Thanks for joining me this Friday the 15th August, I’m Grady Wulff, Senior Market Analyst with Bell Direct and this is our 4th reporting season video and weekly market wrap.

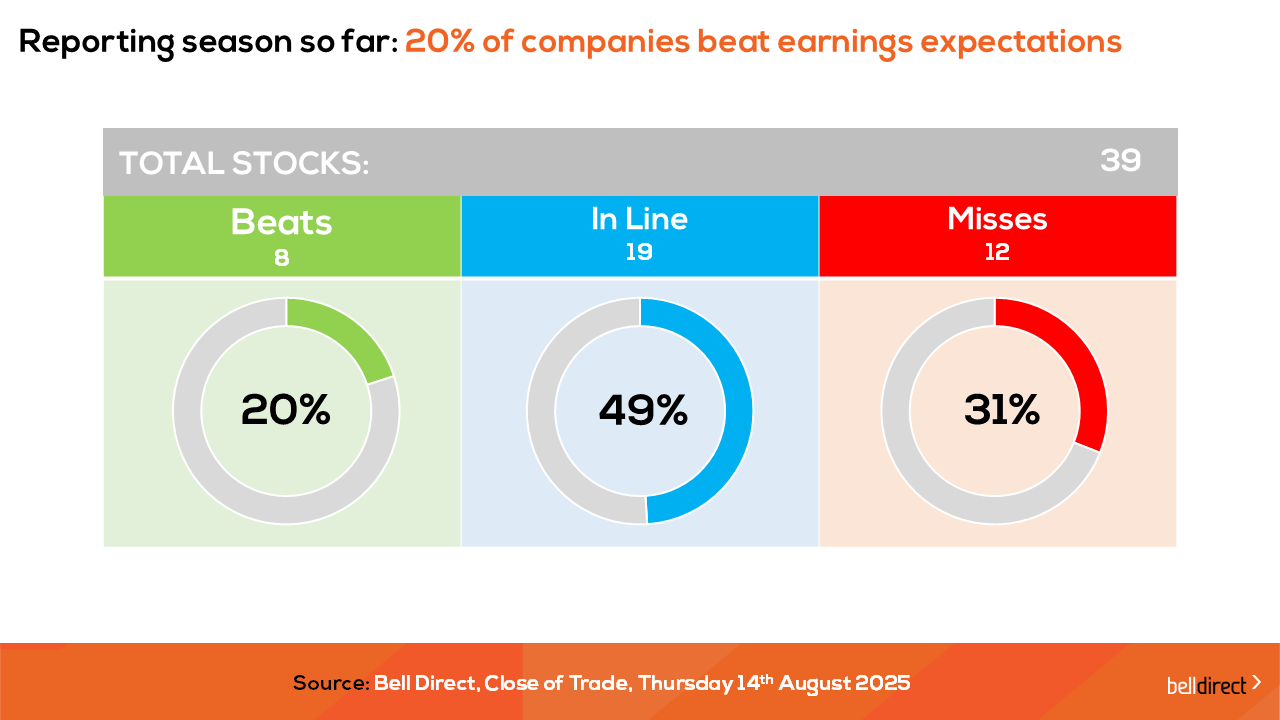

So far this reporting season we have had results out of 39 companies with 8 beating expectations, 19 meeting expectations and 12 missing expectations, with a significant amount more misses hitting the board later this week than the previous reporting season video we released on Wednesday. So far now, 9 companies have been upgraded by brokers including more recently AGL Energy despite missing expectations and 9 have been downgraded by brokers including Treasury Wine Estates. Let’s dive into the latest highlights, lowlights and key emerging themes paving the outlook for FY26 from results released this week.

