Transcript: Weekly Wrap Video 8 September 2023

Thank you for joining me this Friday the 8th September, I’m Grady Wulff, a Market Analyst with Bell Direct and this is the weekly market update.

Reporting season for August 2023 has come to an end and we are heading into the dividend payout period. Despite some companies reporting results that missed broker expectations and facing headwinds in the tougher economic times, prioritising shareholder returns through dividends and share buybacks saw mixed results this reporting season. Generally, we saw dividend cuts from the mining companies that were largely expected given the change in commodity prices, and good dividend increases from financials, particularly the insurers.

There’s no denying this year was a tougher year than most with total dividends falling according to Plato Investment Management. Investors received $36.8 billion last year compared to $29 billion this year from the largest 100 ASX listed companies. This represented a 21.2% reduction in dividends.

Some sectors that thrived from unprecedented demand in FY23 re-introduced dividends, like Flight Centre (ASX:FLT) which paid out $31.957m in FY23 after scrapping its dividend payout in FY22. And on the contrary, some companies that soared in FY22 cut their dividends in FY23 including IRESS (ASX:IRE) and Costa Group (ASX:CGC).

The big names that prioritised shareholder returns through dividends this reporting season were Woolworths Group (ASX:WOW), CSL (ASX:CSL), and Transurban Group (ASX:TCL).

So, which companies increased their dividend payout despite reporting softer-than-expected results in FY23?

The Accent Group (ASX:AX1) released FY23 results that fell short of Bell Potter expectations on a gross margins front, while beating Bell Potter expectations for NPAT, DPS and inventory. Accent Group reported gross revenue up 24% to $1.57bn beating Bell Potter estimates by 1%, company owned sales rose 2% to $1.393bn, underlying NPAT rose to $89m which was 3% ahead of Bell Potter’s estimate. Inventory for the footwear and sports leisure retailer was reduced to $239.6m which beat Bell Potter estimates but the increase in promotional activity to move inventory led to gross margins coming in at around 70bps in the second half which fell short of BPe. Despite the slowing consumer spend environment, Accent Group remains a key pick for Bell Potter in the retail sector and is a clear standout among retailers for rewarding shareholders through increasing the FY23 dividend to 17.5cps from 4cps in FY22. Accent Group also has an annual dividend yield of 8.62% which is well above a vast majority of dividend paying companies on the ASX.

Bendigo & Adelaide Bank (ASX:BEN) boasts an historically strong dividend yield of 6.88% and despite FY23 results falling just short of market expectations, the company’s final dividend rose 21% 32cps which was up from 26.5cps in FY22. For the year, BEN paid out 62cps in dividends, up 15.1% on FY22. For the last financial year, the regional bank reported cash earnings of $577m which was around 2% below market expectations, net interest margin rose 20bps to 1.94% and customer numbers rose 9.9%. FY24 will be a big year for this bank though as the ACCC has named Bendigo and Adelaide Bank as the preferred acquirer for Suncorp’s banking arm against ANZ… watch this space.

Lithium and market darling Pilbara Minerals (ASX:PLS) also holds a strong annual dividend yield of 5.31% and increased the full year dividend by 100% from 0cps in FY22 to 14cps in FY23. Pilbara shares were sold off following the release of results primarily on the outlook and implications of higher CAPEX in FY24 and lower volume guidance than was expected. The FY23 results were very strong though with EBITDA of $3.317bn, underlying NPAT of $2.28bn and net cash of $3.08bn.

And Australian conglomerate Wesfarmers (ASX:WES) paid out a whopping $1.169bn in final dividends to shareholders with a yield of 3.57% following an impressive year in FY23 including the first full financial year of results with API under the Wesfarmers umbrella. As consumer spend trends lower and shoppers shift to value retail spend over fashion retail spend, Wesfarmers’ Kmart division experienced revenue growth of 16.5% to $10.635bn accounting for ¼ of Wesfarmers’ total revenue. Bunnings revenue rose 4.4% amid a slowdown in DIY projects throughout the higher interest rate and rising cost of living environment in FY23, and the company’s online business catch.com.au extended its loss-making run through revenue dropping 30% and with a total earnings loss reported of $163m. While the drop in total dividends paid out this year may seem like a dampener for investors, it does provide less fuel for inflation given less money is placed in investor’s hands.

