Thanks for joining me this Friday the 8th August, I’m Grady Wulff, Senior Market Analyst with Bell Direct and this is our weekly market update and reporting season video 2 for this August earnings period.

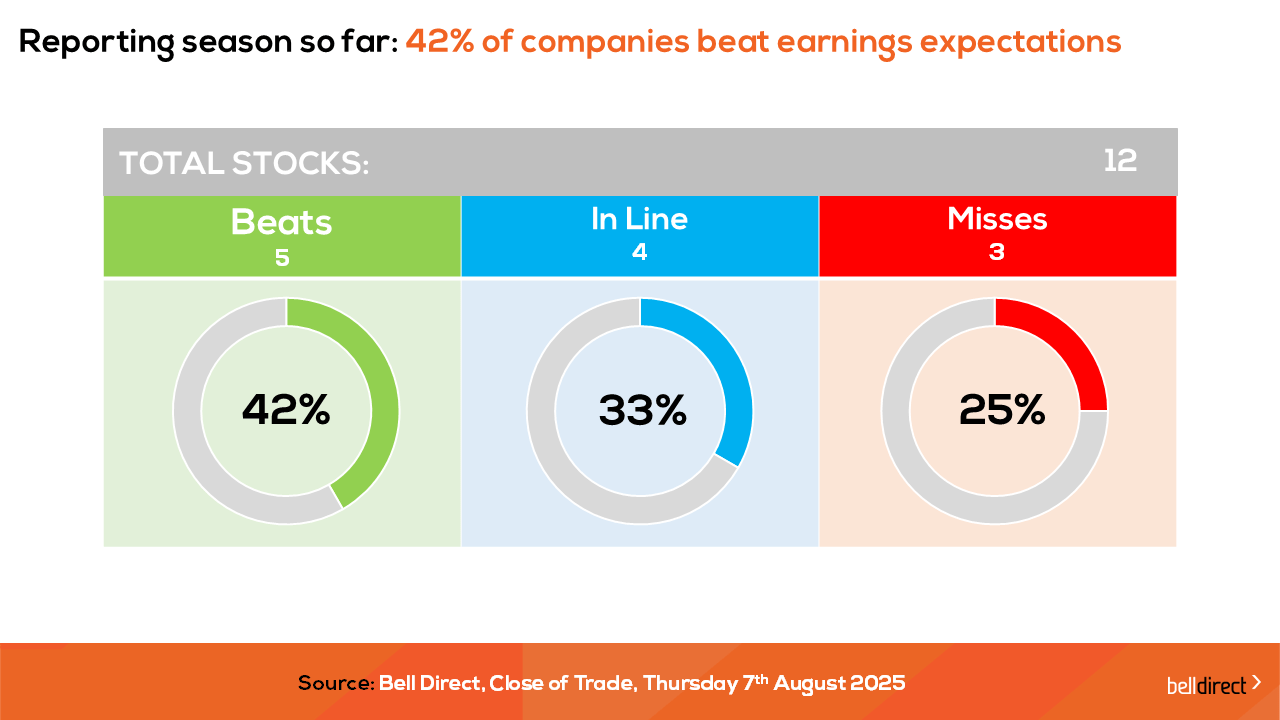

So far this reporting season we have had just 12 companies release results with 5 beating expectations, 4 meeting expectations and 3 missing expectations. A broker upgraded the rating on just BWP Trust (ASX:BWP) which met expectations, while News Corporation (ASX:NWS), Beach Energy (ASX:BPT) and Pinnacle Investment Management (ASX:PNI) have been downgraded by brokers. Let’s dive into the latest earnings results released, investor reactions and what themes have emerged so far this reporting season.