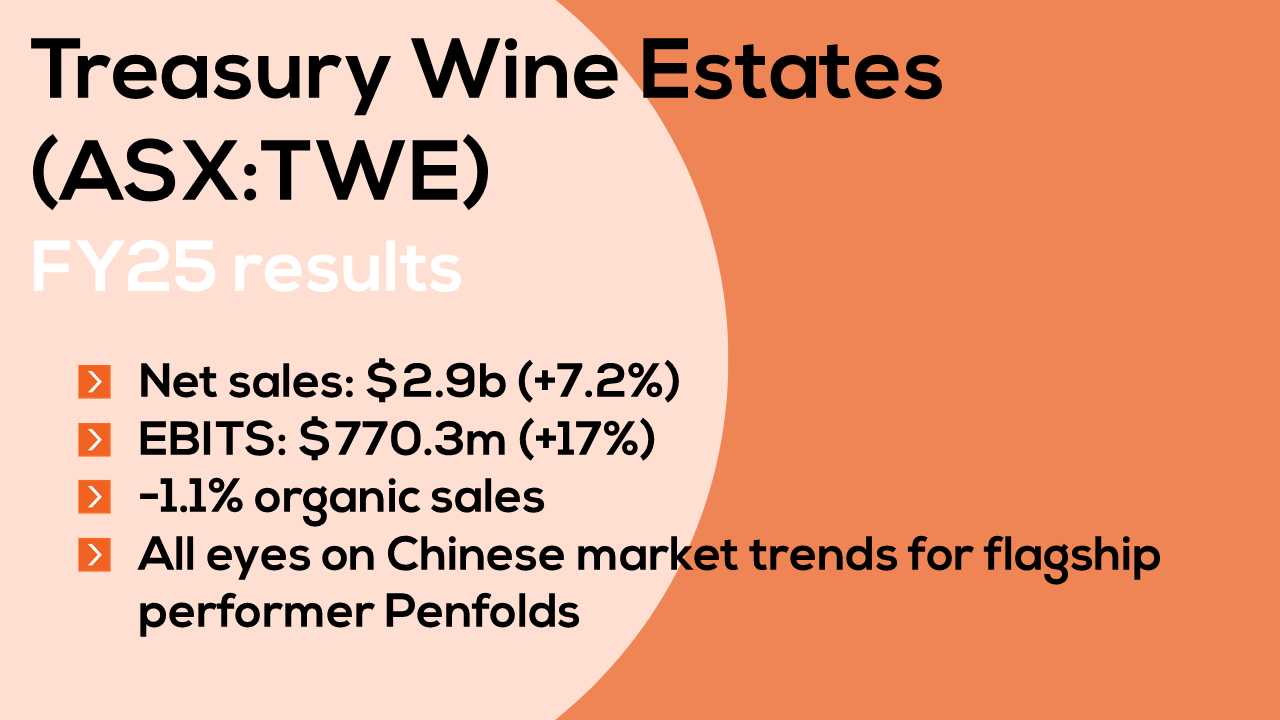

Treasury Wine Estates (ASX:TWE) may have been downgraded by 2 brokers on results being released but investors sent shares in the wine maker up over 1% on results day. Treasury Wine Estates (TWE) missed expectations due to a slowdown in stock depletion in China, driven by tighter alcohol restrictions and a shift in consumer behaviour away from large banquets toward smaller gatherings. This trend, which emerged in June and July, typically low-demand months, has dampened momentum in TWE’s most important Asian market. Despite strong overall FY25 results, including a 7.2% rise in net sales to AUD 2.9 billion and a 17% increase in EBITS to AUD 770.3 million, organic sales declined 1.1% due to weaker performance in commercial and lower-priced wines. Penfolds remained the standout performer, particularly in China, with sales surging 19.1% following the removal of tariffs. However, concerns such as ongoing price inversion from parallel imports and rising business costs added pressure. Looking to FY26, TWE is closely monitoring Chinese market trends ahead of the crucial Mid-Autumn Festival and may adjust marketing and inventory strategies accordingly. The company remains confident in Penfolds’ brand strength and is prepared to reallocate resources globally if needed. Cheers to that for investors, but a cautious cheer from the brokers.

