Thanks for joining me this Friday the 31st October for my last weekly wrap for a little while as I head off on maternity leave until 2026. I’m Grady Wulff, Senior Market Analyst with Bell Direct.

Has the AI rally run out of steam or is the train just taking off? This week we had 5 of the Magnificent 7 post results giving clear indication that the AI revolution is well and truly underpinning earnings growth and there is no slowing down of expansion potential any time soon. Let’s dive into three of the big names, and what the market reactions were to results, as well as what picture is being painted about the growth of AI.

Microsoft kicked off FY26 with another standout quarter, comfortably beating Wall Street expectations as its cloud and AI strategy continued to pay off. Revenue surged 18% to US$77.7bn, while operating income rose 24% to US$38bn. The results underscored the strength of its Intelligent Cloud division, especially Azure, which is proving to be the backbone of Microsoft’s growth. AI adoption across its ecosystem, from enterprise Copilots to cloud infrastructure, has driven real demand and expanding margins. Management struck an upbeat tone, with CEO Satya Nadella calling Microsoft a “planet-scale cloud and AI factory” and CFO Amy Hood noting momentum across productivity and consumer segments. Despite a softer consumer tech environment, Microsoft’s breadth positions it uniquely to capture structural AI growth while maintaining disciplined profitability. Shares fell after hours as investors reacted to a CAPEX jump to US$34.9bn from US$24bn last quarter, reflecting continued heavy investment in AI capacity.

Alphabet’s third-quarter results reaffirmed that its AI and cloud strategy is gaining serious traction, with revenue up 16% year-on-year to US$102.35 billion and profit comfortably topping expectations. The revenue result saw Google’s parent company surpass US$100bn in a quarter for the first time thanks to growth in search, AI and cloud capabilities. The standout performer was Google Cloud, which surged 34%, underscoring accelerating enterprise demand for AI-driven infrastructure and analytics. Strength also flowed through to core advertising, YouTube and search, where the integration of generative AI tools has enhanced engagement and monetisation. Management’s focus on deploying AI across every layer of its business; from products to platforms, is translating into a clear competitive edge and renewed growth momentum. The market responded decisively, with Alphabet shares climbing around 6% in after-hours trade, as investors welcomed signs that the company’s pivot toward scalable AI and cloud solutions is broadening its growth profile well beyond the traditional advertising engine.

Meta’s Q3 results were mixed and sparked an 8% sell-off in after-hours trade amid a major tax bill hurting EPS and a multi-billion dollar hiring spree to bolster AI expansion which hurt the margins of the social media giant. The social media giant delivered an impressive quarter on the surface, with revenue jumping 26% year-on-year to US$51.24 billion, comfortably beating Wall Street expectations and highlighting continued strength across its advertising and Reels platforms, alongside early benefits from AI-driven engagement. However, the market reaction told a different story with shares sliding in after-hours trade as investors digested a US$15.9 billion one-off tax charge and a sharp increase in AI-related hiring and infrastructure spend that weighed on profitability. While CEO Mark Zuckerberg reaffirmed Meta’s long-term commitment to building “the leading AI platform,” the company’s outlook pointed to higher expenses and capex in the coming quarters, reflecting its rapid buildout of AI data centres and model development. The result is a mixed investor narrative; strong operational momentum and clear strategic vision, but near-term profit pressure that’s testing patience as Meta shifts from social media dominance to AI platform leadership.

So, from an investment perspective what overall picture is painted about the AI thematic in the markets? There is clearly solid headroom for growth in earnings on the back of AI expansion, despite significant spend in the space eating into margin expansion this results period. Profit growth is a longer-term focus across the Magnificent 7 as higher CAPEX this quarter will be used to bolster AI offerings in a bid to deliver meaningful margin appreciation for years to come.