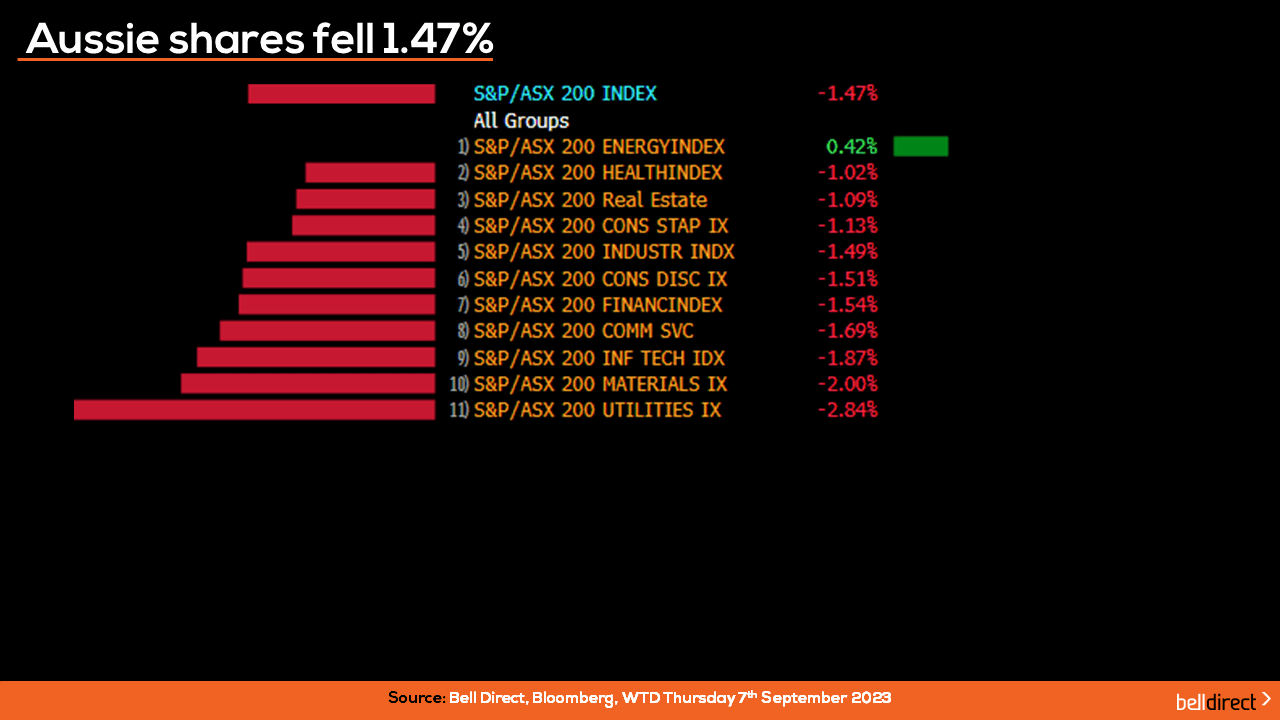

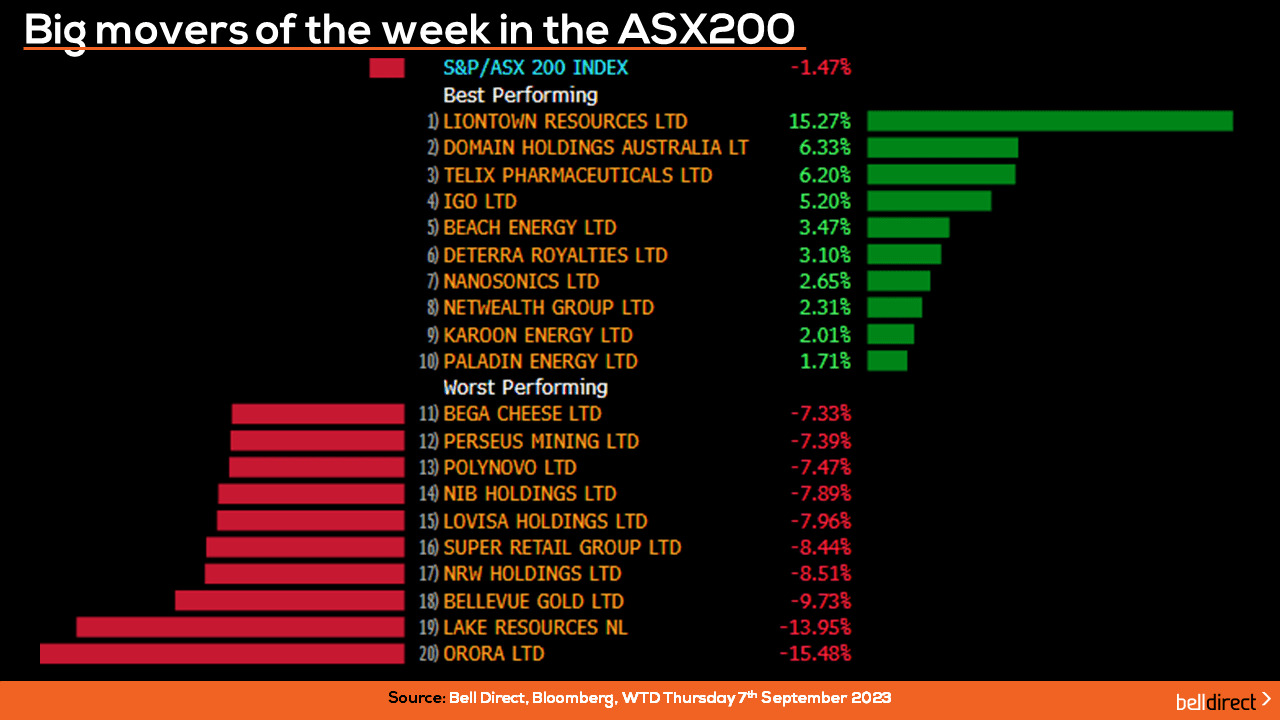

Locally from Monday to Thursday it was a vastly different outcome this week than last week’s rally with the ASX200 falling 1.47% over the four trading days, weighed down by utilities stocks dropping 2.84% and materials stocks losing 2%. The energy sector was the only sector to post a gain this week amid the rising price of oil on output cuts from Saudi Arabia and Russia.

Economic data weighed on investor sentiment this week as the optimism from interest rates being held by the RBA at 4.1% on Tuesday was quickly overshadowed by Australia’s GDP growth rate data coming in above consensus expectations at a 0.4% rise in Q2, which could provide further reason for the RBA to look at raising rates again in the near-term.