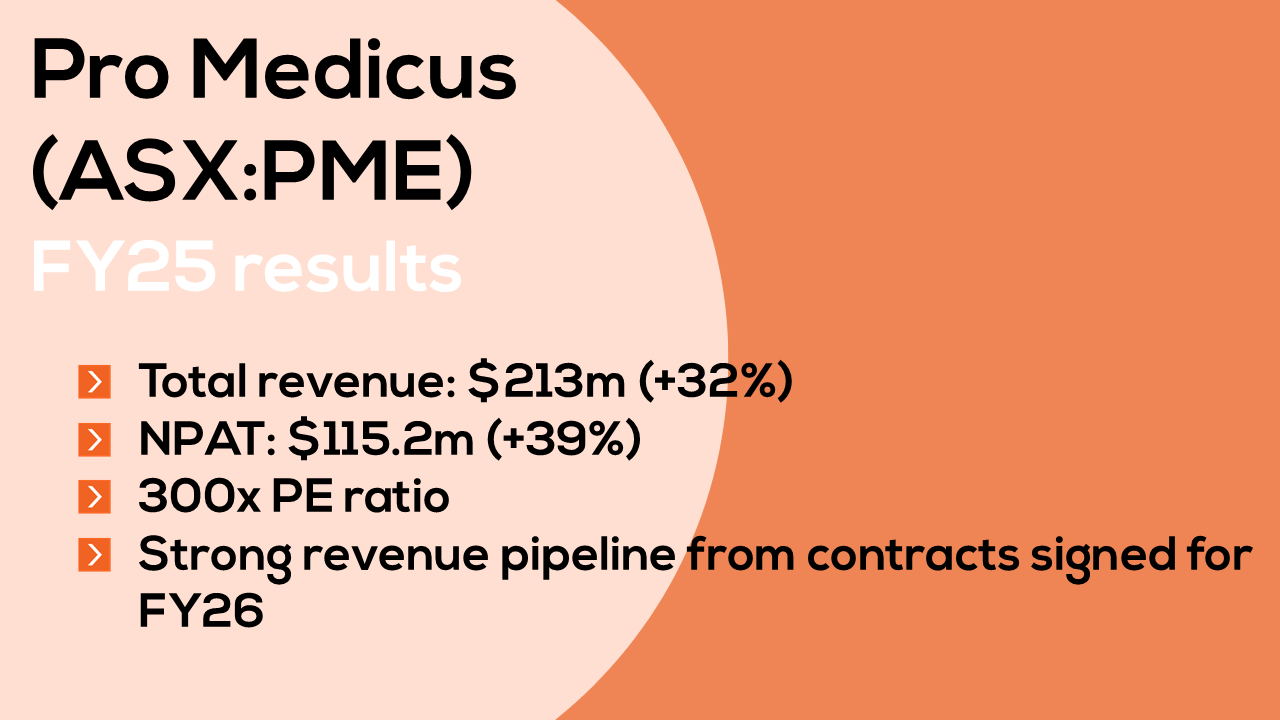

A record FY25 fuelled tailwinds for the Pro Medicus (ASX:PME) share price on Thursday as the leading global healthcare imaging tech provider once again proved why it’s over 300xPE ratio valuation is justified in the eye of investors. Pro Medicus shares rose 6% following strong FY25 results that exceeded expectations, with revenue increasing 31.9% to $213 million and net profit after tax up 39.2% to $115.2 million. The company achieved record new contract wins and renewals worth over $520 million, including major long-term deals with leading U.S. health systems, alongside $130 million in contract renewals. CEO Dr Sam Hupert highlighted that most contracts were signed in the second half of the year and will start contributing significantly from FY26, creating a substantial revenue pipeline. With a debt-free balance sheet, strong cash reserves, and growing demand for its fully cloud-based imaging technology, driven partly by a global shortage of radiologists, Pro Medicus remains well positioned for continued domestic and international growth across key healthcare sectors.