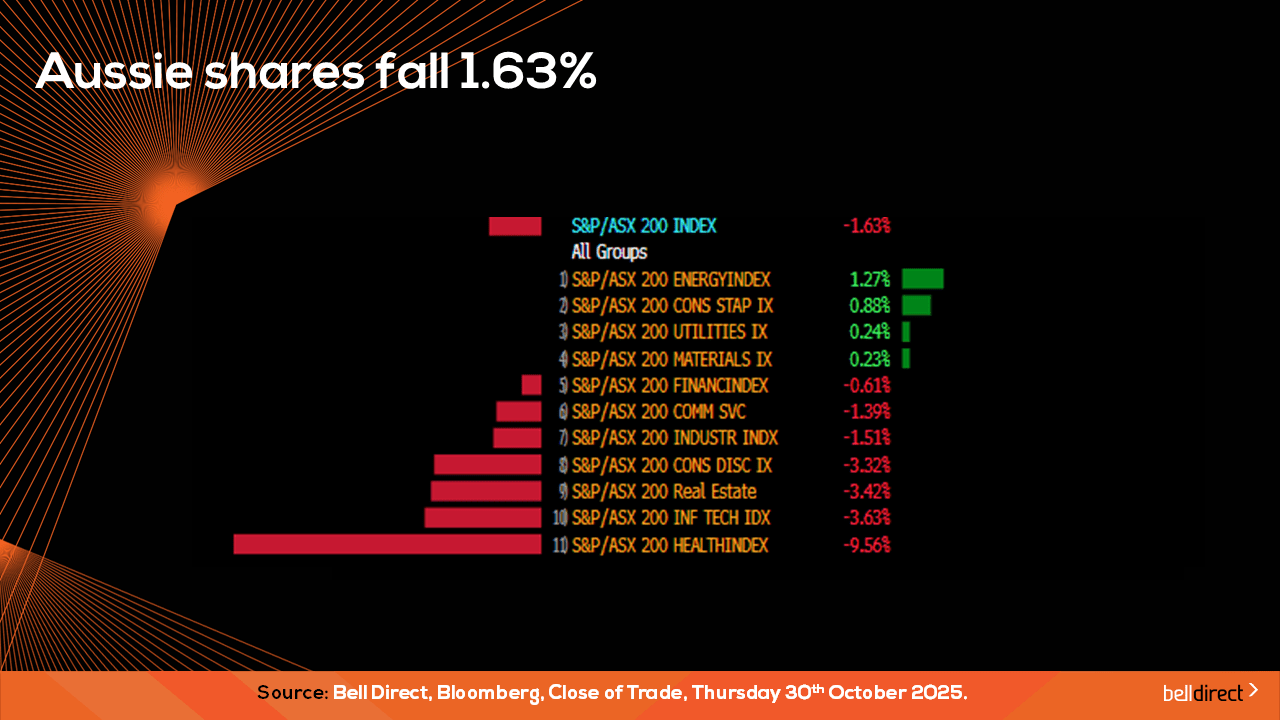

Locally from Monday to Thursday the ASX200 posted a 1.63% loss as health care stocks plummeted 9.56% led by sector heavyweight CSL (ASX:CSL) tanking this trading week on updated guidance and demerger delays.

