Thanks for joining me this Friday the 26th September, I’m Grady Wulff, Senior Market Analyst with Bell Direct and this is our weekly market update.

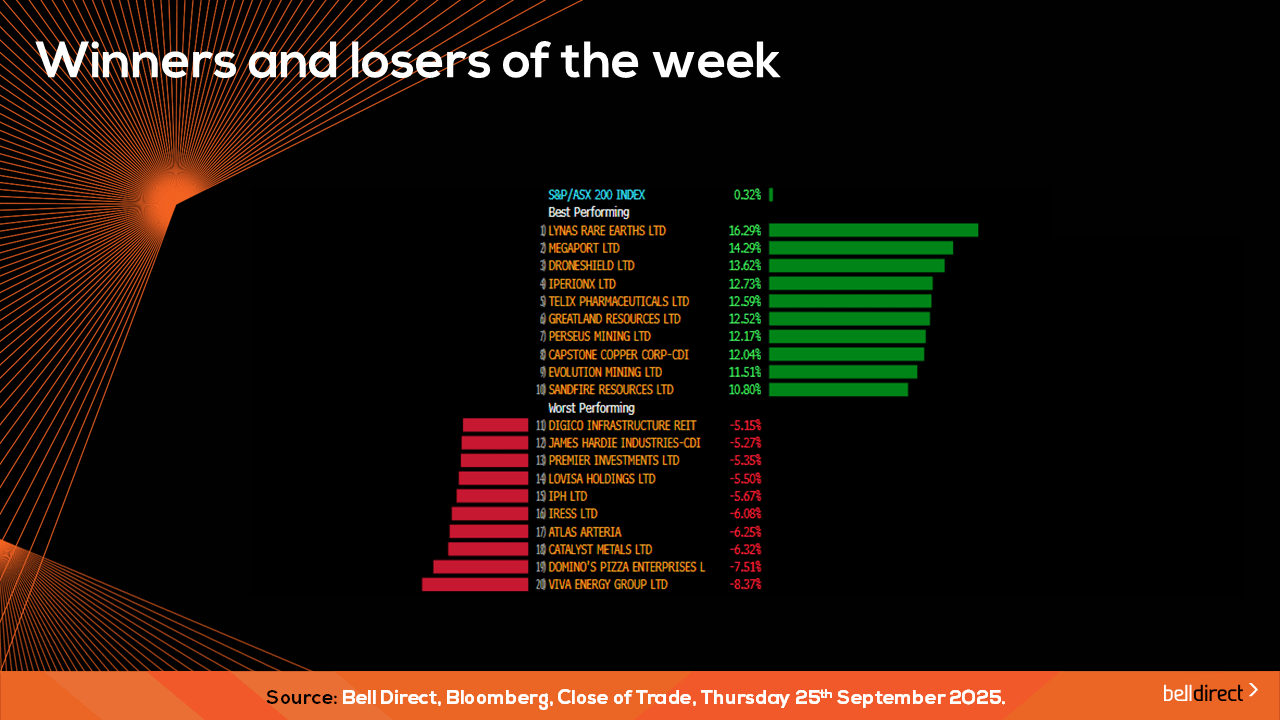

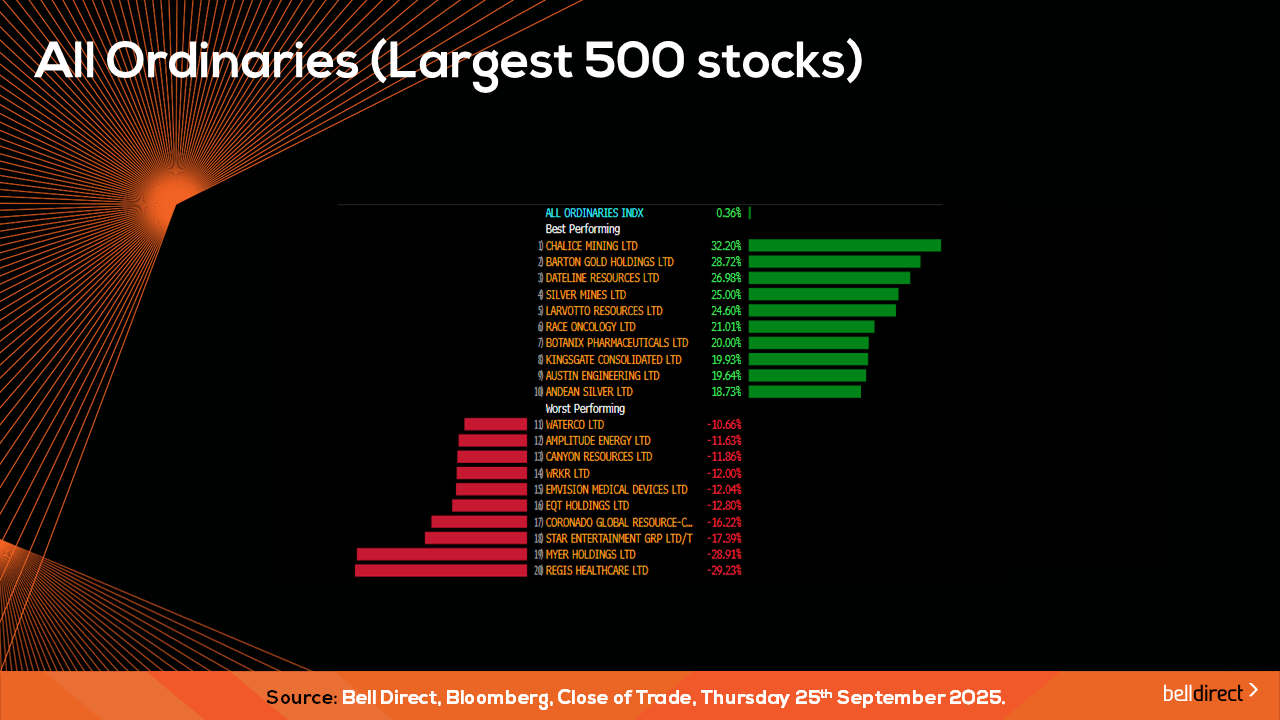

September’s market volatility extended into this trading week with AI overvaluation, inflation and visa fears on a global scale sparking escalated market uncertainty leading to a sell-off among many major global indices. The uncertainty also propelled gold to new record heights which boosted our local gold miners even further into the green over the course of the trading week.

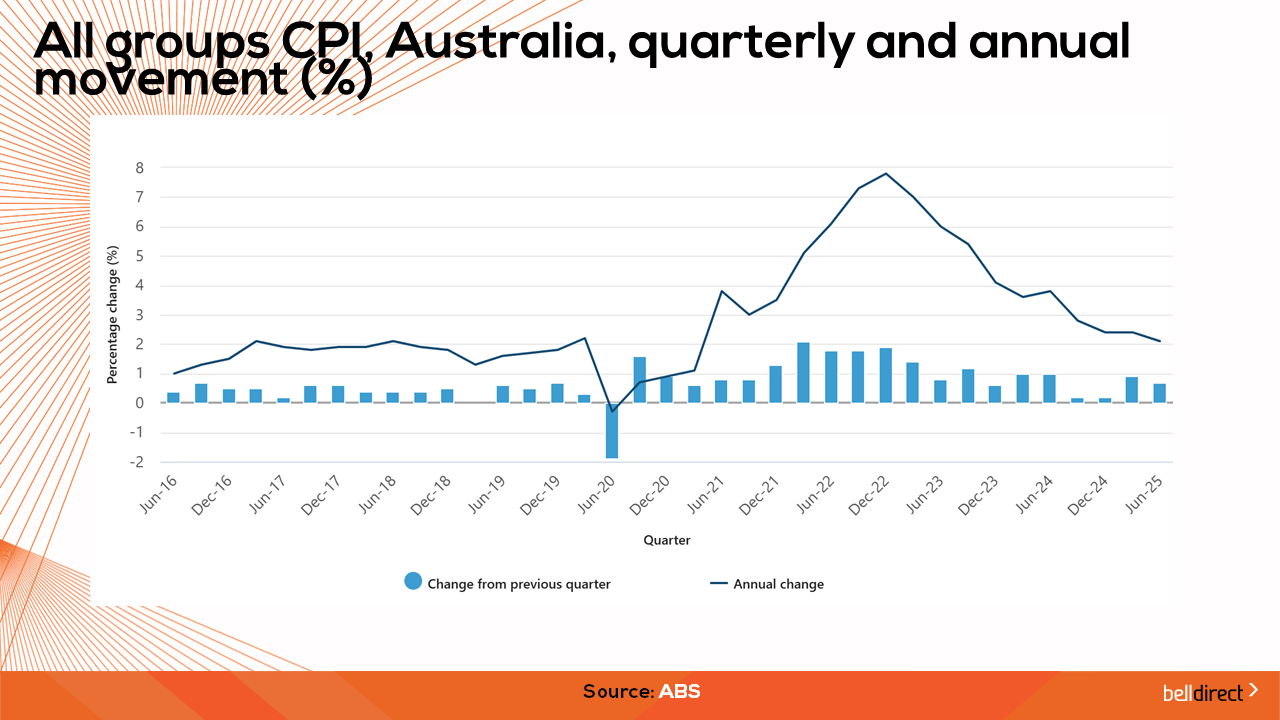

Locally we had the latest monthly inflation print released, indicating the RBA’s job on taming inflation is not quite done. Despite the RBA preferring the quarterly data, this week showed inflation or the monthly CPI indicator rose 3% annually to August 2025 with the largest contributors being annual housing inflation (up 4.5%), Food and non-alcoholic beverages inflation (up 3%) and alcohol and tobacco inflation (up 6%). The end of the government electricity subsidies also saw Annual Housing inflation was 4.5 per cent to August, up from 3.6 per cent to July, reflecting increases in electricity costs, which rose 24.6% in the year to August. As a result of the latest CPI reading, investors in true fashion of late, reacted negatively by fleeing rate-sensitive sectors including REIT and discretionary stocks on Wednesday.