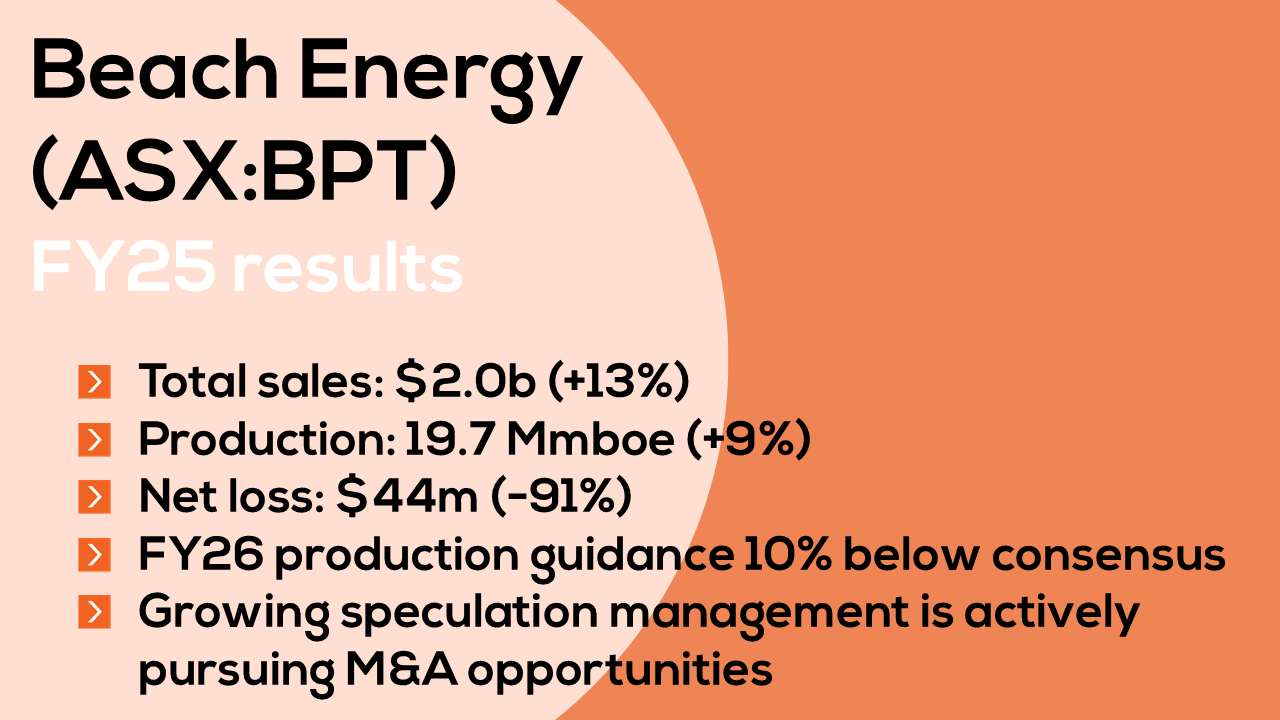

Despite a highly challenging year on the oil price and outlook front, Beach Energy managed to post resilient results in FY25 including sales revenue increasing by 13% to $2.0 billion, production growth of 9% to 19.7 MMboe, driven by increased East Coast gas demand, and a net loss of $44m, which was significantly lower than the $475m loss reported in FY24. The oil and gas producer also paid down debt during FY25 and rewarded shareholders with a record fully franked final dividend of 6cps. Higher costs, including abandonment expenses between $200m and $250m, along with FY26 production guidance 10% below consensus, have led to downgraded forecasts, resulting in lower valuations and price targets. On a positive note, the successful de-risking of the Waitsia project was a highlight, and there’s growing speculation that management is actively pursuing M&A opportunities to address the limited lifespan of the company’s assets. Currently, brokers have four Hold ratings and two Sell ratings on Beach Energy.