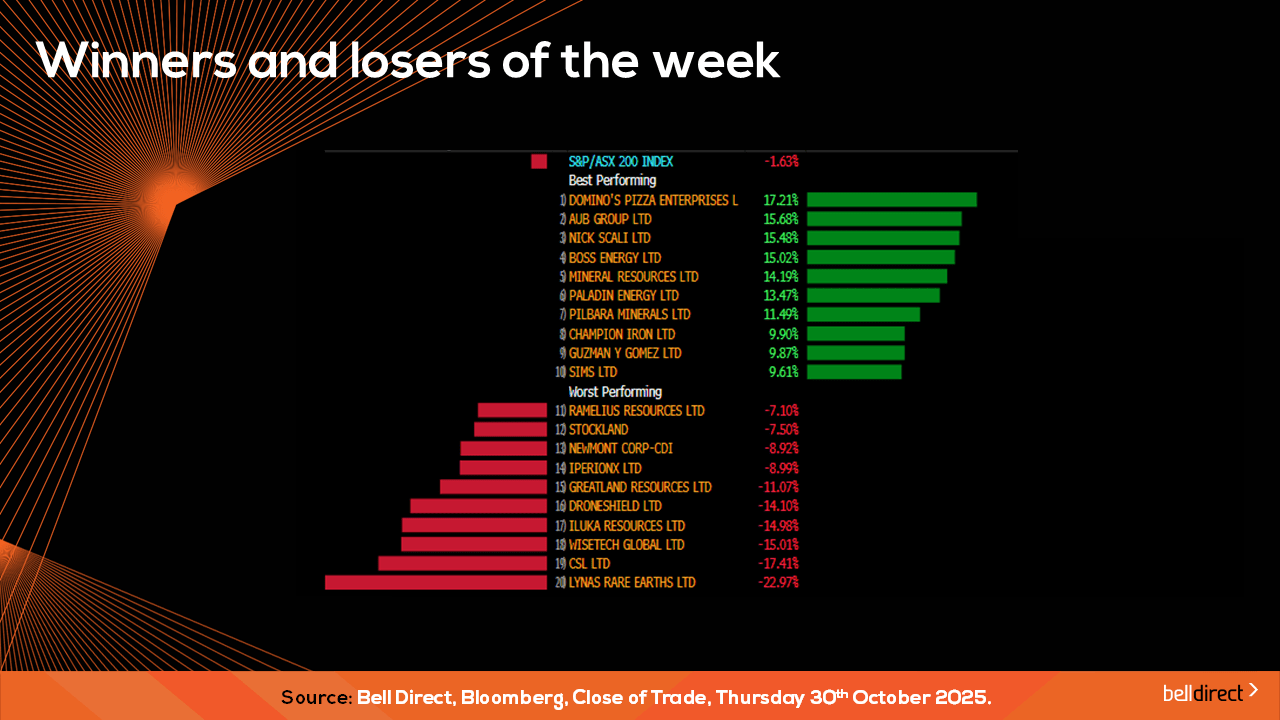

The winning stocks were led by Domino’s Pizza (ASX:DMP) soaring over 17% on takeover rumours, while AUB Group (ASX:AUB) and Nick Scali (ASX:NCK) rose 15.68% and 15.48% respectively this week.

And on the losing end Lynas Rare Earths (ASX:LYC) fell 22.97% while CSL (ASX:CSL) and WiseTech Global (ASX:WTC) ended the week down 17.41% and 15.01% respectively.

The most traded stocks by Bell Direct clients this week were BHP (ASX:BHP), Tasmea (ASX:TEA), Pilbara Minerals (ASX:PLS), Eagers Automotive (ASX:APE), and L1 Group (ASX:L1G). Clients also bought into CSL (ASX:CSL), WiseTech Global (ASX:WTC), and LGI (ASX:LGI) while taking profits from CBA (ASX:CBA) and Lynas Rare Earths (ASX:LYC).