Overall, on the RBA’s inflation journey, the economy is looking stable, and inflation remains under control according to the latest data across the key drivers of inflation.

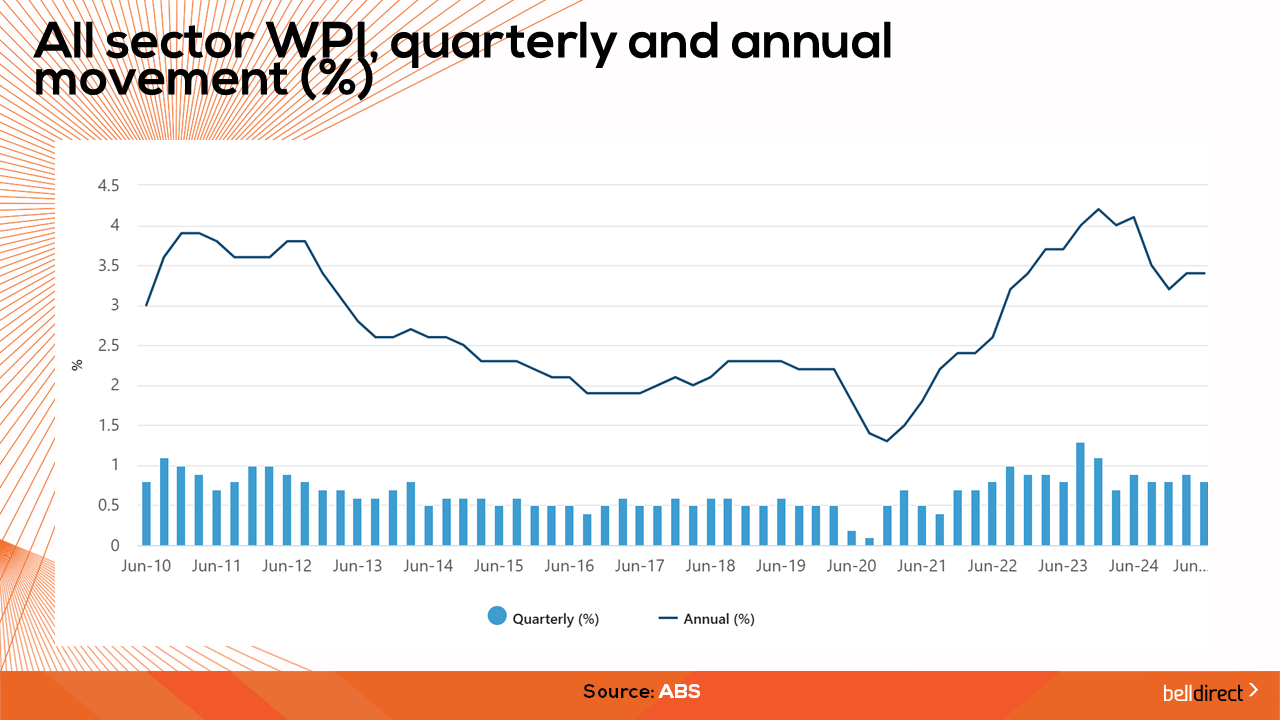

Wages price inflation was a key sticking point that fuelled the RBA’s prolonged rate hold over cut decisions until recently with the latest wages data showing for the June quarter, seasonally adjusted wages rose by 0.8%, driven mainly by private sector growth, which also rose 0.8%, while public sector wages increased by 1.0%. Annual wage growth remained steady at 3.4%, the same as the March quarter and lower than the 4.1% seen a year earlier. With the trend now flatlined as of the latest reading, the RBA will be cautious to see if an uptick or maintenance of WPI is achieved in the next quarterly data due out for September soon.