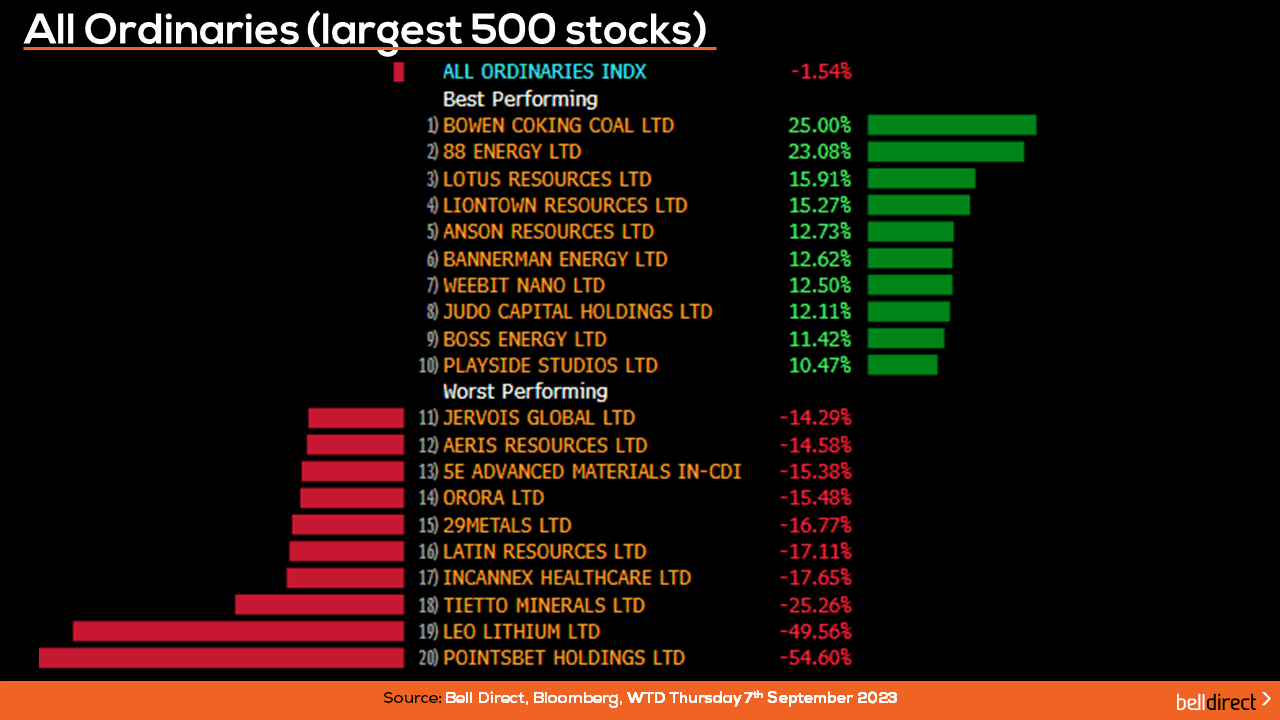

The winning stocks were led by Liontown Resources (ASX:LTR) soaring 25% after the lithium miner received an upgraded takeover bid from Albermarle. 88 Energy jumped 23% and Lotus Resources rose 15.91% from Monday to Thursday.

And on the losing end PointsBet (ASX:PBH) fell 54.60% after the company announced it is using the proceeds from the sale of its US business to return capital to shareholders via two capital return tranches. Leo Lithium (ASX:LLL) plunged 49.56% over the week and Tietto Minerals (ASX:TIE) fell over 25%.

On the broader index, the All Ords fell this week with Bowen Coking Coal (ASX:BCB) rallying 25% while Incannex Healthcare (ASX:IHL) fell 17.65% over the week.