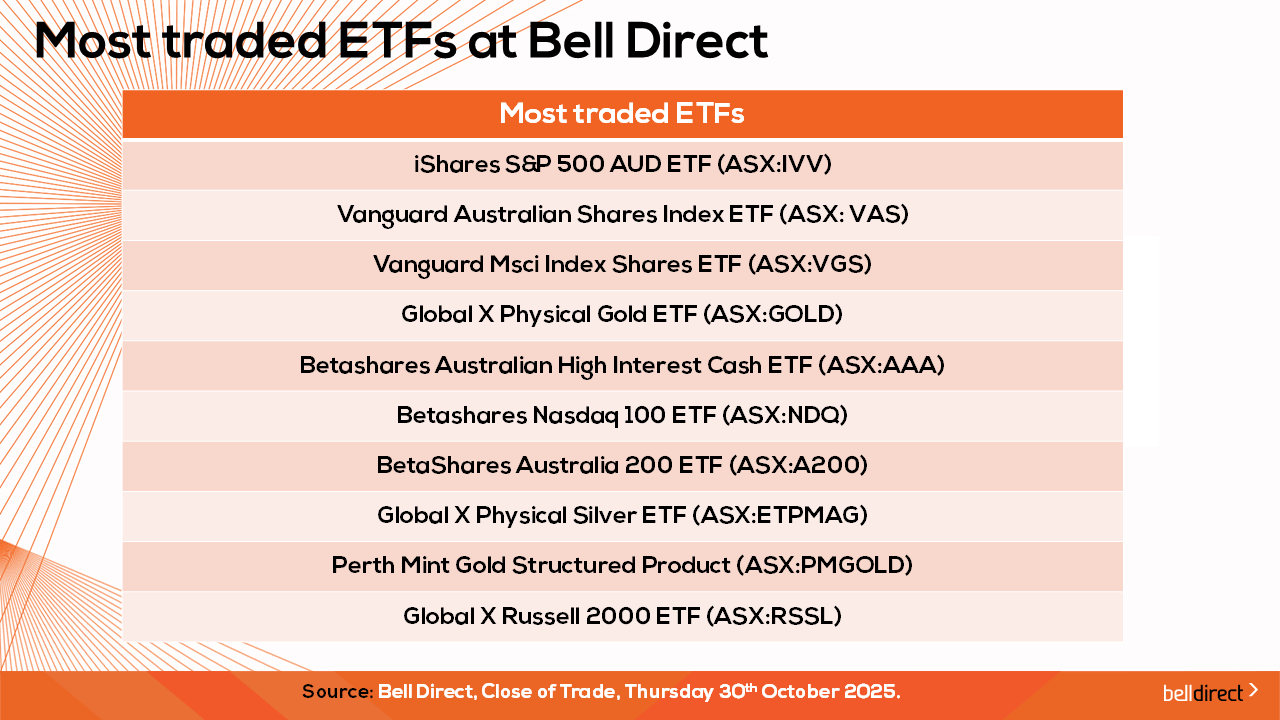

And the most traded ETFs by our clients were led by iShares S&P 500 AUD ETF (ASX:IVV), Vanguard Australian Shares Index ETF (ASX:VAS) and Vanguard MSCI Index International Shares ETF (ASX:VGS).

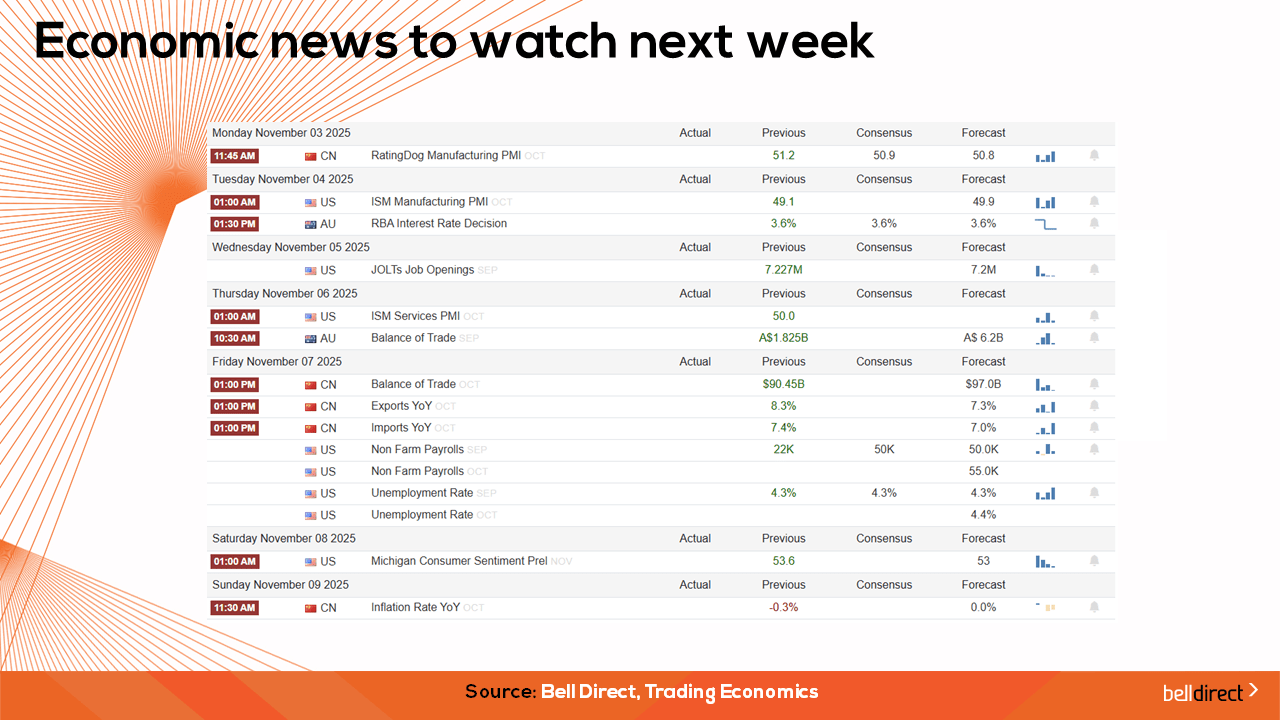

Next week we may see investors react to the RBA’s latest rate decision locally where the market is now expecting Australia’s central bank to hold rates given the latest CPI print uptick, while overseas key US jobs data and key Chinese trade balance data are released later next week which will give an insight into how the world’s two largest economies fared over the last few months.

And that’s all for this Friday and from me for a little while, I will see you in the new year and as always, happy investing.

This information is general in nature and does not take into account your financial situation, objectives or needs. You should consider whether it is appropriate for you. You should read our Financial Services Guide and any relevant Product Disclosure Statements before making an investment. For more information visit belldirect.com.au or call 1300 786 199. Bell Direct is the trading name of Third Party Platform Pty Ltd ABN 74 121 227 905, AFSL 314341.