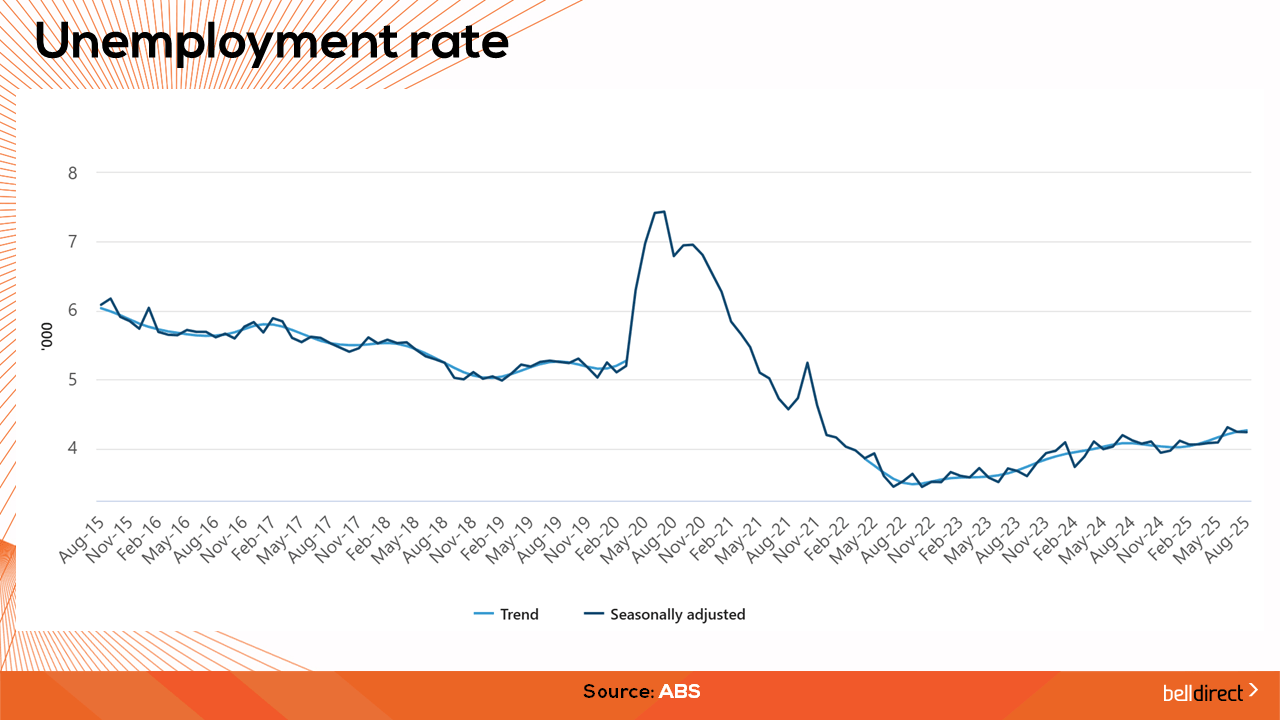

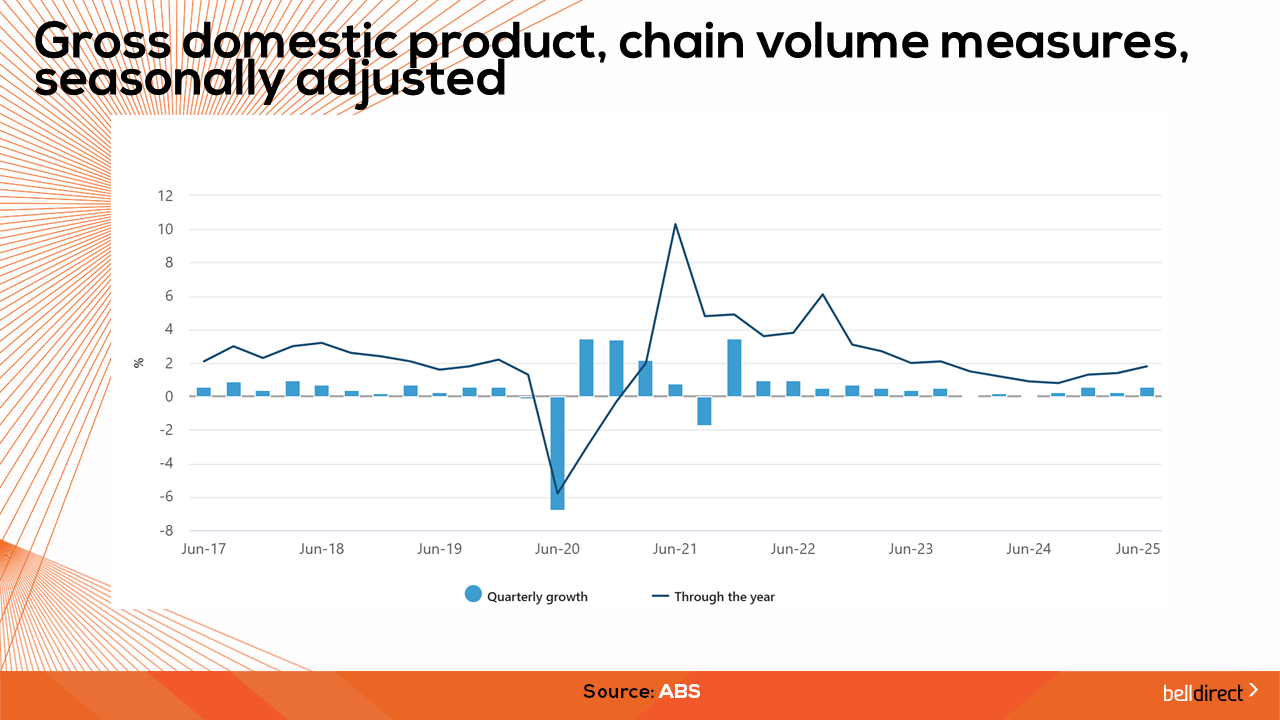

The unemployment rate down under remains low and stable which is a key factor the RBA considers when devising the rate journey. In seasonally adjusted terms for August, the unemployment rate remained at 4.2%, significantly below the 6-7.4% band we saw over the years from 2015-2021 and remains stable within this range indicating many Australians are employed.In terms of economic health and expansion, Australia’s latest GDP reading outlined the steady uptick in economic growth continued in the June quarter as GDP rose 0.6% QoQ and 1.3% over 