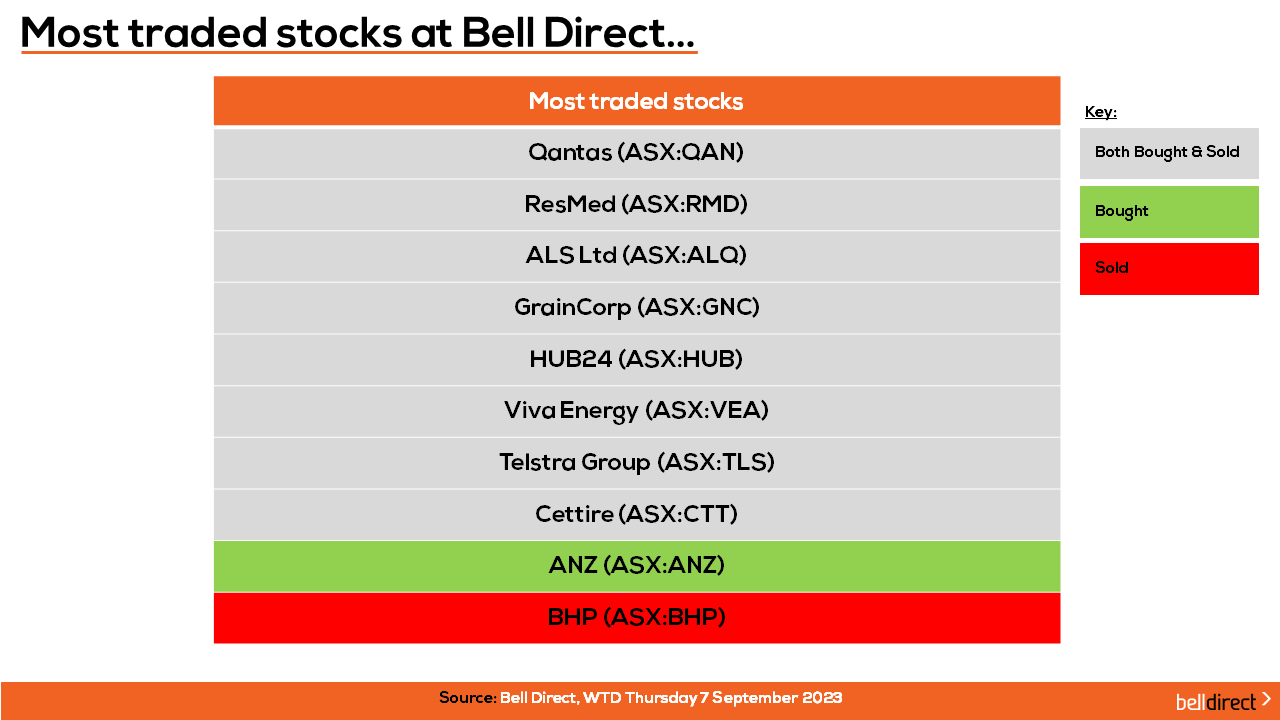

The most traded stocks by Bell Direct clients from Monday to Thursday were Qantas (ASX:QAN), ResMed (ASX:RMD), ALS (ASX:ALQ), GrainCorp (ASX:GNC), HUB24 (ASX:HUB), Viva Energy (ASX:VEA), Telstra Group (ASX:TLS), and Cettire (ASX:CTT). Clients