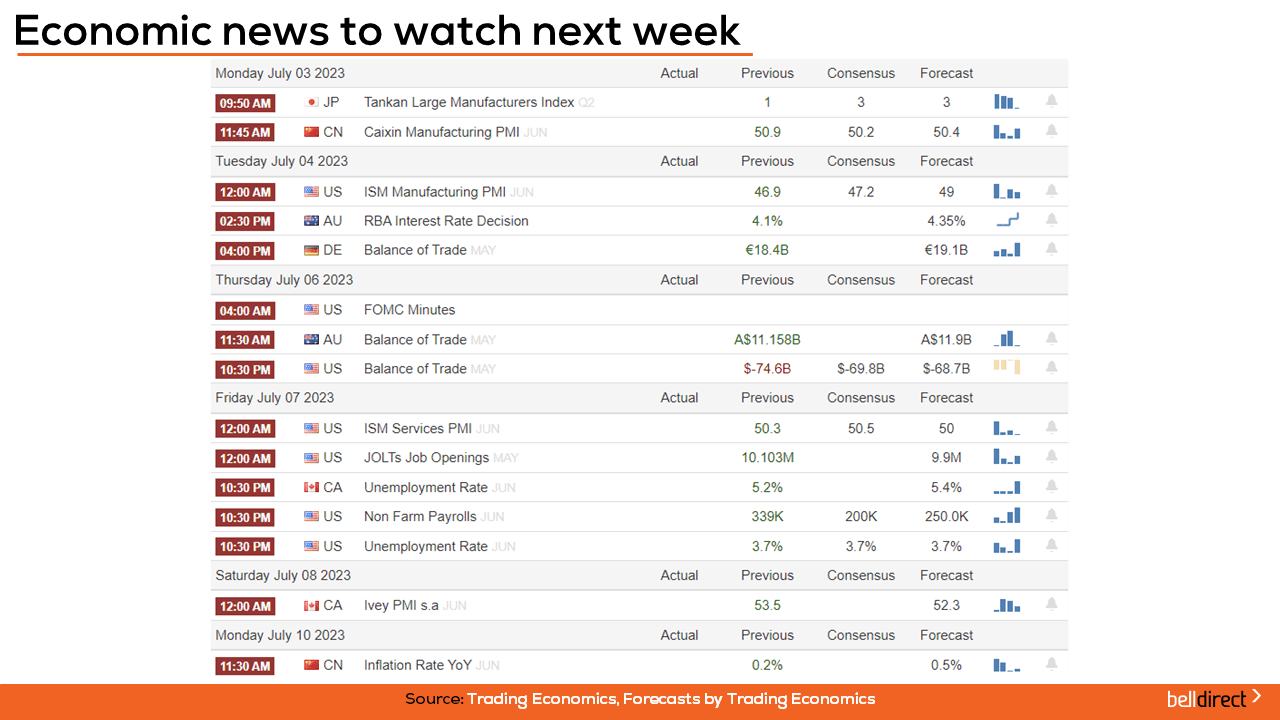

Taking a look to the week ahead, the economic data being released that may impact markets includes the RBA’s rate decision for July out on Tuesday. The consensus expectation for the RBA’s decision is for a hold in the current cash rate of 4.1% for the month of July. Australia’s trade balance data for May is out on Wednesday next week with the forecast for a rise in trade surplus to $11.9bn from $11.14bn in April.

Overseas, the FOMC meeting minutes are released in the US on Wednesday which could cause some market movements as investors assess just how hawkish the Federal Reserve is in regard to rate hikes over the coming months.

US JOLTs Job Openings data, Nonfarm Payrolls data and Unemployment data for June are each released on Thursday with the consensus expectation for unemployment to remain at 3.7%, Nonfarm payrolls to fall significantly with the addition of just 200,000 jobs in June, down from 339,000 added in May, and JOLTs Job Openings are also expected fall to 9.9m. US trade balance data for May is also out on Wednesday next week with consensus expecting an improvement in the trade deficit from $74.6bn in April to a deficit of $69.8bn in May.

And that’s all we have time for today, have a wonderful weekend and as always, happy investing!