2024-2025. Despite the annual figure being the weakest YoY growth since the 1990s (excluding the COVID impact of 2019-2020), a rebound is in sight as GDP per capita rose 0.2% this quarter following a decline in March quarter 2025.

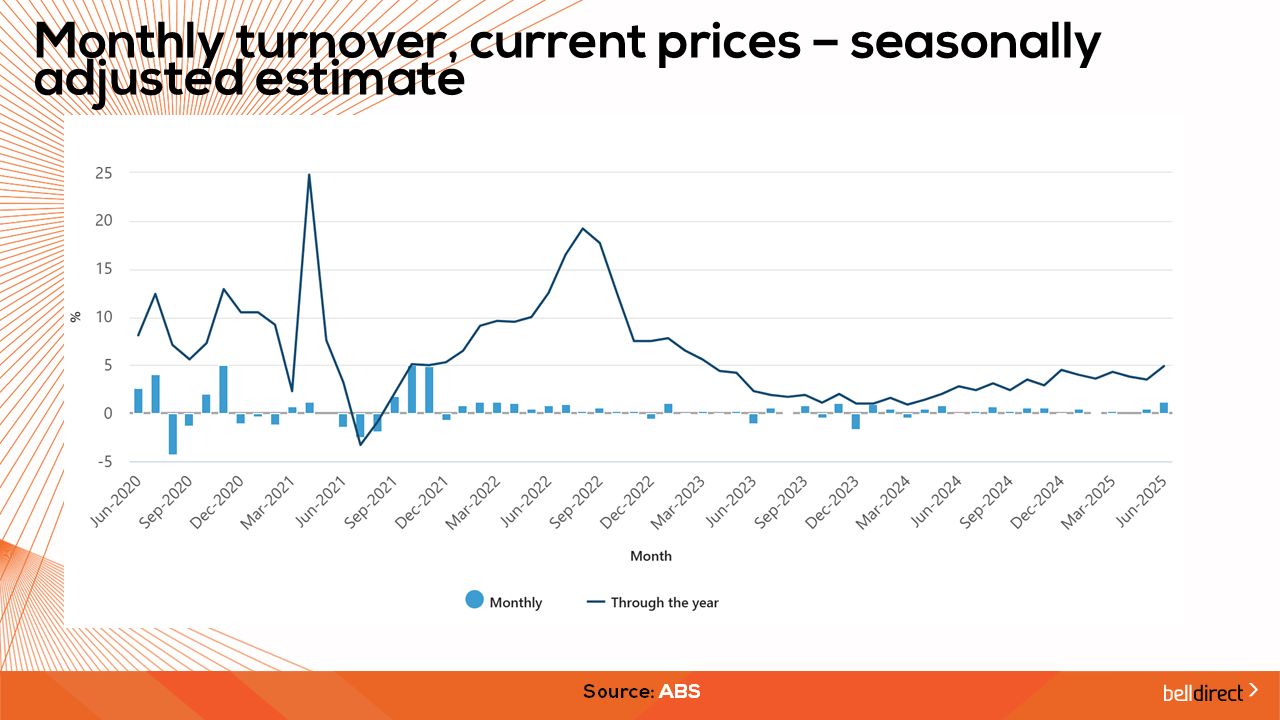

Retail spend has remained resilient and another sticky point of the RBA’s rate journey despite elevated cost-of-living pressures over FY25, but with the trend only steadily inclining as inflation eases and GDP remain robust, this signals the RBA’s rate decisions to date are working for a soft landing without inflation cooling into a recession.