also bought into ANZ (ASX:ANZ) while taking profits from BHP (ASX:BHP).

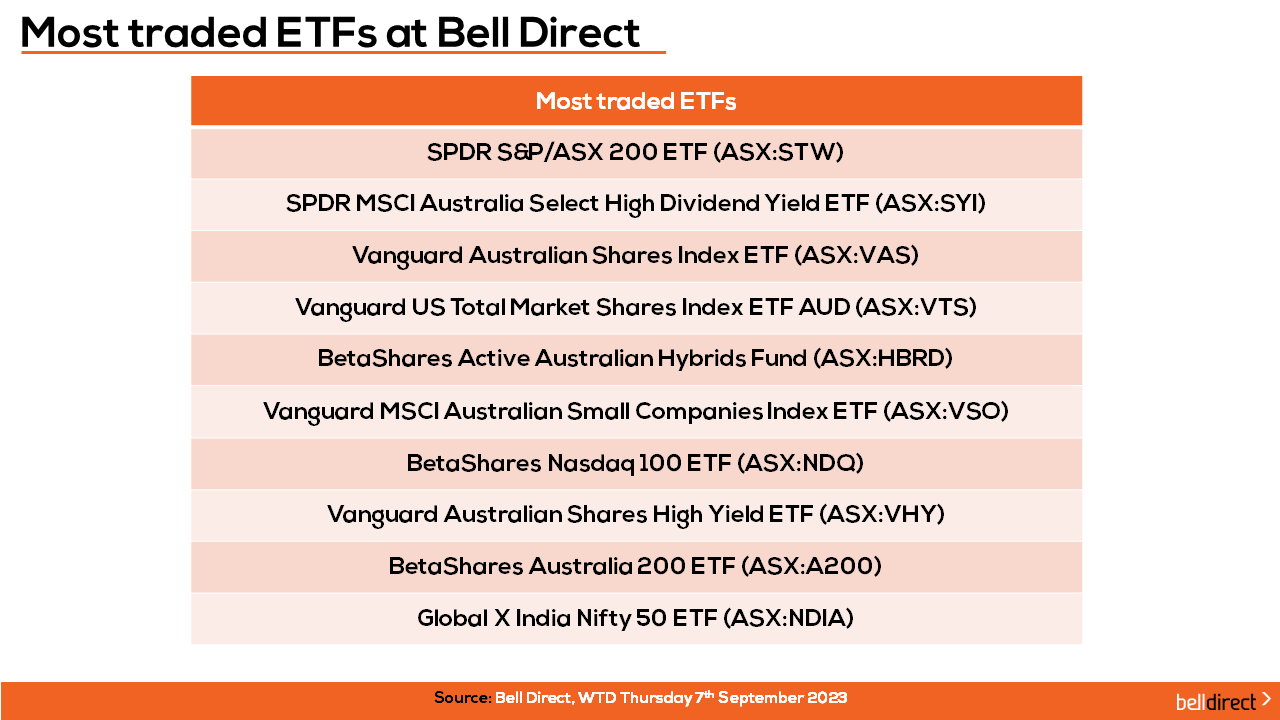

And the most traded ETFs were led by SPDR S&P/ASX 200 ETF, SPDR MSCI Australia Select High Dividend Yield ETF, and Vanguard Australian Shares Index ETF.