Australia’s leading online real estate platform, REA Group (ASX:REA) also reported this week with investors sending shares in the company up almost 7% on Wednesday after results were released. For FY25, REA Group reported revenue growth of 15% to $1.673bn, EBITDA up 18% to $969m, Net profit increased 23% to $564m and a final dividend of $1.38/share, taking full year dividends up 31% to $2.48/share. Operations in India experienced strong growth during the last financial year with revenues up 25% in the region, while national listings saw a rebound to growth earlier in the FY before sliding in Q4. The Australian property market is demonstrating resilience, with buyer inquiries hitting a three-year peak. Expected interest rate cuts are likely to support consistent growth in house prices, which fuels tailwinds for companies like REA heading into FY26 and led to the company maintaining guidance for FY26 at yield growth of 13-15%. With REA’s closest listed competitor in Domain now being delisted through takeover and with strong outlook for resilient growth in FY26, three brokers have a buy rating on REA Group.

And linked to REA Group was the Q4 results out of News Corporation this week as News Corp owns 61.4% of REA Group. For the quarter, NWS beat consensus with earnings (EBITDA) of US$322m led by Dow Jones and Digital Real Estate services, while book publishing and news media underwhelmed investors. For the full year of FY25, revenues rose 2% to US$8.45bn, while net income from continuing operations increased 71% to US$648m. News Corp has unveiled a share buyback program, signalling confidence in its financial strength and a commitment to delivering value to shareholder, which is one key area investors are analysing this reporting season. Despite headwinds in traditional media, the company’s focus on digital transformation and professional services positions it well for future growth.

So with all results in mind so far this reporting season and the fact that the ASX reset its record again this week, what key themes are emerging from an investment standpoint heading into FY26 from what we have learnt so far?

- Dividends signal stability and investors are looking for any signs of certainty from FY25 results.

- Guidance is the key to securing a share price rally on results being released – as investors hunt for any form of certainty in forecasting.

- And Cost management is the key to margin expansion this reporting season, and investors are quick to punish those who don’t increase prices to offset cost pressures.