And finally, producer price index, another key driver of inflation, came in at an annual rise of 3.4% for the 12-months to June, down from the 3.7% reported in the year to March and well below the peak of 6.4% in September 2022. The gradual decline signals cost pressures are easing for producers and remain under control for the RBA’s rate journey.

Understanding the rate outlook and journey of inflation taming is important as an investor as your can navigate the market to find the best opportunities and sectors with the greatest tailwinds to match the rate outlook. As there is an anticipated at least one further cut out of the RBA to come this year, sectors that are rate sensitive like REIT, retail and tech stocks will feel tailwinds, while the banks and utilities stocks become less favourable in a lower interest rate environment.

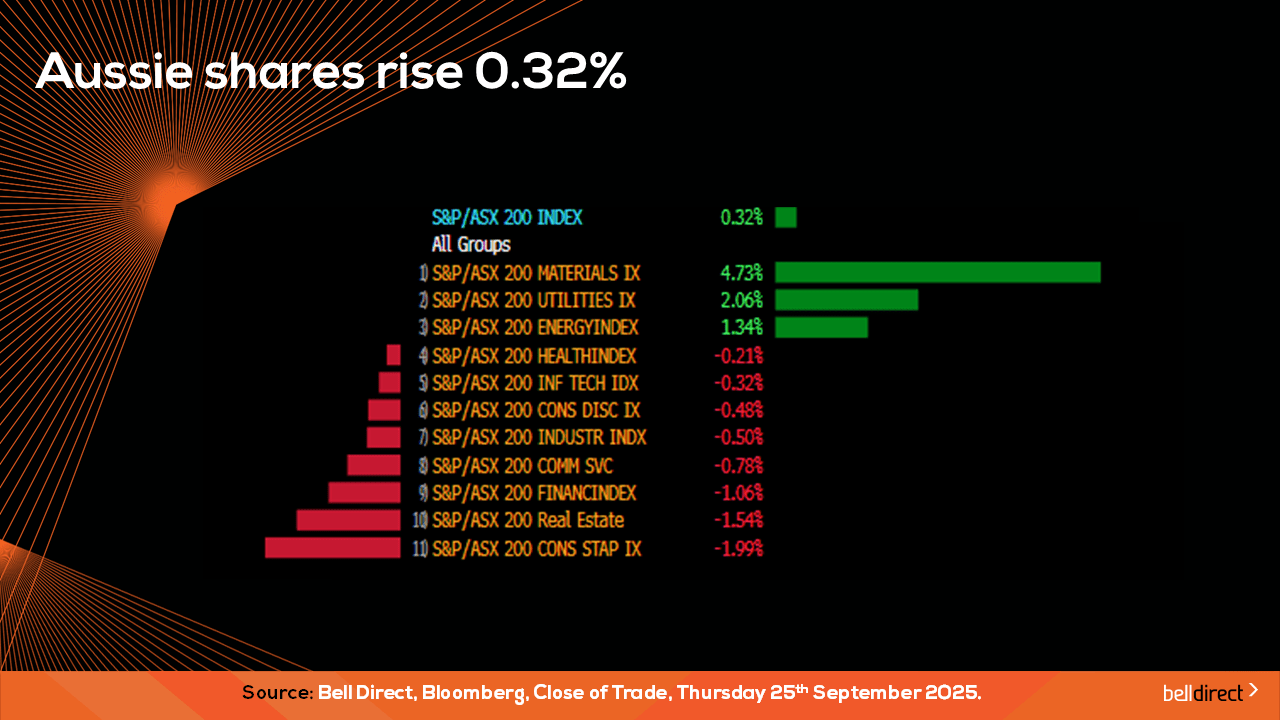

Locally from Monday to Thursday the ASX 200 posted a 0.32% rise as a surge in materials stocks boosted the key index into the green over the trading week. Commodity price spikes for copper and gold were the primary drivers of the materials surge this week.