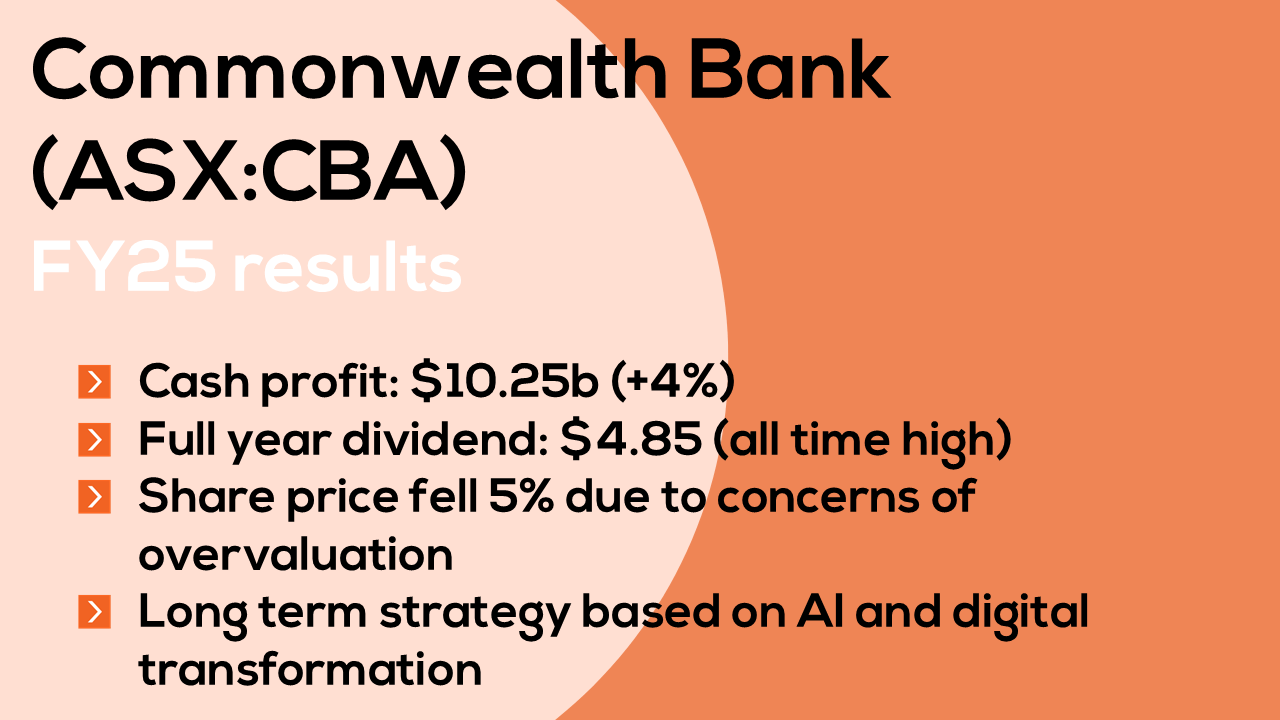

Commonwealth Bank of Australia (ASX:CBA) delivered a record FY25 result, posting a $10.25 billion cash profit, up 4%, and lifting its full-year dividend to an all-time high of $4.85 per share. Despite the strong performance, shares fell over 5% as investors took profits and questioned the bank’s lofty valuation after a 30% rally over the past year. Analysts noted the result lacked upside surprises, and with the RBA entering a rate-cutting cycle, CBA’s ability to sustain high margins and earnings growth may be challenged. CEO Matt Comyn remained unfazed by short-term market moves, emphasising long-term strategy execution, including a $2.3 billion annual investment spend, now boosted by $300 million, focused heavily on AI and digital transformation. The bank also announced a multi-year partnership with OpenAI to enhance customer experience and combat financial crime. While CBA’s balance sheet remains robust and lending volumes are growing, particularly in business and institutional segments, increased competition and rising costs from tech investment may weigh on near-term profitability. The outlook for FY26 is steady, but slightly softer given margin pressure and a more cautious economic environment.

So, with these results in mind, what key themes are shaping on the outlook front for FY26?

- Margin pressures are hitting the growth outlook for the banks heading into FY26.

- Record results are being overshadowed by valuations and eased growth outlook from an investment perspective.

- And China’s economic recovery continues to pave the way for many companies guidance with key operations in the region.