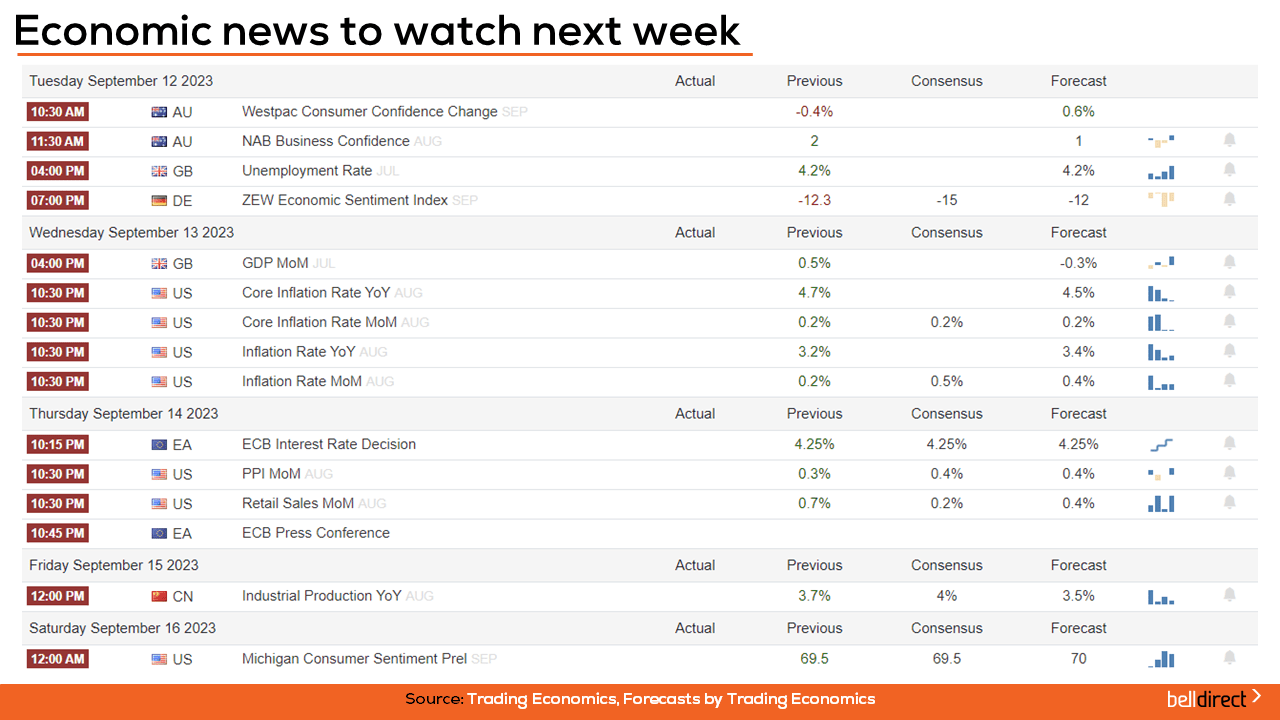

On the economic calendar outlook for next week, Westpac Consumer Confidence data for September, and NAB Business Confidence data for August are both released on Tuesday with the forecast of a rise in consumer confidence and a decline in business confidence across the respective readings.

It’s a big week over in the US for economic data that is likely to move markets including the release of core inflation rate data, producer price index data and retail sales data all for August released with consensus expecting core inflation to remain at 0.2%, the inflation rate to rise 0.5%, PPI to increase slightly and retail sales to rise just 0.2%.

And that’s all we have time for today, have a wonderful Friday, a great weekend and as always, happy investing!