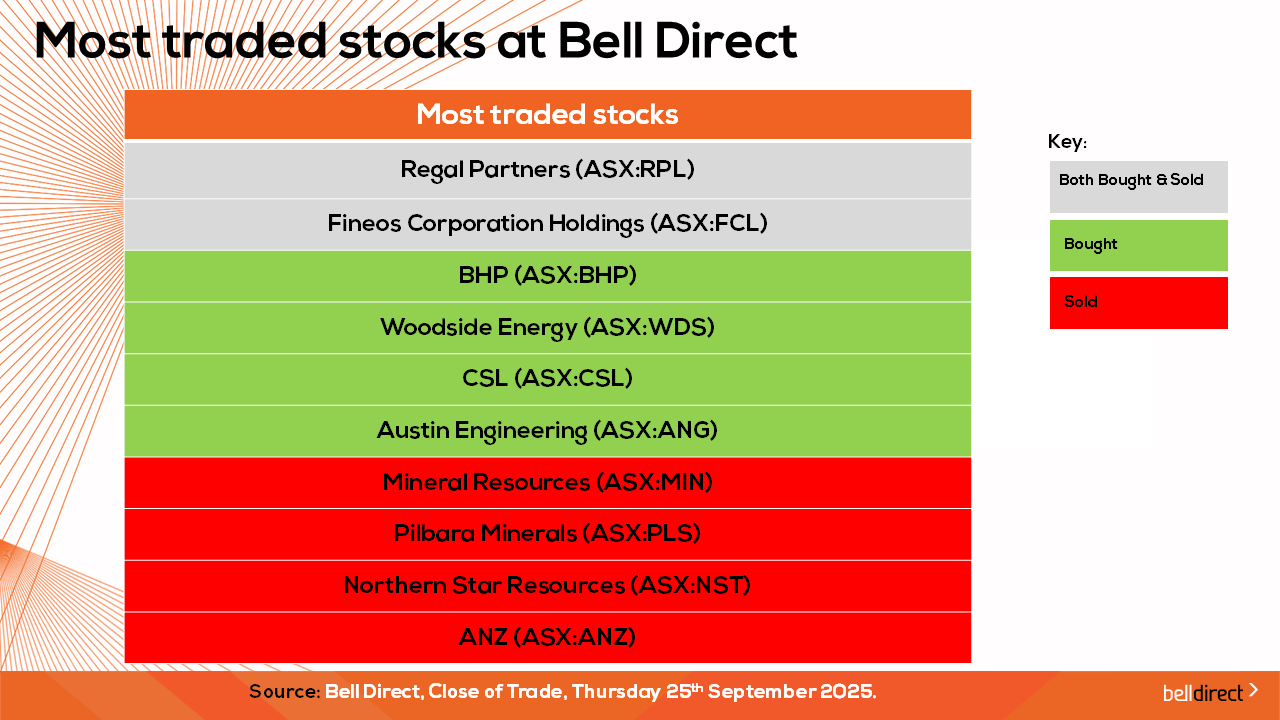

The most traded stocks by Bell Direct clients this trading week were Regal Partners (ASX:RPL), and Fineos Corporation Holdings PLC (ASX:FCL). Clients also bought into BHP (ASX:BHP), Woodside (ASX:WDS), CSL (ASX:CSL), and Austin Engineering (ASX:ANG) while taking profits from Mineral Resources (ASX:MIN), Pilbara Minerals (ASX:PLS), Northern Star Resources (ASX:NST) and ANZ (ASX:ANZ).