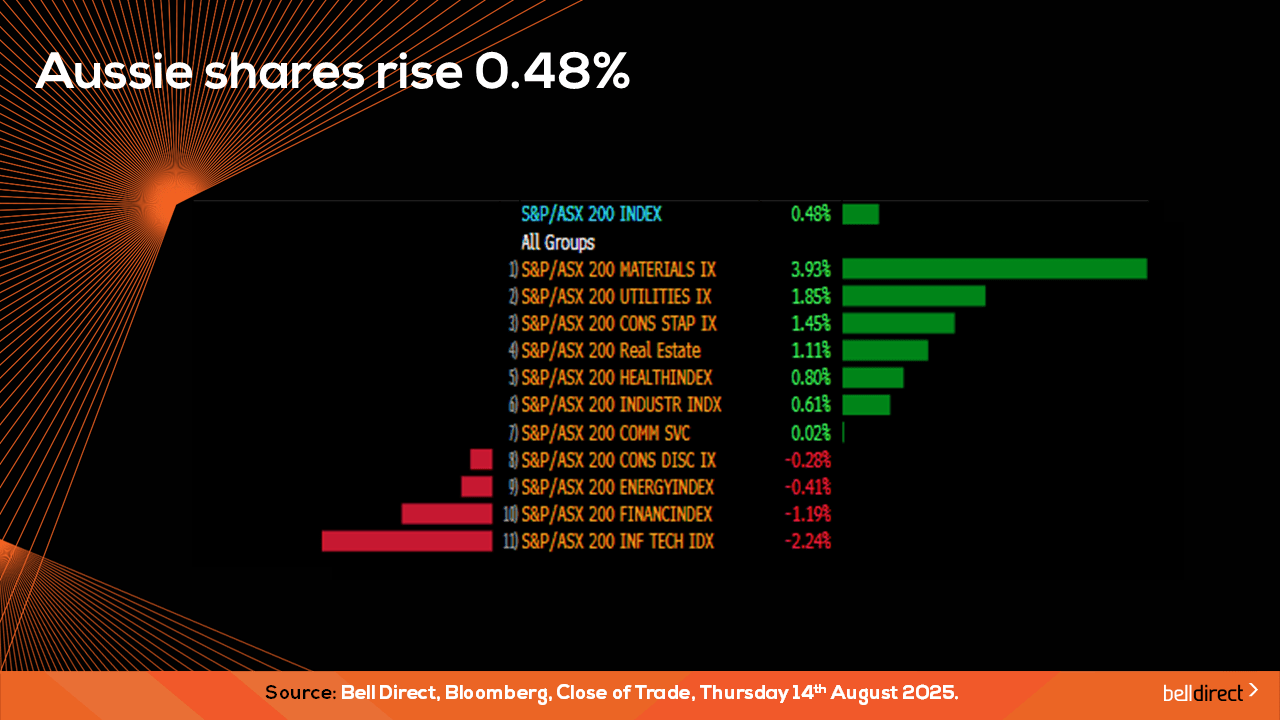

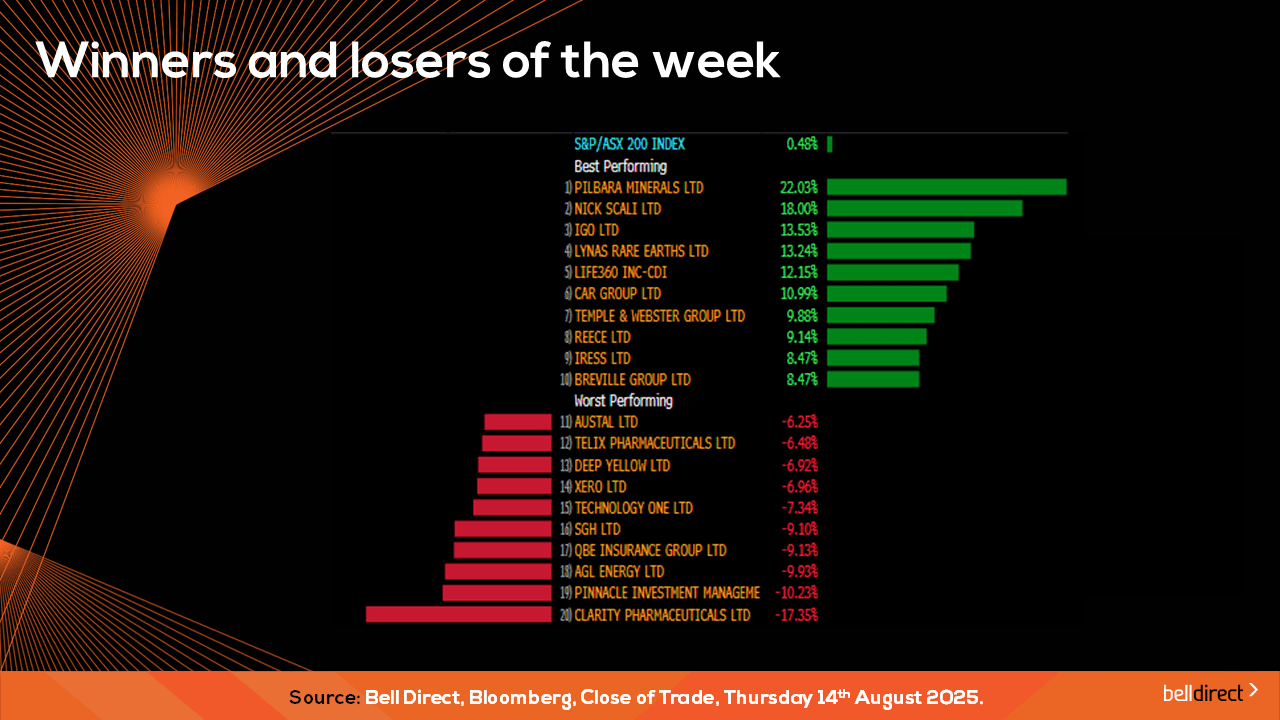

Locally from Monday to Thursday the ASX200 posted a 0.48% gain as a surge in materials and utilities stocks offset weakness among the tech and financials sectors.