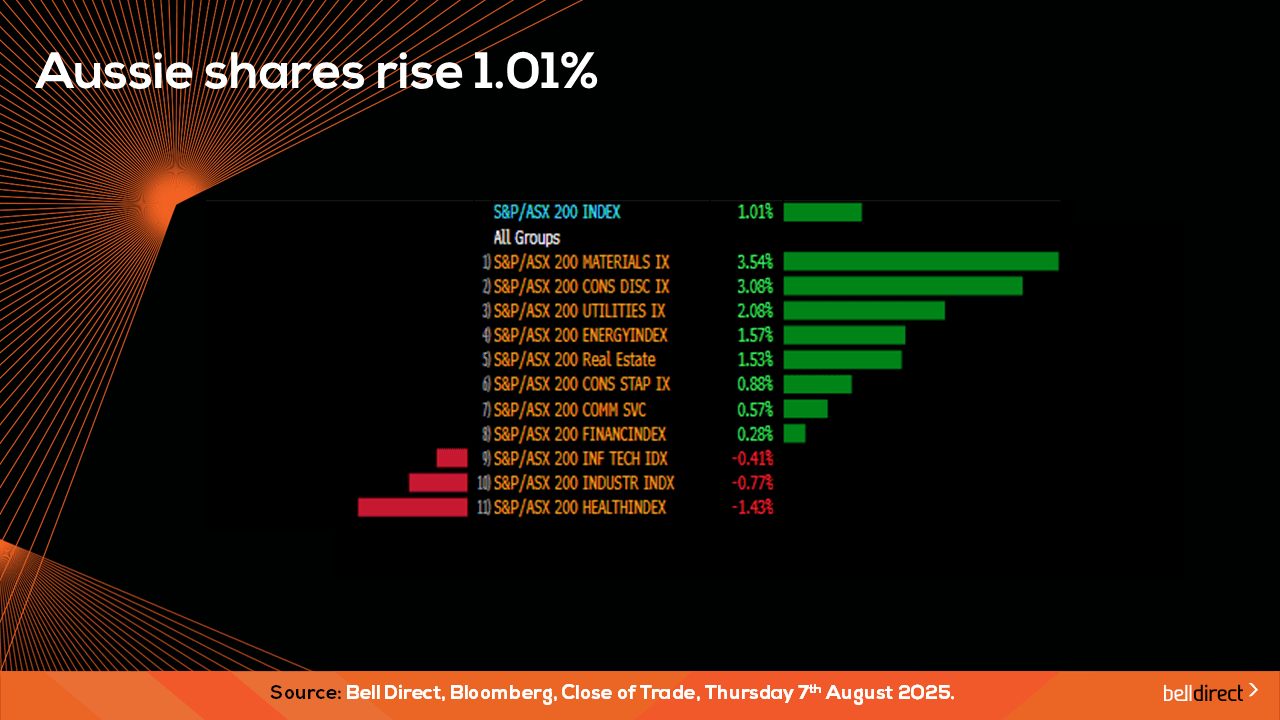

Locally from Monday to Thursday the ASX200 posted a 1.01% gain led by materials stocks rallying 3.54% while consumer discretionary stocks added 3.08%. Healthcare and industrial stocks came under pressure this week with declines of 1.43% and 0.77% respectively.

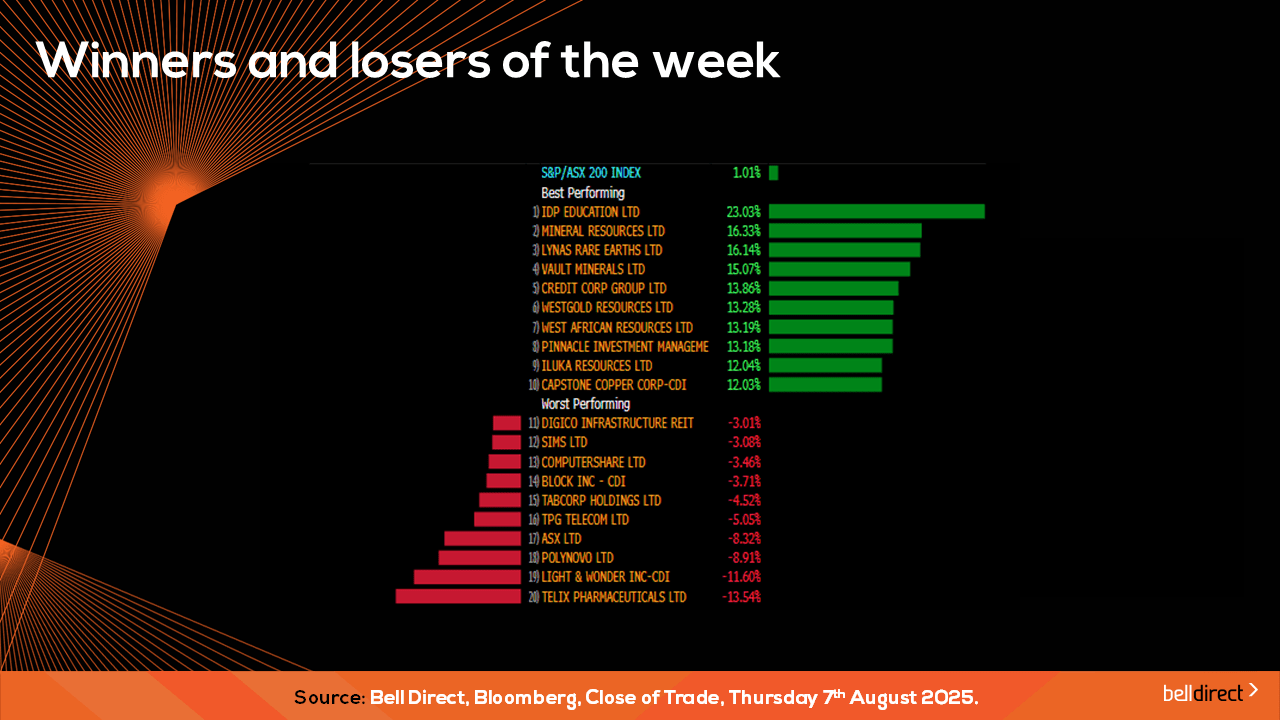

The winning stocks on the ASX200 were led by IDP Education (ASX:IEL) jumping over 23% while Mineral Resources (ASX:MIN) gained 16.33%. On the losing end of the major average, Telix Pharmaceuticals (ASX:TLX) tumbled 13.54% on higher expenses expected this half.