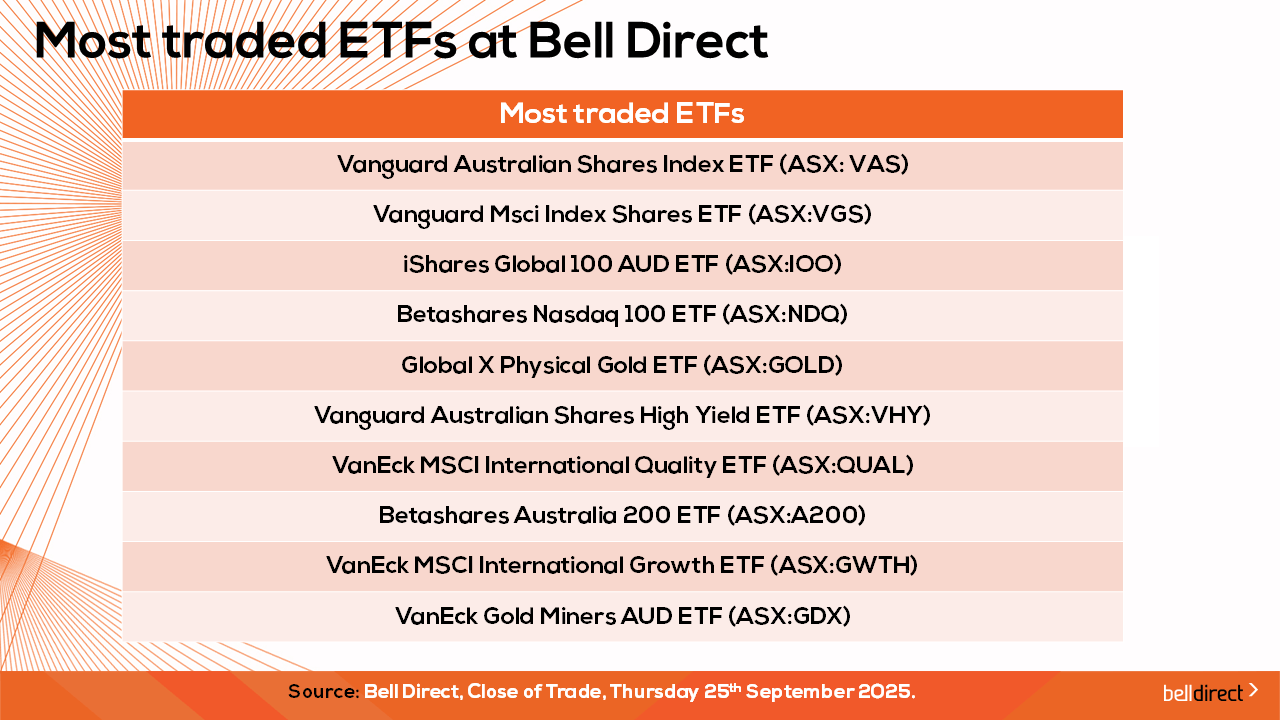

And the most traded ETFs were led by Vanguard Australian Shares Index ETF (ASX:VAS), Vanguard Msci Index International Shares ETF (ASX:VGS), and iShares Global 100 AUD ETF (ASX:IOO).

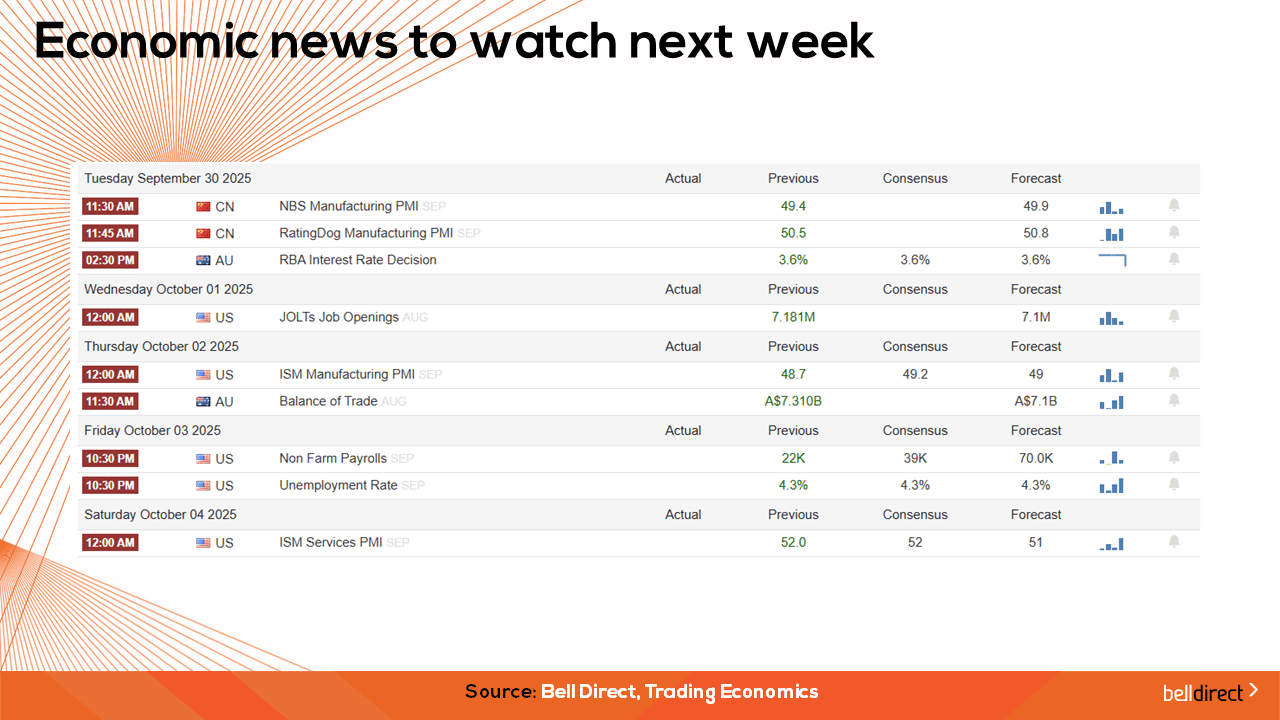

Looking to the week ahead on the economic calendar front, we may see investors respond to the RBA’s latest rate decision on Tuesday where it is widely expected the central bank will maintain the current cash rate at 3.6% for the next period, while Australia’s latest trade balance data is out on Thursday. Overseas, we will see key US jobs data for August and September out later in the week and earlier in the week China’s latest manufacturing PMI will provide an update on the state of the world’s second largest economy from a manufacturing perspective.

And that’s all for this Friday, have a wonderful weekend and happy investing!

This information is general in nature and does not take into account your financial situation, objectives or needs. You should consider whether it is appropriate for you. You should read our Financial Services Guide and any relevant Product Disclosure Statements before making an investment. For more information visit belldirect.com.au or call 1300 786 199. Bell Direct is the trading name of Third Party Platform Pty Ltd ABN 74 121 227 905, AFSL 314341.