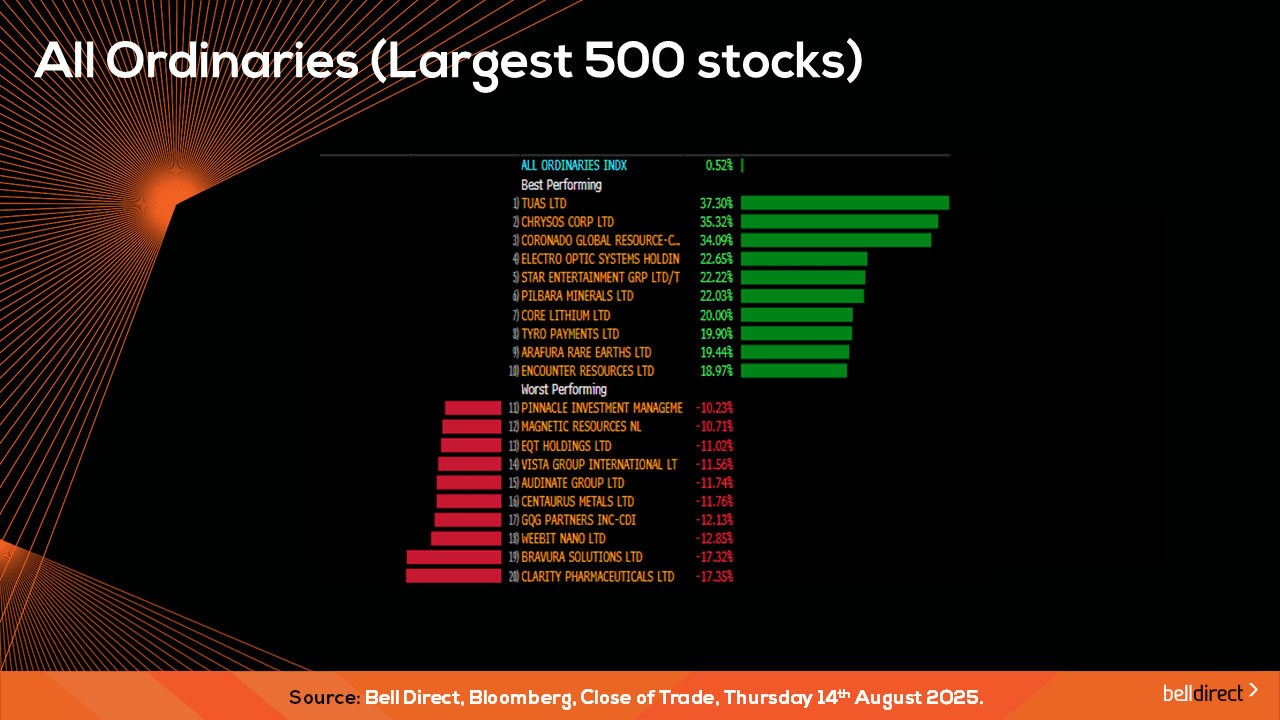

On the broader market index, the All Ords posted a 0.52% gain as Tuas (ASX:TUA) and Chrysos Corp (ASX:C79) posted over 35% gains while Bravura Solutions (ASX:BVS) ended the week down 17.32%.

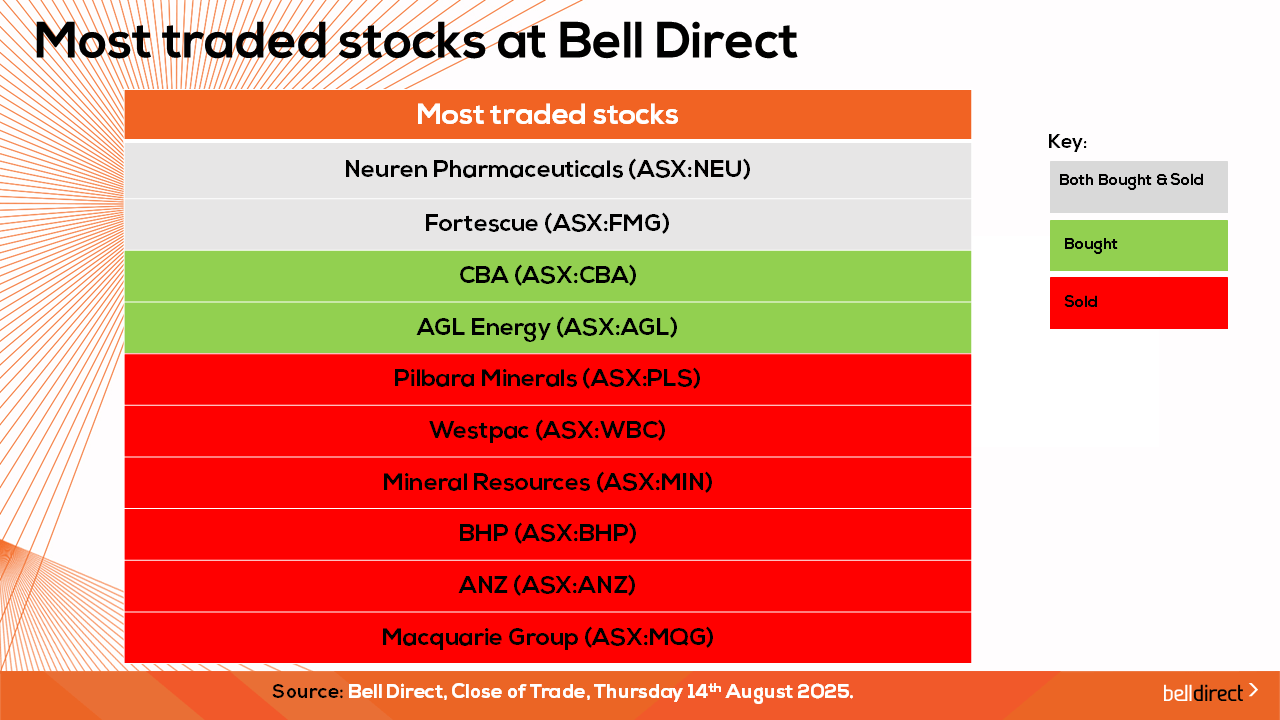

The most traded stocks by Bell Direct clients from Monday to Thursday were Neuren Pharmaceuticals (ASX:NEU), and Fortescue (ASX:FMG). Clients also bought into CBA (ASX:CBA), and AGL Energy (ASX:AGL) while taking profits from Pilbara (ASX:PLS), Westpac (ASX:WBC), Mineral Resources (ASX:MIN), BHP (ASX:BHP), ANZ (ASX:ANZ) and Macquarie Group (ASX:MQG).