The most traded stocks by Bell Direct clients from Monday to Thursday were CBA (ASX:CBA), DroneShield (ASX:DRO), Fortescue (ASX:FMG), and BHP (ASX:BHP). Clients also bought into Telix Pharmaceuticals (ASX:TLX), Woodside (ASX:WDS) and Neuren (ASX:NEU) while taking profits from Wesfarmers (ASX:WES), ANZ (ASX:ANZ), and Westpac (ASX:WBC).

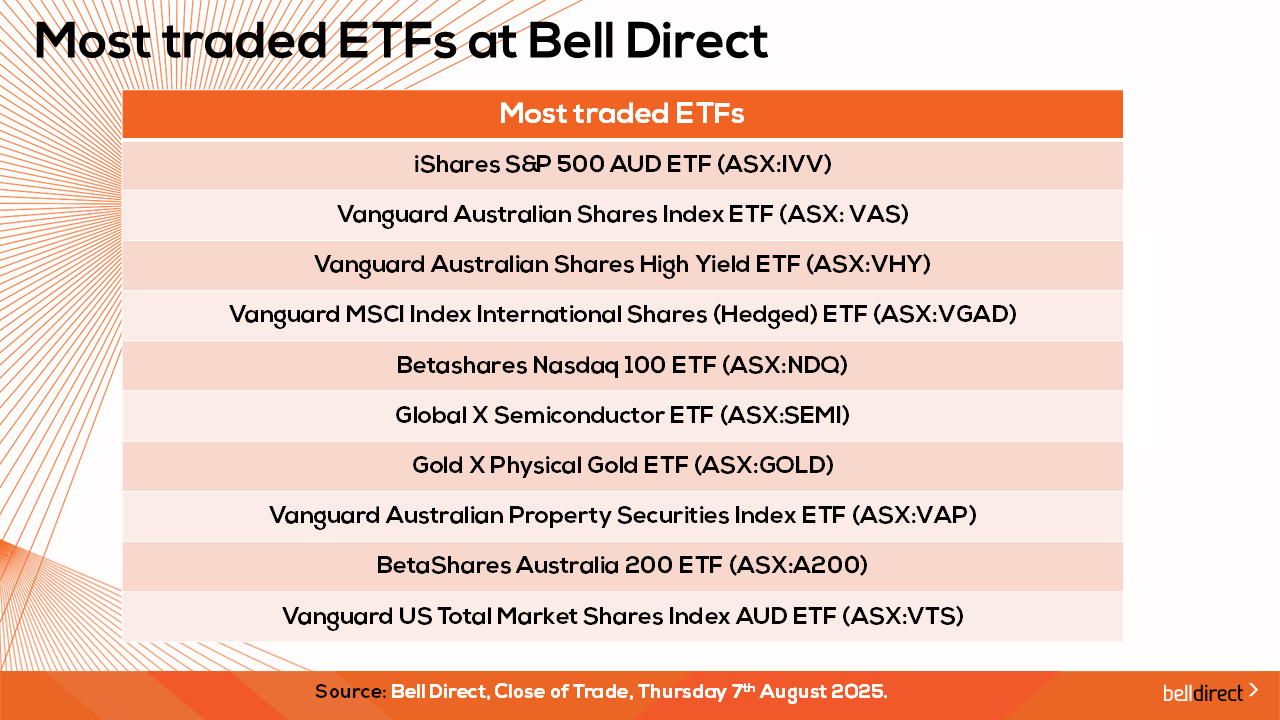

And the most traded ETFs by our clients were led by iShares S&P 500 AUD ETF (ASX:IVV), Vanguard Australian Shares Index ETF (ASX:VAS) and Vanguard Australian Shares High Yield ETF (ASX:VHY).