And the most traded ETFs were led by iShares S&P500 AUD ETF (ASX:IVV), Betashares Nasdaq 100 ETF (ASX:NDQ) and Vanguard Australian Shares Index ETF (ASX:VAS).

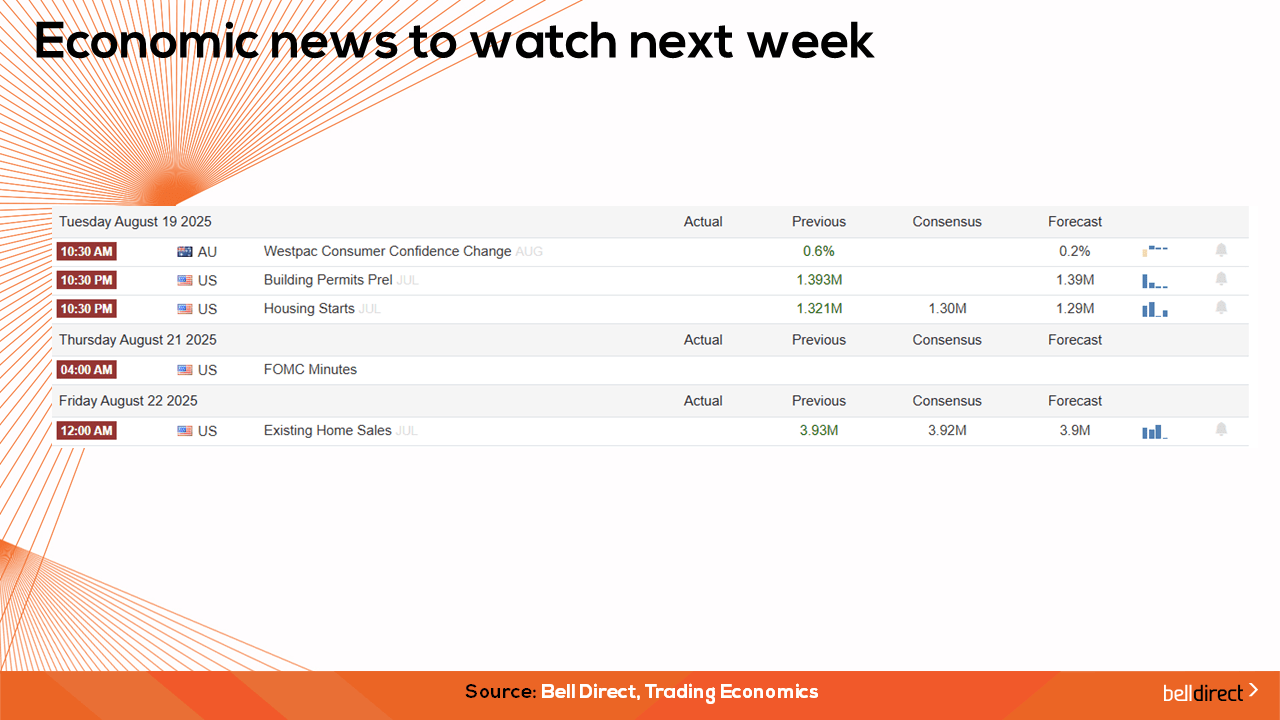

On the economic calendar front next week, we may see local investors respond to Australia’s Westpac Consumer Confidence Change, while overseas key US data including building permits, housing starts, and existing home sales may spark investor reactions.

And on the reporting season calendar next week we have one of the busiest weeks yet with over 20 companies reporting including Goodman Group (ASX:GMG), CSL (ASX:CSL), Zip Co (ASX:Z1P), A2 Milk (ASX:A2M), MediBank Private (ASX:MPL) and many more so stay tuned for our Wednesday video wrapping the first half of the week’s results.

And that’s all for this Friday, I hope you have a wonderful weekend and happy investing.