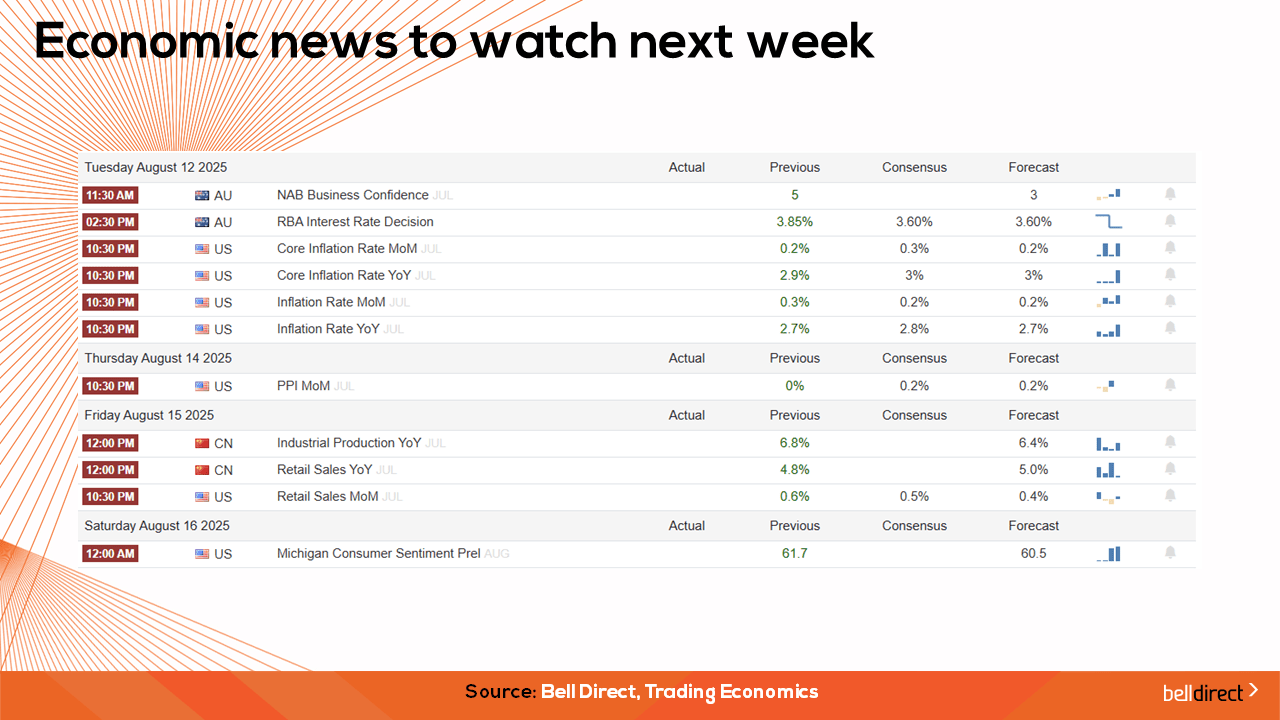

On the economic calendar next week we may see investors react to the RBA’s latest rate decision on Tuesday where it is widely expected Australia’s central bank will cut the cash rate to 3.6%. US inflation data is also out later next week while China’s latest industrial production and retail sales data are also out next week.

And on the reporting season calendar next week we have results out of JB Hi-Fi, (ASX:JBH) Evolution Mining (ASX:EVN), CBA (ASX:CBA), Treasury Wine Estates (ASX:TWE), Telstra (ASX:TLS), Pro Medicus (ASX:PME) and Cochlear (ASX:COH) among many others reporting.

And that’s all for this Friday and week. Have a wonderful weekend and happy investing.